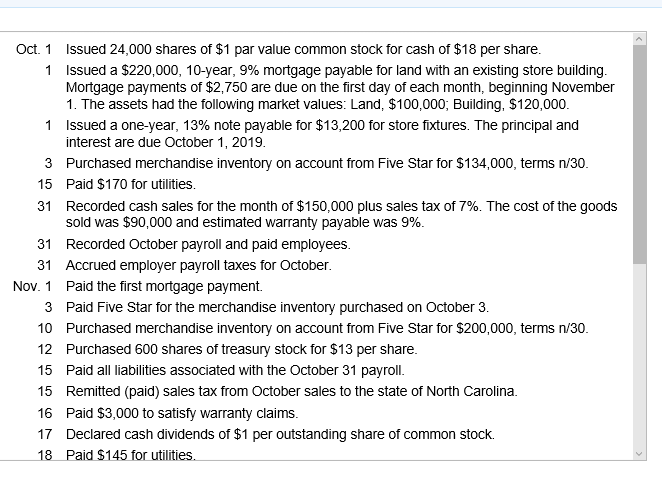

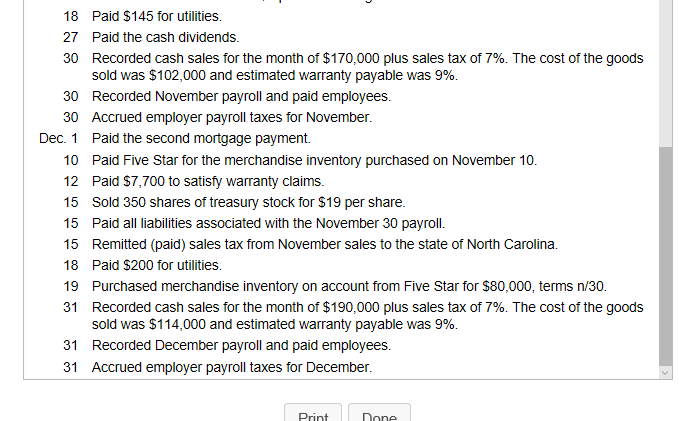

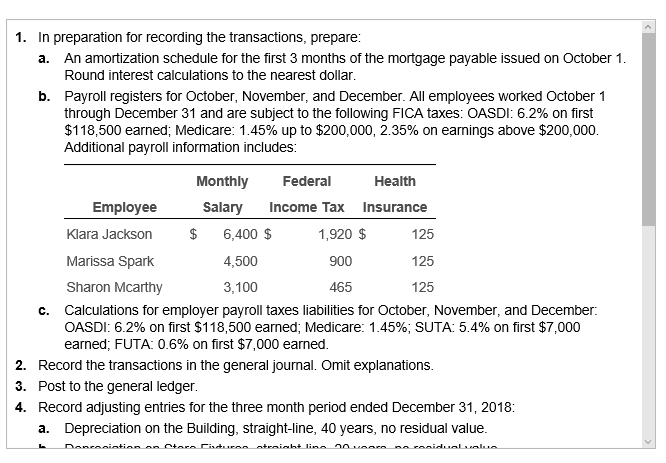

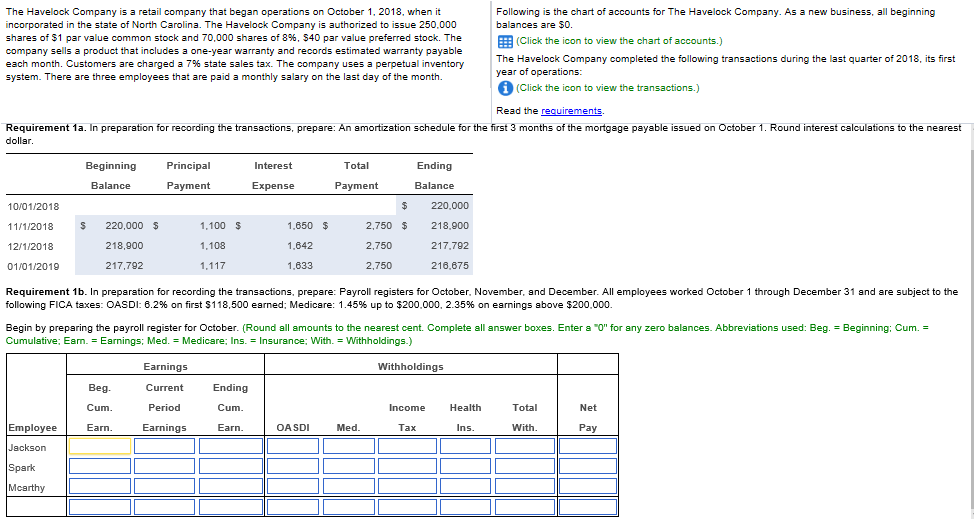

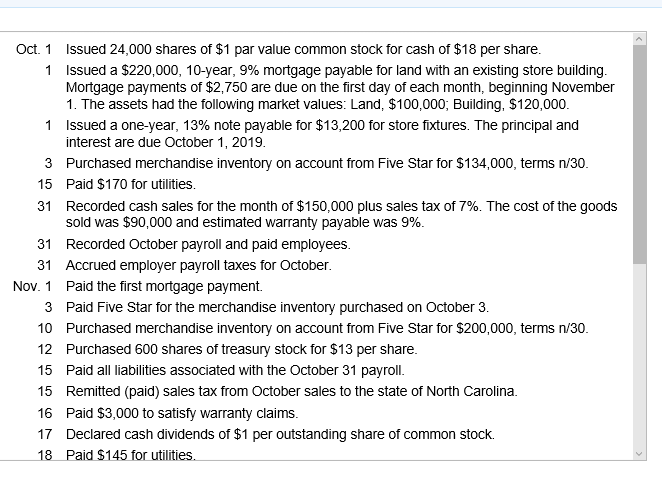

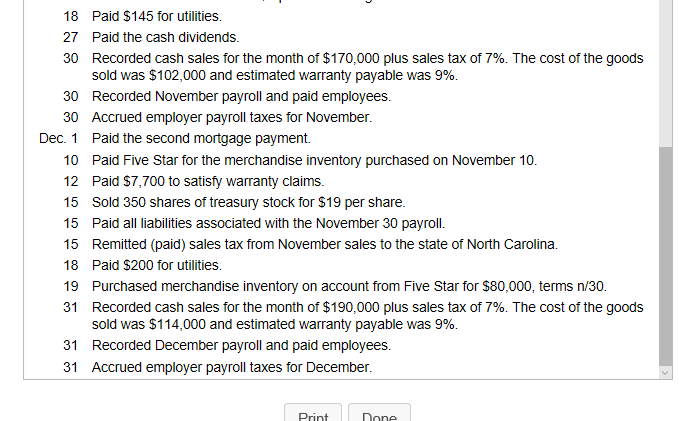

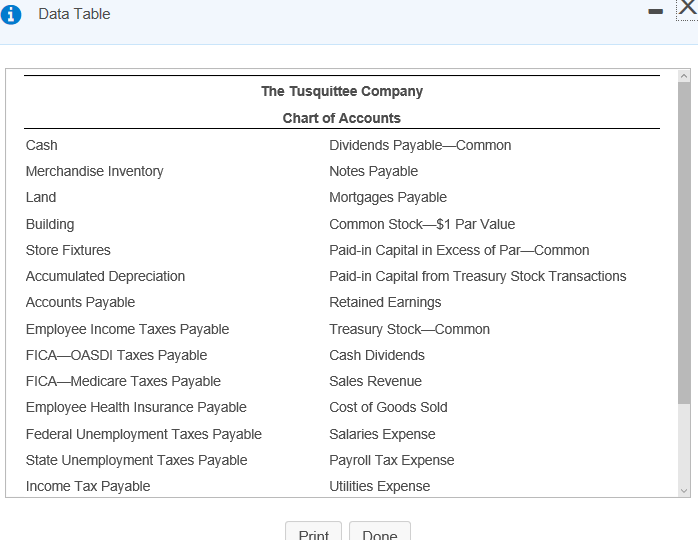

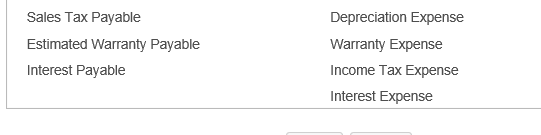

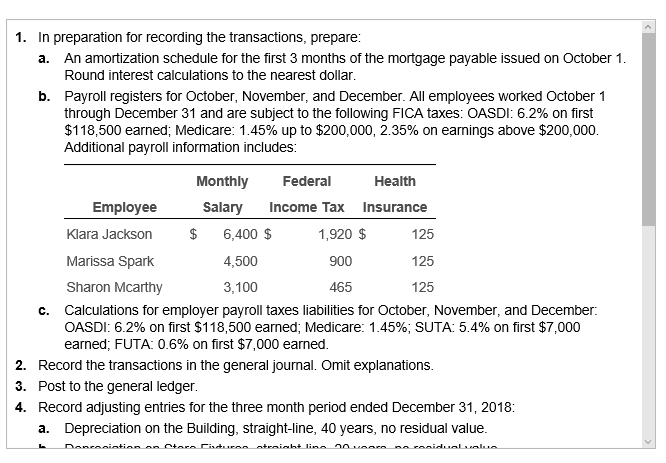

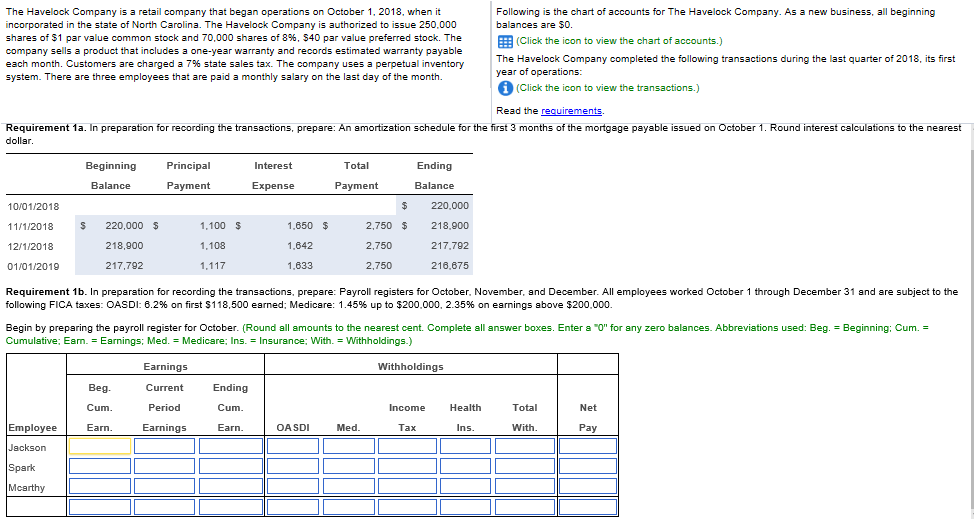

Issued 24,000 shares of $1 par value common stock for cash of $18 per share issued a $220,000, 10-year, 9% mortgage payable for land with an existing store building Mortgage payments of $2,750 are due on the first day of each month, beginning November 1. The assets had the following market values: Land, $100,000, Building, $120,000 Issued a one-year, 13% note payable for $13,200 for store fixtures. The principal and interest are due October 1, 2019 Oct. 1 I 1 3 Purchased merchandise inventory on account from Five Star for S134,000, terms n/30 15 31 Paid $170 for utilities Recorded cash sales for the month of $150,000 plus sales tax of 7%. The cost of the goods sold was $90,000 and estimated warranty payable was 9% Recorded October payroll and paid employees Accrued employer payroll taxes for October Paid the first mortgage payment. Paid Five Star for the merchandise inventory purchased on October 3 Purchased merchandise inventory on account from Five Star for $200,000, terms n/30 Purchased 600 shares of treasury stock for $13 per share 31 31 Nov. 1 3 10 12 15 Paid all liabilities associated with the October 31 payrol 15 Remitted (paid) sales tax from October sales to the state of North Carolina 16 17 18 Paid $3,000 to satisfy warranty claims Declared cash dividends of $1 per outstanding share of common stock. Paid $145 for utiliti Issued 24,000 shares of $1 par value common stock for cash of $18 per share issued a $220,000, 10-year, 9% mortgage payable for land with an existing store building Mortgage payments of $2,750 are due on the first day of each month, beginning November 1. The assets had the following market values: Land, $100,000, Building, $120,000 Issued a one-year, 13% note payable for $13,200 for store fixtures. The principal and interest are due October 1, 2019 Oct. 1 I 1 3 Purchased merchandise inventory on account from Five Star for S134,000, terms n/30 15 31 Paid $170 for utilities Recorded cash sales for the month of $150,000 plus sales tax of 7%. The cost of the goods sold was $90,000 and estimated warranty payable was 9% Recorded October payroll and paid employees Accrued employer payroll taxes for October Paid the first mortgage payment. Paid Five Star for the merchandise inventory purchased on October 3 Purchased merchandise inventory on account from Five Star for $200,000, terms n/30 Purchased 600 shares of treasury stock for $13 per share 31 31 Nov. 1 3 10 12 15 Paid all liabilities associated with the October 31 payrol 15 Remitted (paid) sales tax from October sales to the state of North Carolina 16 17 18 Paid $3,000 to satisfy warranty claims Declared cash dividends of $1 per outstanding share of common stock. Paid $145 for utiliti