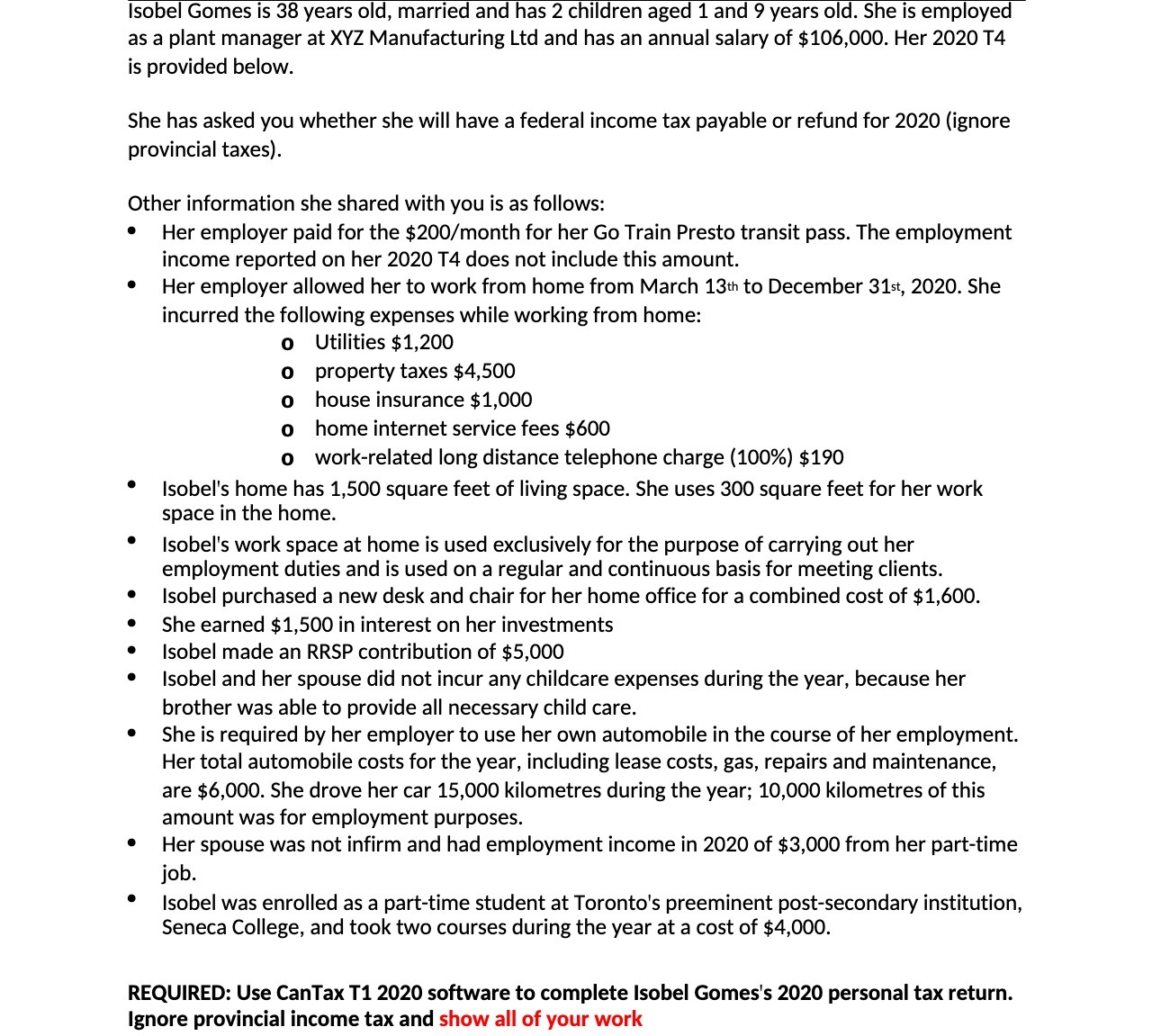

Isobel Gomes is 38 years old, married and has 2 children aged 1 and 9 years old. She is employed as a plant manager at XYZ Manufacturing Ltd and has an annual salary of $106,000. Her 2020 T4 is provided below. She has asked you whether she will have a federal income tax payable or refund for 2020 (ignore provincial taxes). Other information she shared with you is as follows: Her employer paid for the $200/month for her Go Train Presto transit pass. The employment income reported on her 2020 T4 does not include this amount. Her employer allowed her to work from home from March 13111 to December 31st, 2020. She incurred the following expenses while working from home: 0 Utilities $1,200 a property taxes $4,500 0 house insurance $ 1,000 0 home internet service fees $600 0 work-related long distance telephone charge (100%) $190 Isobel's home has 1,500 square feet of living space. She uses 300 square feet for her work space in the home. Isobel's work space at home is used exclusively for the purpose of carrying out her employment duties and is used on a regular and continuous basis for meeting clients. Isobel purchased a new desk and chair for her home ofce for a combined cost of $1,600. She earned $1,500 in interest on her investments Isobel made an RRSP contribution of $5,000 Isobel and her spouse did not incur any childcare expenses during the year, because her brother was able to provide all necessary child care. She is required by her employer to use her own automobile in the course of her employment. Her total automobile costs for the year, including lease costs, gas, repairs and maintenance, are $6,000. She drove her car 15,000 kilometres during the year; 10,000 kilometres of this amount was for employment purposes. Her spouse was not infirm and had employment income in 2020 of $3,000 from her part-time job. Isobel was enrolled as a part-time student at Toronto's preeminent post-secondary institution, Seneca College, and took two courses during the year at a cost of $4.000. REQUIRED: Use CanTax T1 2020 software to complete Isobel Gomes's 2020 personal tax return. Ignore provincial income tax and show all of your work