Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Island Angler Fishing Team Balance Sheet Assets Current Assest Liabilities and Owner's Equity Fixed Assets You are to refer to the Island Angler Fishing Team,

Island Angler Fishing Team

Balance Sheet

Assets

Current Assest

Liabilities and Owner's Equity

Fixed Assets

You are to refer to the Island Angler Fishing Team, Inc. financial statements to answer the next

four questions. For the income statement, all expenses will be proportional to the increase in

sales. For the balance sheet, all assets are affected proportionally by the increase in sales and

only the accounts payable on the liability side will be affected by the increase in sales. Assume

the Island Angler Fishing Team, Inc, wants to maintain a constant dividend payout ratio.

Referring to the Island Angler Fishing Team, the company is

currently operating at of capacity. If the company were to

operate at capacity, what would be the capital intensity

ratio?

None of the answer provided are correct

Island Angler Fishing Team

Balance Sheet

You are to refer to the Island Angler Fishing Team, Inc. financial statements to answer the next

four questions. For the income statement, all expenses will be proportional to the increase in

sales. For the balance sheet, all assets are affected proportionally by the increase in sales and

only the accounts payable on the liability side will be affected by the increase in sales. Assume

the Island Angler Fishing Team, Inc, wants to maintain a constant dividend payout ratio.

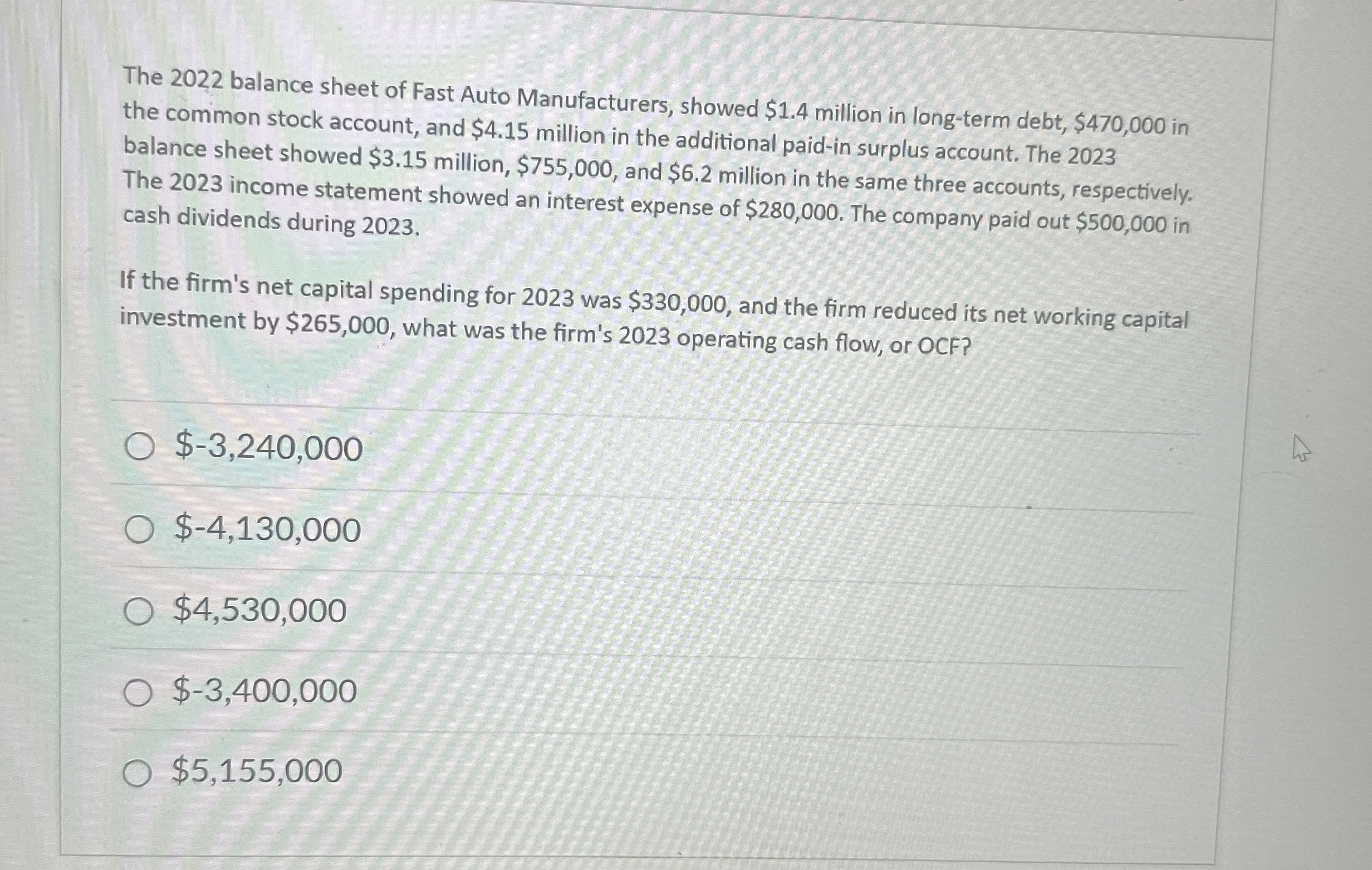

The balance sheet of Fast Auto Manufacturers, showed $ million in longterm debt, $ in

the common stock account, and $ million in the additional paidin surplus account. The

balance sheet showed $ million, $ and $ million in the same three accounts, respectively.

The income statement showed an interest expense of $ The company paid out $ in

cash dividends during

If the firm's net capital spending for was $ and the firm reduced its net working capital

investment by $ what was the firm's operating cash flow, or OCF?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started