Question

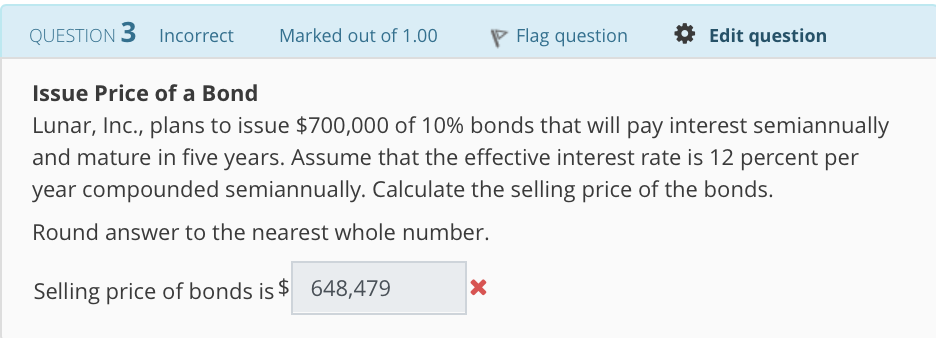

Issue Price of a Bond Lunar, Inc., plans to issue $700,000 of 10% bonds that will pay interest semiannually and mature in five years. Assume

Issue Price of a Bond Lunar, Inc., plans to issue $700,000 of 10% bonds that will pay interest semiannually and mature in five years. Assume that the effective interest rate is 12 percent per year compounded semiannually. Calculate the selling price of the bonds.

Round answer to the nearest whole number.

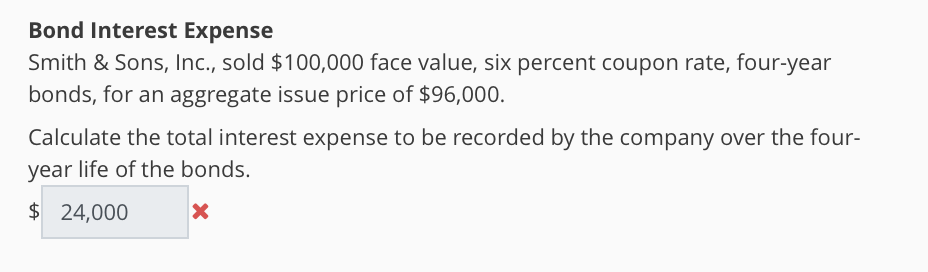

Bond Interest Expense Smith & Sons, Inc., sold $100,000 face value, six percent coupon rate, four-year bonds, for an aggregate issue price of $96,000.

Calculate the total interest expense to be recorded by the company over the four-year life of the bonds.

QUESTION 3 Incorrect Marked out of 1.00 Flag question Edit question Issue Price of a Bond Lunar, Inc., plans to issue $700,000 of 10% bonds that will pay interest semiannually and mature in five years. Assume that the effective interest rate is 12 percent per year compounded semiannually. Calculate the selling price of the bonds. Round answer to the nearest whole number. Selling price of bonds is $ 648,479 Bond Interest Expense Smith & Sons, Inc., sold $100,000 face value, six percent coupon rate, four-year bonds, for an aggregate issue price of $96,000 Calculate the total interest expense to be recorded by the company over the four- year life of the bonds. $24,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started