Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it has this type of asnwer place (small, so please help me) Please note that you should send in the excel file or share excel

it has this type of asnwer place (small, so please help me)

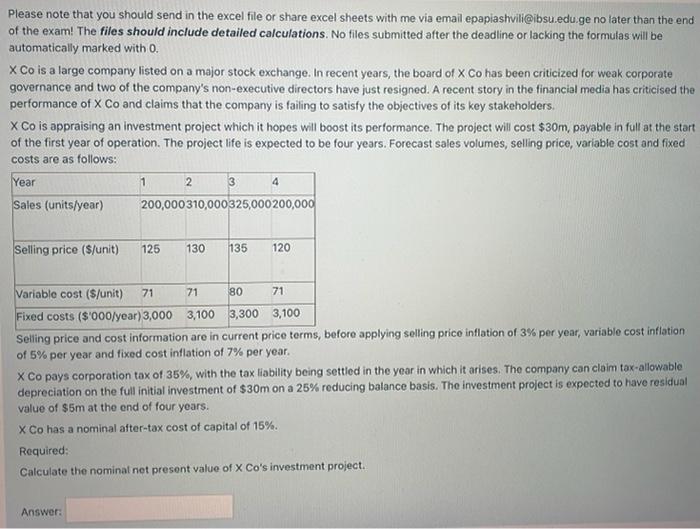

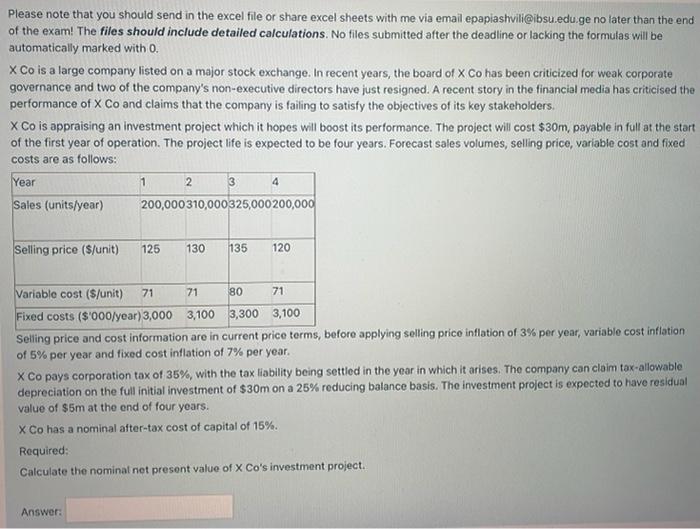

Please note that you should send in the excel file or share excel sheets with me via email epapiashvili@ibsu.edu.ge no later than the end of the exam! The files should include detailed calculations. No tiles submitted after the deadline or lacking the formulas will be automatically marked with O. X Co is a large company listed on a major stock exchange. In recent years, the board of X Co has been criticized for weak corporate governance and two of the company's non-executive directors have just resigned. A recent story in the financial media has criticised the performance of X Co and claims that the company is failing to satisfy the objectives of its key stakeholders. X Co is appraising an investment project which it hopes will boost its performance. The project will cost $30m, payable in full at the start of the first year of operation. The project life is expected to be four years. Forecast sales volumes, selling price, variable cost and fixed costs are as follows: Year 2 Sales (units/year) 200,000 310,000325,000 200,000 1 3 4 Selling price (S/unit) 125 130 135 120 Variable cost ($/unit) 71 71 80 71 Fixed costs ($'000/year) 3,000 3,100 3,300 3,100 Selling price and cost information are in current price terms, before applying selling price inflation of 3% per year, variable cost inflation of 5% per year and fixed cost inflation of 7% per year. X Co pays corporation tax of 35%, with the tax liability being settled in the year in which it arises. The company can claim tax-allowable depreciation on the full initial investment of $30m on a 25% reducing balance basis. The investment project is expected to have residual value of $5m at the end of four years. X Co has a nominal after-tax cost of capital of 15%. Required: Calculate the nominal not present value of X Co's investment project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started