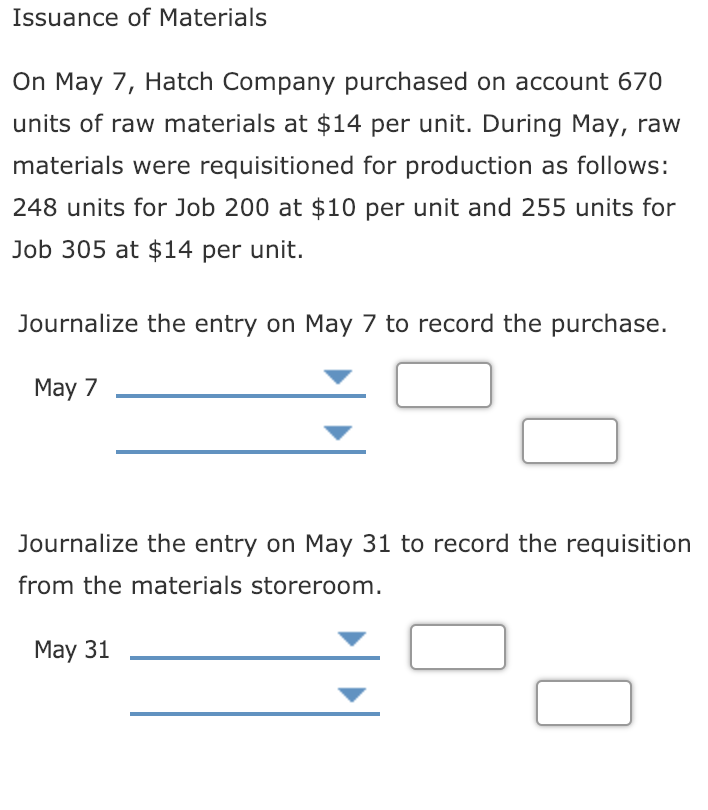

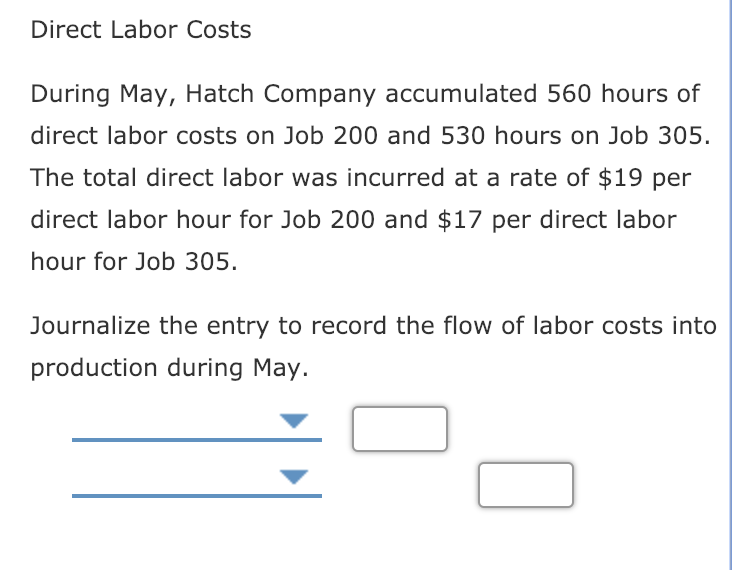

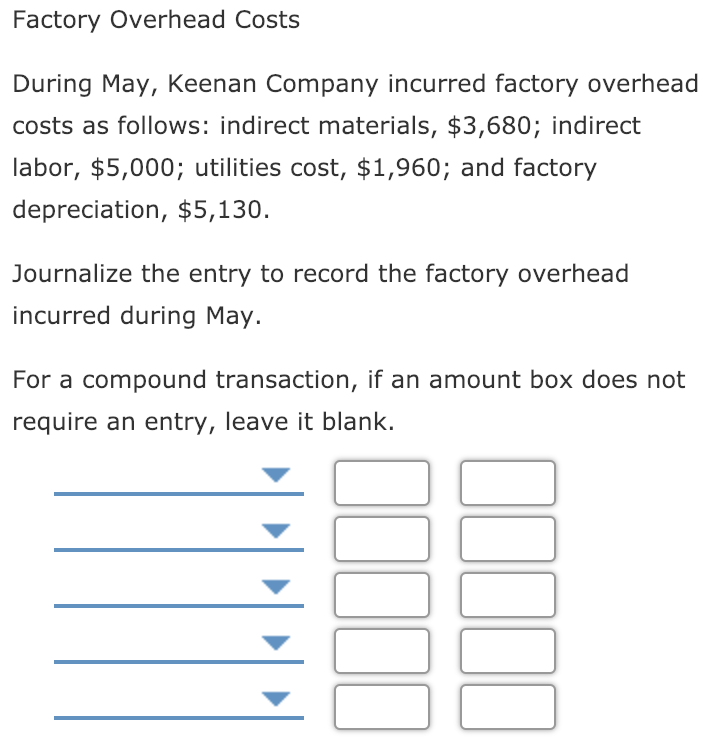

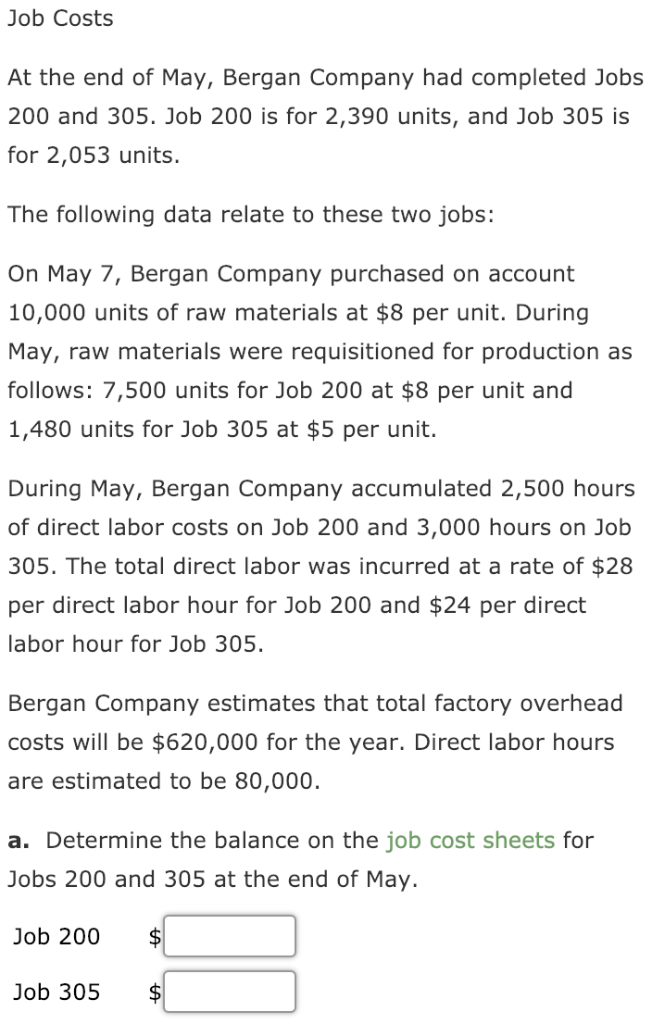

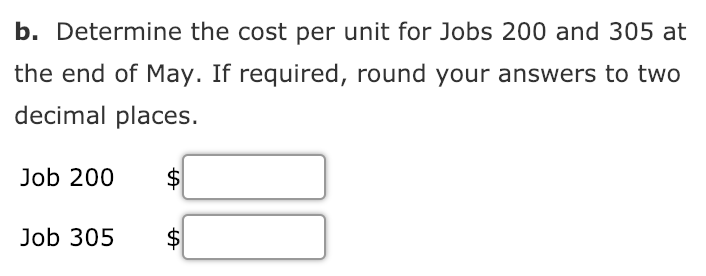

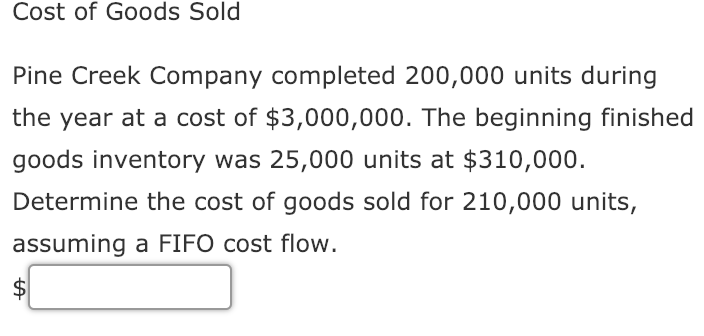

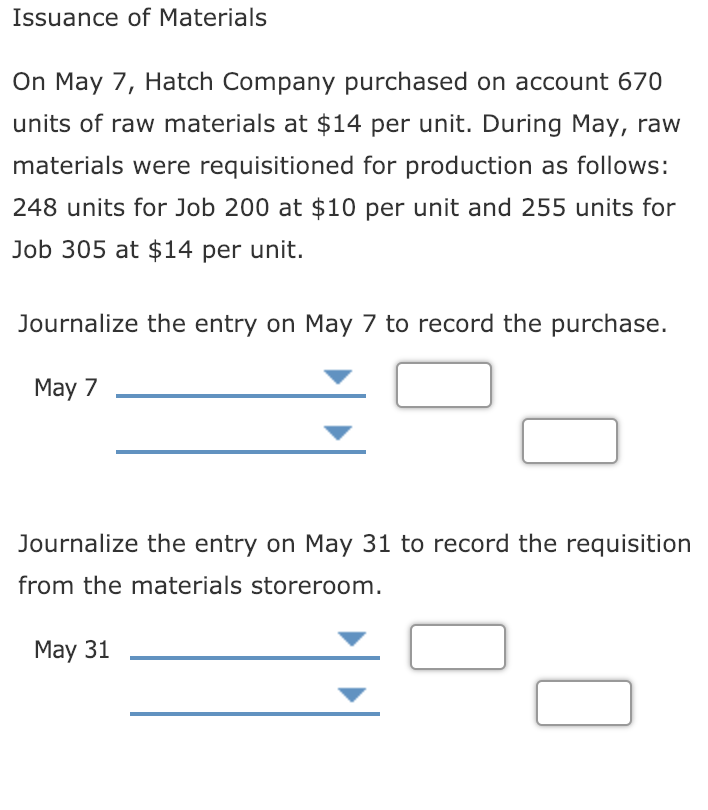

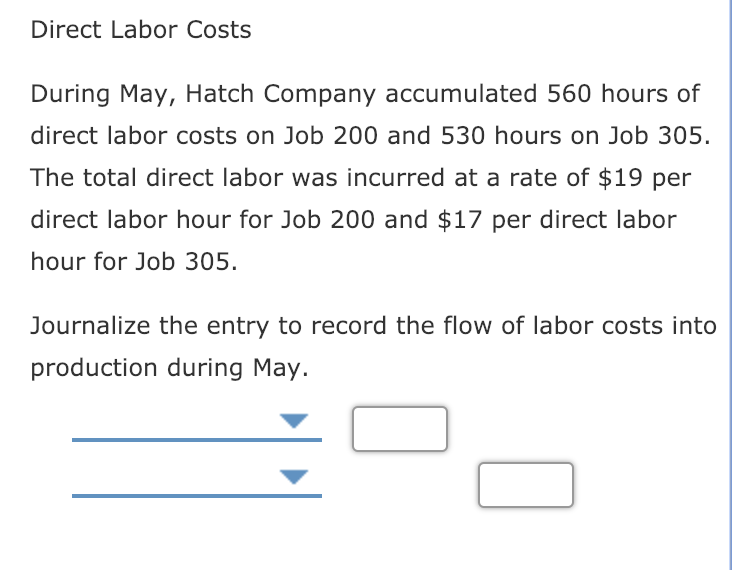

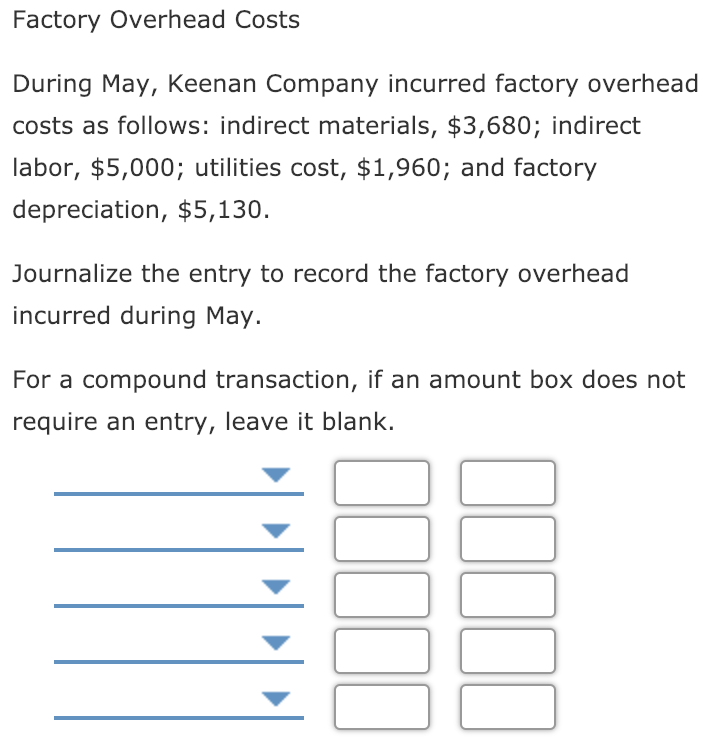

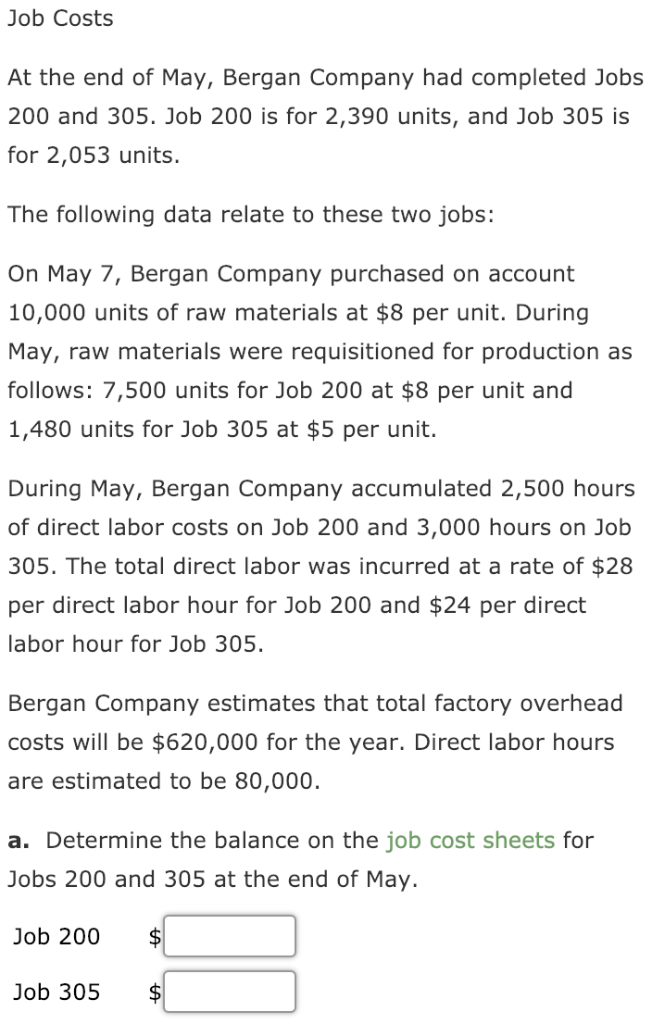

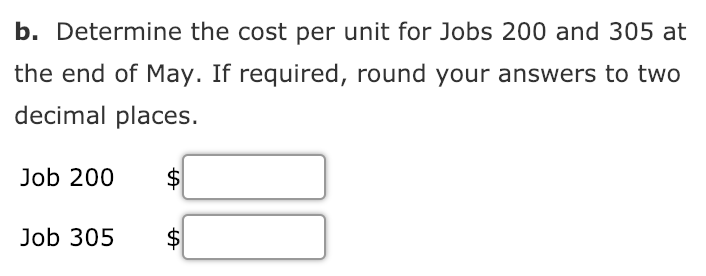

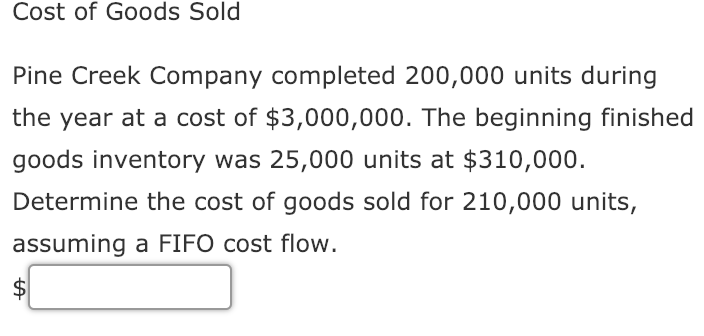

Issuance of Materials On May 7, Hatch Company purchased on account 670 units of raw materials at $14 per unit. During May, raw materials were requisitioned for production as follows: 248 units for Job 200 at $10 per unit and 255 units for Job 305 at $14 per unit. Journalize the entry on May 7 to record the purchase. May 7 Journalize the entry on May 31 to record the requisition from the materials storeroom. May 31 Direct Labor Costs During May, Hatch Company accumulated 560 hours of direct labor costs on Job 200 and 530 hours on Job 305 The total direct labor was incurred at a rate of $19 per direct labor hour for Job 200 and $17 per direct labor hour for Job 305 Journalize the entry to record the flow of labor costs into production during May. Factory Overhead Costs During May, Keenan Company incurred factory overhead costs as follows: indirect materials, $3,680; indirect labor, $5,000; utilities cost, $1,960; and factory depreciation, $5,130 Journalize the entry to record the factory overhead incurred during May. For a compound transaction, if an amount box does not require an entry, leave it blank. Job Costs At the end of May, Bergan Company had completed Jobs 200 and 305. Job 200 is for 2,390 units, and Job 305 is for 2,053 units. The following data relate to these two jobs: On May 7, Bergan Company purchased on account 10,000 units of raw materials at $8 per unit. During May, raw materials were requisitioned for production as follows: 7,500 units for Job 200 at $8 per unit and 1,480 units for Job 305 at $5 per unit. During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. The total direct labor was incurred at a rate of $28 per direct labor hour for Job 200 and $24 per direct labor hour for Job 305 Bergan Company estimates that total factory overhead costs will be $620,000 for the year. Direct labor hours are estimated to be 80,000. a. Determine the balance on the job cost sheets for Jobs 200 and 305 at the end of May. Job 200 $ Job 305$ b. Determine the cost per unit for Jobs 200 and 305 at the end of May. If required, round your answers to two decimal places. Job 200 $ Job 305$ Cost of Goods Sold Pine Creek Company completed 200,000 units during the year at a cost of $3,000,000. The beginning finished goods inventory was 25,000 units at $310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow