Question

It is 2021 and you will need to file your federal income tax for the 2020 year. Here is your situation:You are married filing jointly.

It is 2021 and you will need to file your federal income tax for the 2020 year. Here is your situation:You are married filing jointly. You are both under 65 years old. You do not own a house. You have no dependents. Assume you have no taxable investment earnings. Your combined income from wages is $116,000. You are taking the standard deduction for married filing jointly. The standard federal tax deductions are determined as follows: Single $12,200; $13,850 if 65 Years OldMarried Filing Jointly $24,400; $25,700 if one spouse is 65, $27,000 if both areHead of Household $ 18,350; $20,000 if 65The2020 federal tax tables are given below. In the American tax system, income taxes are graduated, so you pay different rates on different amounts of taxable income, called tax brackets. The more you make, the more you pay. For example, a single taxpayer will pay 10 percent on taxable income up to $9,875 and then will pay 12% on income over $9,875 up to $40,125.

rate 10% $0 to 9875 single joint 0 to 19750

12% $9876 to 40125 single joint $19751 to 80250

22% 40126 to 85525 single joint 80251 to 171050

Personal exemption for married filing jointly: $24,400

Federal Taxable Income (=income exemption):$116,000-$24,400=$91,600

Federal taxes to be paid:

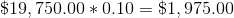

On taxable income from $0 to $19,750

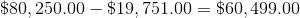

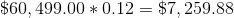

On taxable income from $19,751 to $80,250

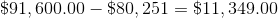

On taxable income from $80,251 to $171,050

Total federal income tax to be paid for 2020:

The answer is: $11,731.66

question

Federal - Effective Tax Rate ET Your effective tax rate is the average rate at which your earned income is taxed.ET= Taxes Paid / Federal Taxable Income Determine your effective federal tax rate to the nearest tenth of a percent. ____________________________Show your calculations:

Federal - Marginal Tax Rate Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your top tax bracket.Determine your marginal tax rate: ____________________________________

Massachusetts state income tax is 5.00%. Let us assume this is paid on your federal taxable income amount. Enter your Massachusetts state tax

FICA (Social Security and Medicare taxes) is 7.65% of your TOTAL wages (no deductions) under $137,700. Enter you FICA taxes

Calculate your 2020 TOTAL taxes paid and enter here:Federal + State + FICA = (we will not consider local taxes in this example)

The money you have left over from your wages after paying federal, state, and local taxes is your disposable personal income. Calculate your disposable personal income for 2020.

What is the percentage rate of change between your original wages of $116,000 and your disposable income? Show your calculations and round to the nearest tenth of a percent.

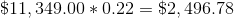

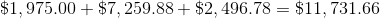

$19,750.00 +0.10 = $1,975.00 $80, 250.00 - $19,751.00 = $60,499.00 $60,499.00 +0.12 = $7, 259.88 $91,600.00 - $80, 251 = $11, 349.00 $11,349.00 +0.22 = $2,496.78 $1,975.00 + $7, 259.88 + $2,496.78 = $11,731.66Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started