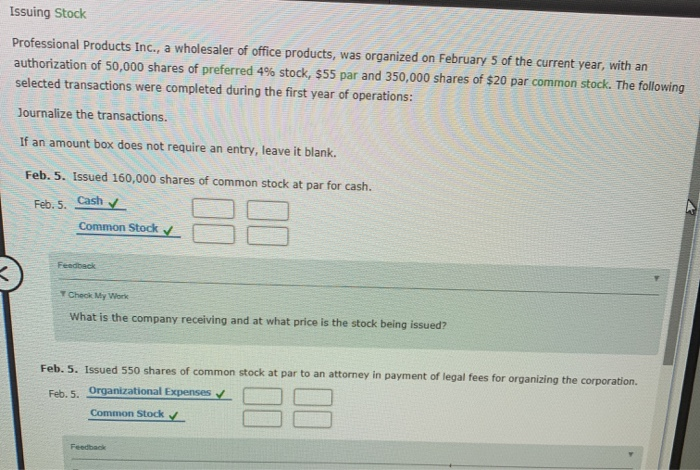

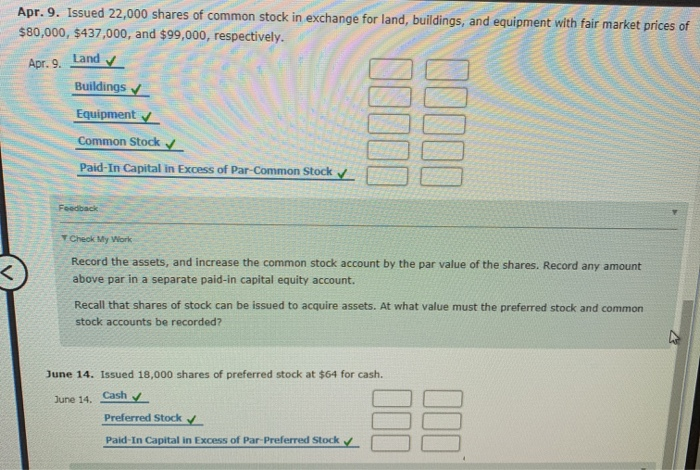

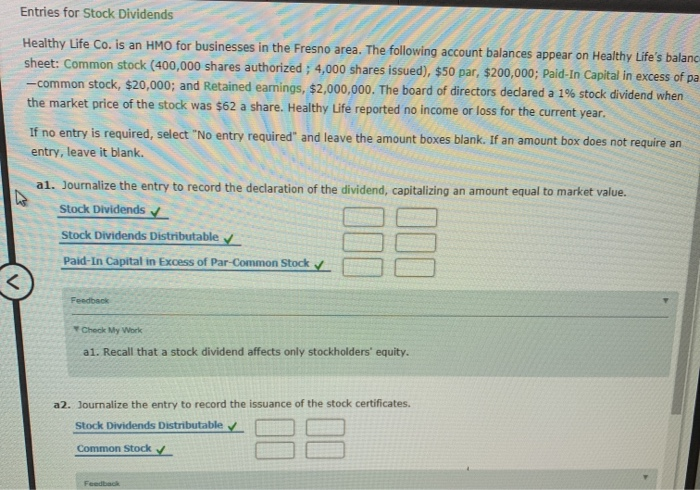

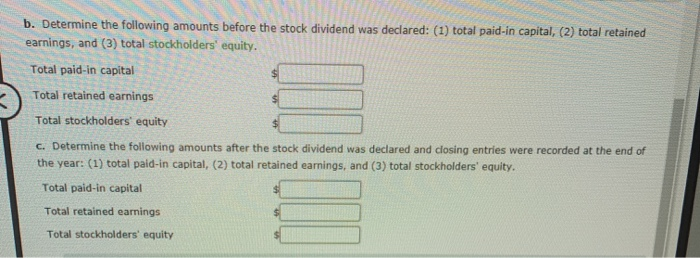

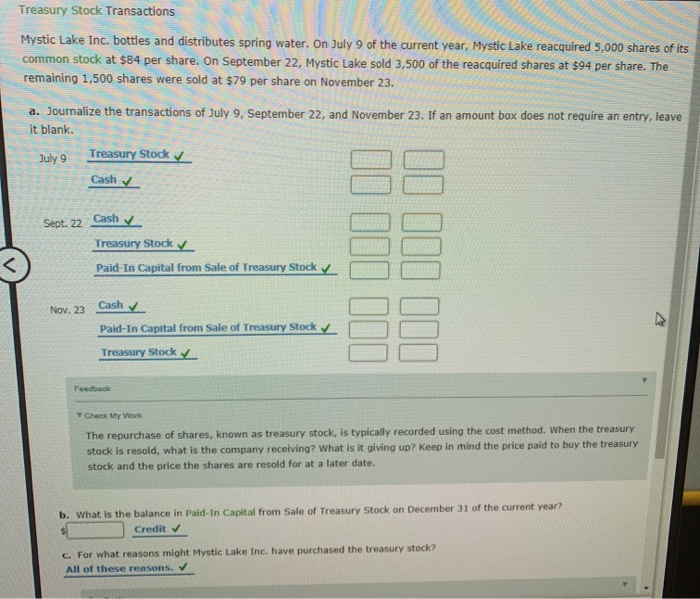

Issuing Stock Professional Products Inc., a wholesaler of office products, was organized on February 5 of the current year, with an authorization of 50,000 shares of preferred 4% stock, $55 par and 350,000 shares of $20 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. If an amount box does not require an entry, leave it blank. Feb. 5. Issued 160,000 shares of common stock at par for cash. Cash Feb. 5. Common Stock Feedback Y Check My Work What is the company receiving and at what price is the stock being issued? Feb. 5. Issued 550 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Feb. 5. Organizational Expenses y Common Stock Feedback Apr. 9. Issued 22,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $80,000, $437,000, and $99,000, respectively. Land Apr. 9. Buildings Equipment Common Stock Paid-In Capital in Excess of Par-Common Stock Feedback TCheck My Work Record the assets, and increase the common stock account by the par value of the shares. Record any amount above par in a separate paid-in capital equity account. Recall that shares of stock can be issued to acquire assets. At what value must the preferred stock and common stock accounts be recorded? June 14. Issued 18,000 shares of preferred stock at $64 for cash. Cash June 14. Preferred Stock y Paid-In Capital in Excess of Par-Preferred Stock 000 Entries for Stock Dividends Healthy Life Co. is an HMO for businesses in the Fresno area. The following account balances appear on Healthy Life's balanc sheet: Common stock (400,000 shares authorized ; 4,000 shares issued), $50 par, $200,000; Paid-In Capital in excess of pa -common stock, $20,000; and Retained earnings, $2,000,000. The board of directors dedared a 1% stock dividend when the market price of the stock was $62 a share. Healthy Life reported no income or loss for the current year. If no entry is required, select "No entry required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. al. Journalize the entry to record the declaration of the dividend, capitalizing an amount equal to market value. Stock Dividends Stock Dividends Distributable v Paid-In Capital in Excess of Par-Common Stock Feedback Check My Work al. Recall that a stock dividend affects only stockholders' equity. a2. Journalize the entry to record the issuance of the stock certificates. 38 Stock Dividends Distributable y Common Stock y Feedback b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity. Total paid-in capital Total retained earnings Total stockholders' equity C. Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity. Total paid-in capital Total retained earnings Total stockholders' equity Treasury Stock Transactions Mystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 5,000 shares of its common stock at $84 per share. On September 22, Mystic Lake sold 3,500 of the reacquired shares at $94 per share. The remaining 1,500 shares were sold at $79 per share on November 23. a. Journalize the transactions of July 9, September 22, and November 23. If an amount box does not require an entry, leave it blank, Treasury Stock v July 9 Cash Cash Sept. 22 Treasury Stock v Paid-In Capital from Sale of Treasury Stock Cash Nov. 23 Paid-In Capital from Sale of Treasury Stock y Treasury Stock y Feedback TCheck My Work The repurchase of shares, known as treasury stock, is typically recorded using the cost method. When the treasury stock is resold, what is the company receiving? What is it giving up? Keep in mind the price paid to buy the treasury stock and the price the shares are resold for at a later date. b. What is the balance in Paid-In Capital from Sale of Treasury Stock on December 31 of the current year? Credit v %$4 C. For what reasons might Mystic Lake Inc. have purchased the treasury stock? All of these reasons. V 000