Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is a Islamic banking and finance related case study, please send it as soon as possible i have a deadline. Thank you so much

It is a Islamic banking and finance related case study, please send it as soon as possible i have a deadline.

Thank you so much Team Chegg, you guys are life savers

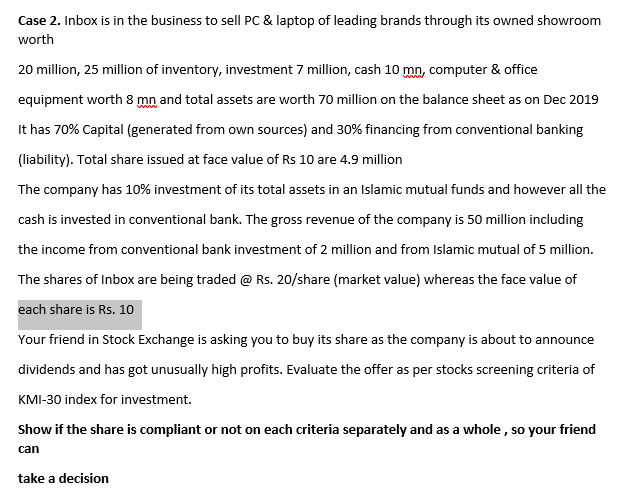

Case 2. Inbox is in the business to sell PC & laptop of leading brands through its owned showroom worth 20 million, 25 million of inventory, investment 7 million, cash 10 mn, computer & office equipment worth 8 mn and total assets are worth 70 million on the balance sheet as on Dec 2019 It has 70% Capital (generated from own sources) and 30% financing from conventional banking liability). Total share issued at face value of Rs 10 are 4.9 million The company has 10% investment of its total assets in an Islamic mutual funds and however all the cash is invested in conventional bank. The gross revenue of the company is 50 million including the income from conventional bank investment of 2 million and from Islamic mutual of 5 million. The shares of Inbox are being traded @ Rs. 20/share (market value) whereas the face value of each share is Rs. 10 Your friend in Stock Exchange is asking you to buy its share as the company is about to announce dividends and has got unusually high profits. Evaluate the offer as per stocks screening criteria of KMI-30 index for investment. Show if the share is compliant or not on each criteria separately and as a whole , so your friend can take a decision Case 2. Inbox is in the business to sell PC & laptop of leading brands through its owned showroom worth 20 million, 25 million of inventory, investment 7 million, cash 10 mn, computer & office equipment worth 8 mn and total assets are worth 70 million on the balance sheet as on Dec 2019 It has 70% Capital (generated from own sources) and 30% financing from conventional banking liability). Total share issued at face value of Rs 10 are 4.9 million The company has 10% investment of its total assets in an Islamic mutual funds and however all the cash is invested in conventional bank. The gross revenue of the company is 50 million including the income from conventional bank investment of 2 million and from Islamic mutual of 5 million. The shares of Inbox are being traded @ Rs. 20/share (market value) whereas the face value of each share is Rs. 10 Your friend in Stock Exchange is asking you to buy its share as the company is about to announce dividends and has got unusually high profits. Evaluate the offer as per stocks screening criteria of KMI-30 index for investment. Show if the share is compliant or not on each criteria separately and as a whole , so your friend can take a decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started