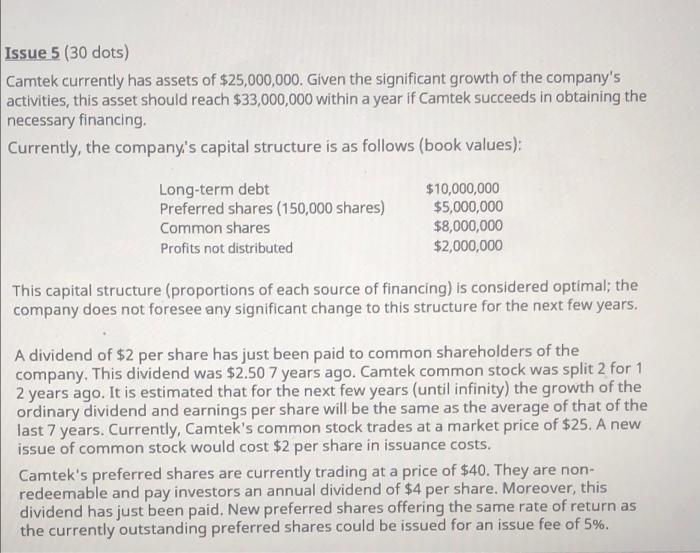

Issue 5 (30 dots) Camtek currently has assets of $25,000,000. Given the significant growth of the company's activities, this asset should reach $33,000,000 within a year of Camtek succeeds in obtaining the necessary financing Currently, the company's capital structure is as follows (book values): Long-term debt Preferred shares (150,000 shares) Common shares Profits not distributed $10,000,000 $5,000,000 $8,000,000 $2,000,000 This capital structure (proportions of each source of financing) is considered optimal; the company does not foresee any significant change to this structure for the next few years. A dividend of $2 per share has just been paid to common shareholders of the company. This dividend was $2.50 7 years ago. Camtek common stock was split 2 for 1 2 years ago. It is estimated that for the next few years (until infinity) the growth of the ordinary dividend and earnings per share will be the same as the average of that of the last 7 years. Currently, Camtek's common stock trades at a market price of $25. A new issue of common stock would cost $2 per share in issuance costs. Camtek's preferred shares are currently trading at a price of $40. They are non- redeemable and pay investors an annual dividend of $4 per share. Moreover, this dividend has just been paid. New preferred shares offering the same rate of return as the currently outstanding preferred shares could be issued for an issue fee of 5%. In total, Camtek has just paid an amount of $1,800,000 in dividends (ordinary and preferred), which represents 60% of its net profit after taxes. Camtek's long-term debt consists of bonds issued exactly 10 years ago. When they were issued (10 years ago), the maturity of these bonds was 20 years. The annual coupon rate of these bonds is 12%; interest coupons are paid semi-annually. New bonds with a maturity of 10 years could be issued at per (nominal value). The coupon rate of these new bonds would be 9% per annum (coupons paid semi-annually). This new issue would incur a fee equivalent to 5% of the sale price (face value) of the bonds. Camtek's corporate tax rate is 40%. The personal income tax rate for ordinary shareholders is estimated at 35% and the dividend reinvestment fee is estimated at 5% a) Calculate Camtek's weighted average cost of capital before and after the breakout point using book values. b) Calculate Camtek's weighted average cost of capital before and after the breakout point using market values. c) Calculate the weighted average financing cost of $8,000,000 using the two approaches, book value, and market value