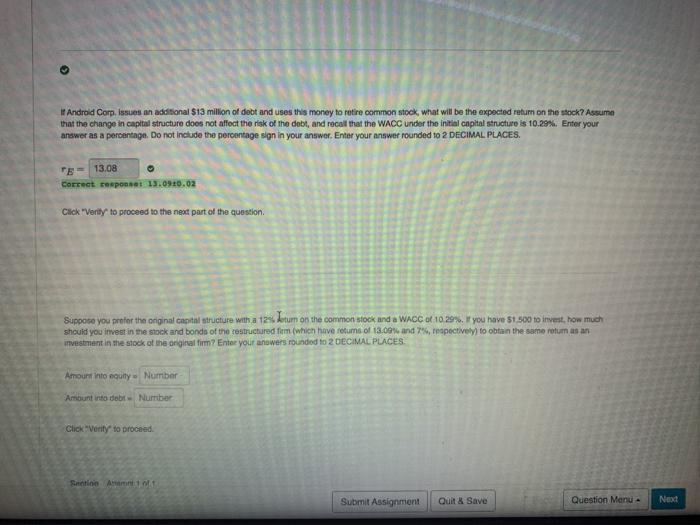

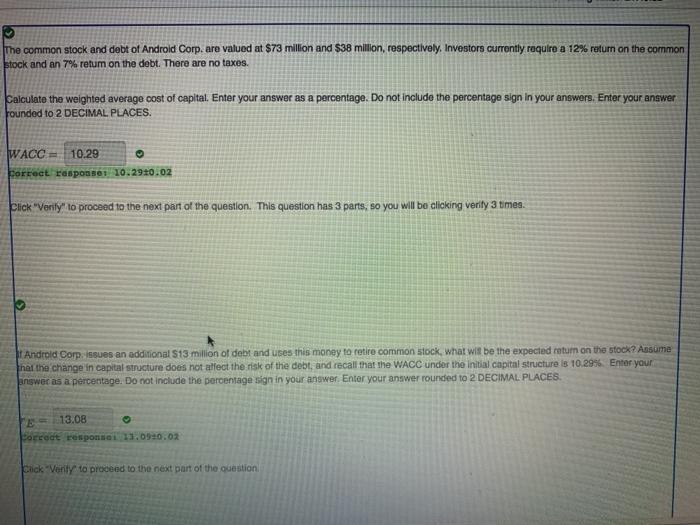

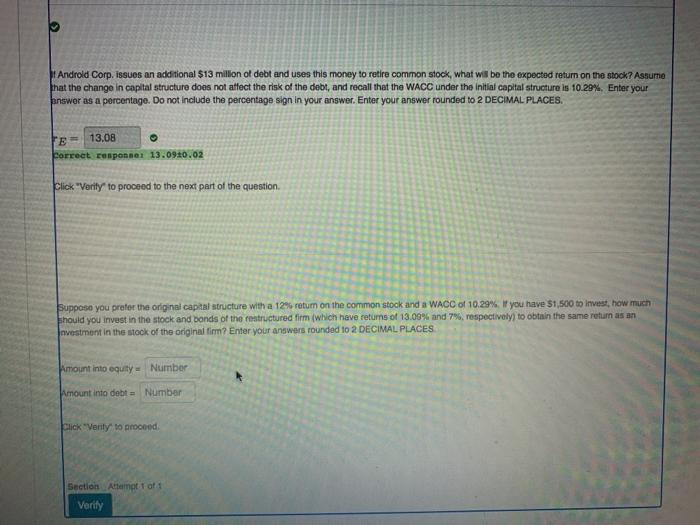

It Android Corp. issues an additional $13 million of debt and uses this money to retire common stock, what will be the expected return on the stock? Assum that the change in capital structure does not affect the risk of the debt, and recall that the WACC under the initial capital structure is 10.29%. Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your answer rounded to 2 DECIMAL PLACES. E = 13.08 CorrettopORS 13.090.02 Click "Verily to proceed to the next part of the question Suppose you enter the original capital structure with a 12. Jotum on the common stock and a WACC of 10.29%. you have St.500 to invest. How much should you invest in the stock and bonds of the restructured firm (which have retums of 18.00 and 7%, respectively) to obtain the same rotu un an investment in the stock of the originaltim? Enter your answers rounded to 2 DECIMAL PLACES Amountino equity Number Amount into debt Number Click Verity to proced Seti A101 Submit Assignment Quit & Save Question Manu Next The common stock and debt of Android Corp. are valued at $73 million and $38 million, respectively. Investors currently require a 12% return on the common stock and an 7% rotum on the debt. There are no taxes. Calculate the weighted average cost of capital. Enter your answer as a percentage. Do not include the percentage sign in your answers, Enter your answer founded to 2 DECIMAL PLACES. WACC = 10.29 Forrect response 10.29.10.02 Click "Verily to proceed to the next part of the question. This question has 3 parts, so you will be clicking verity 3 times. Android Corp. issues an additional S13 million of debt and uses this money to retire common stock, what will be the expected return on the stock? Assume that the change in capital structure does not affect the risk of the debt, and recall that the WACC under the initial capital structure is 10.2956 Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your answer rounded to 2 DECIMAL PLACES 13.08 Porced response 13.0910:02 Click Verity to proceed to the next part of the question Android Corp. issues an additional $13 million of debt and uses this money to retire common stock, what will be the expected return on the stock7 Assume That the change in capital structure does not affect the risk of the debt, and recall that the WACC under the initial capital structure is 10.29%. Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your answer rounded to 2 DECIMAL PLACES. E 13.08 Correct response 13.090.02 Click "Verity to proceed to the next part of the question Suppose you prefer the original capital structure with a 12% roturn on the common stock and a WACC of 10.29% you have $1,500 to invest, how much should you invest in the stock and bonds of the restructured firm (which have retums of 13.09% and 7%, respectively to obtain the same return as an Investment in the stock of the original tim? Enter your answers founded to 2 DECIMAL PLACES Amount into equity - Number Amount into debt = Number Click "Verity to proceed Section Attempt of Verity