Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is a new company on the first year if business Project #12 Statement of Cash Flows Preview of Chapter The cash low statement is

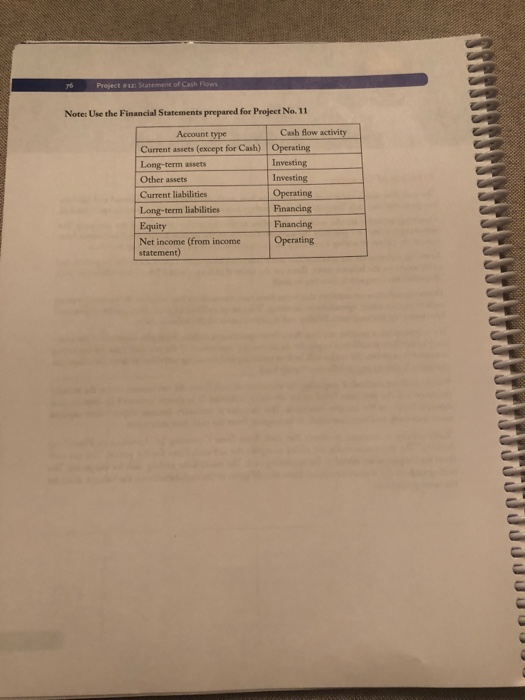

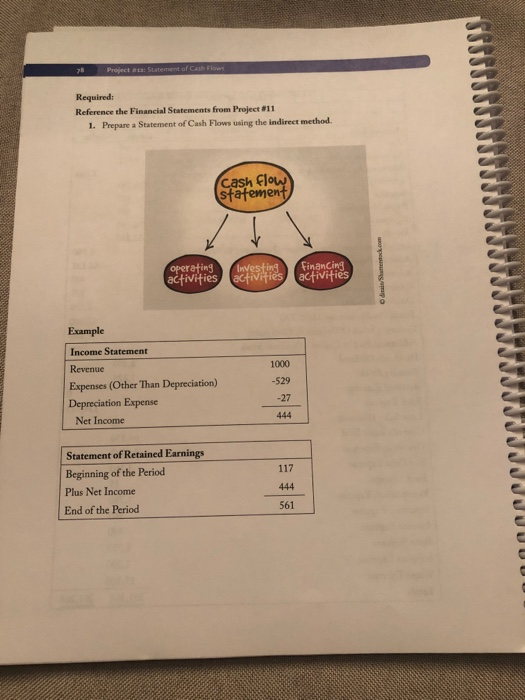

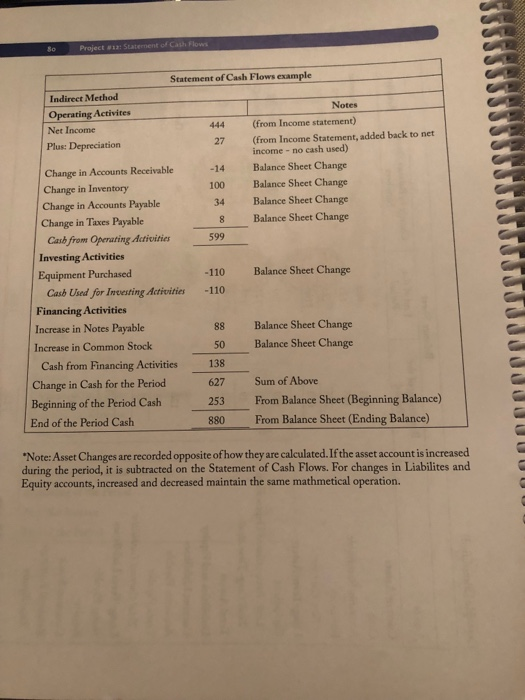

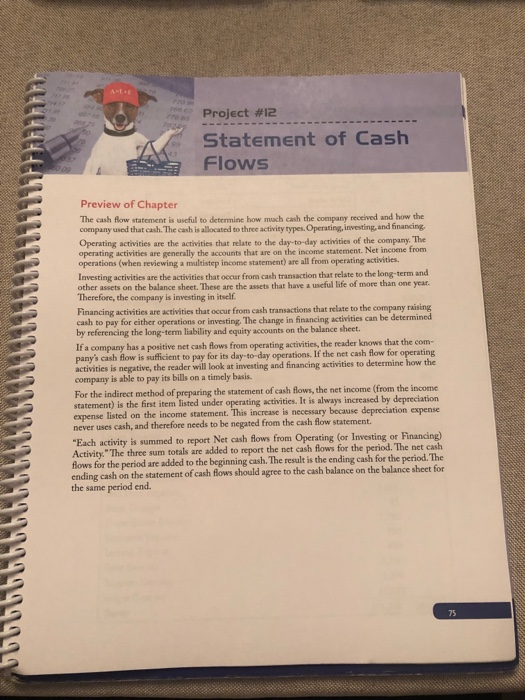

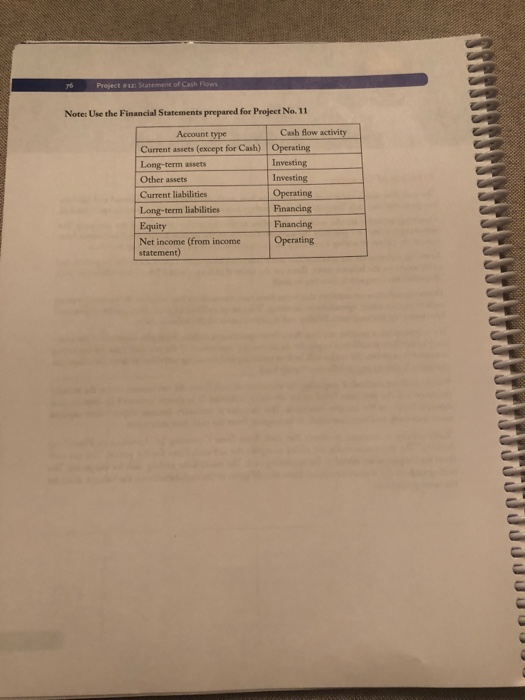

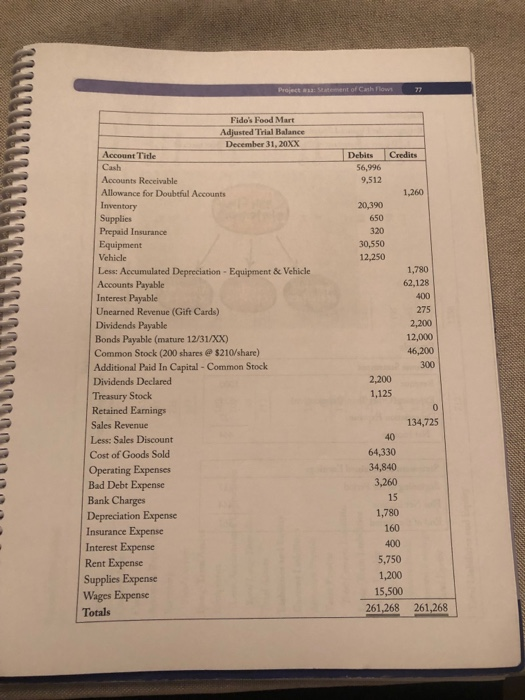

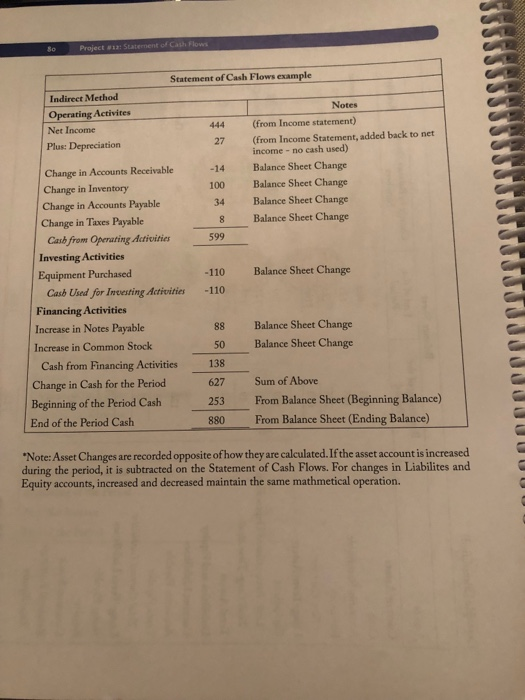

it is a new company on the first year if business Project #12 Statement of Cash Flows Preview of Chapter The cash low statement is useful to determine how mach cash the company received and how the company used that cash. The cash is allocated to three activity types. Operating, investing, and financing. Operating activities are the activities that relate to the day-to -day activities of the company. The operating activities are generally the accounts that are on the income statement. Net incoeme from operations (when reviewing a multistep income statement) are all from operating activities. Investing activities are the activities that occur from cash transaction that relate to the long-term and other assets on the balance sheet. These are the assets that have a uscful life of more than one year. Therefore, the company is investing in itself Financing activities are activities that occur from cash transactions that relate to the company raising cash to pay for either operations or investing. The change in financing activities can be determined by referencing the long-term liability and equity accounts on the balance sheet has a positive net cash fows from operating activities, the reader knows that the com its day-to-day operations. If the net cash flow activities is negative, the reader will look at investing and financing activities to determine how the company is able to pay its bills on a timely basis. income (from the income listed on the income statement. This increase is necessary because depreciation expense is summed to report Net cash flows from Operating (or Investing or Financing) For the indirect method of preparing the statement of cash flows, the net statement) is the first item listed under operating activities. It is always increased by depreciation expense never uses cash, and therefore needs to be negated from the cash flow statement. sum totals are added to report the net cash flows for the period. The net cash Activity."The three flows for the period are added to the beginning cash. The result is the ending cash for the period. The ending cash on the statement of cash flows should agree to the cash balance on the balance sheet for the same period end. 75 Note: Use the Financial Statements prepared for Project No. 11 Cash flow activity Account type Current assets (except for Cash) Operating Long-term assets Other assets Current liabilities Long-term liabilities Investing Investing Operating Financing Financing Net income (from income Operating statement) Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title DebitsCredits 56,996 9,512 Accounts Receivable Allowance for Doubeful Accounts 1,260 Inventory 20,390 650 320 30,550 12,250 Supplies Prepaid Insurance Equipment 1,780 62,128 400 275 2,200 12,000 Less: Accumulated Depreciation Equipment & Vehicle Accounts Payable Interest Payable Unearned Revenue (Gift Cards) Dividends Payable Bonds Payable (mature 12/31xX0) Common Stock (200 shares@$210/share) Additional Paid In Capital Common Stock Dividends Declared Treasury Stock Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses 300 2,200 1,125 134,725 64,330 34,840 3,260 15 1,780 160 Bad Debt Expense Bank Charges Depreciation Expense Insurance Expense Interest Expense 5,750 1,200 15,500 Rent Expense Supplies Expense Wages Expense Totals 261,268 261,268 Requiredr Reference the Financial Statements from Project #11 Prepare a Statement of Cash Flows using the indireet method. 1. cash Clow sfafemen operating ngFinanCing Example Income Statement Revenue Expenses (Other Than Depreciation) Depreciation Expense Net Income 1000 -529 Statement of Retained Earnings Beginning of the Period Plus Net Income End of the Period 561 #12: Stater Statement of Cash Flows example Indireet Method Operating Activites Notes (from Income statement) (from Income Statement, added back to net Net Income Plus: Depreciation Change in Accounts Receivable 444 27 income - no cash used) Balance Sheet Change Balance Sheet Change Balance Sheet Change -14 100 34 Change in Inventory Change in Accounts Payable Change in Taxes Payable 8 Balance Sheet Change Cash from Operating Activities Investing Activities Equipment Purchased Balance Sheet Change -110 Cash Used for Investing Activities Financing Activities -110 Increase in Notes Payable Increase in Common Stock 88 50 138 627 253 880 Balance Sheet Change Balance Sheet Change Cash from Financing Activities Change in Cash for the Period Beginning of the Period Cash Sum of Above From Balance Sheet (Beginning Balance) From Balance Sheet (Ending Balance) End of the Period Cash Note: Asset Changes are recorded opposite ofhow they are calculated.If the asset account is increased during the period, it is subtracted on the Statement of Cash Flows. For changes in Liabilites and Equity accounts, increased and decreased maintain the same mathmetical operation

it is a new company on the first year if business Project #12 Statement of Cash Flows Preview of Chapter The cash low statement is useful to determine how mach cash the company received and how the company used that cash. The cash is allocated to three activity types. Operating, investing, and financing. Operating activities are the activities that relate to the day-to -day activities of the company. The operating activities are generally the accounts that are on the income statement. Net incoeme from operations (when reviewing a multistep income statement) are all from operating activities. Investing activities are the activities that occur from cash transaction that relate to the long-term and other assets on the balance sheet. These are the assets that have a uscful life of more than one year. Therefore, the company is investing in itself Financing activities are activities that occur from cash transactions that relate to the company raising cash to pay for either operations or investing. The change in financing activities can be determined by referencing the long-term liability and equity accounts on the balance sheet has a positive net cash fows from operating activities, the reader knows that the com its day-to-day operations. If the net cash flow activities is negative, the reader will look at investing and financing activities to determine how the company is able to pay its bills on a timely basis. income (from the income listed on the income statement. This increase is necessary because depreciation expense is summed to report Net cash flows from Operating (or Investing or Financing) For the indirect method of preparing the statement of cash flows, the net statement) is the first item listed under operating activities. It is always increased by depreciation expense never uses cash, and therefore needs to be negated from the cash flow statement. sum totals are added to report the net cash flows for the period. The net cash Activity."The three flows for the period are added to the beginning cash. The result is the ending cash for the period. The ending cash on the statement of cash flows should agree to the cash balance on the balance sheet for the same period end. 75 Note: Use the Financial Statements prepared for Project No. 11 Cash flow activity Account type Current assets (except for Cash) Operating Long-term assets Other assets Current liabilities Long-term liabilities Investing Investing Operating Financing Financing Net income (from income Operating statement) Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title DebitsCredits 56,996 9,512 Accounts Receivable Allowance for Doubeful Accounts 1,260 Inventory 20,390 650 320 30,550 12,250 Supplies Prepaid Insurance Equipment 1,780 62,128 400 275 2,200 12,000 Less: Accumulated Depreciation Equipment & Vehicle Accounts Payable Interest Payable Unearned Revenue (Gift Cards) Dividends Payable Bonds Payable (mature 12/31xX0) Common Stock (200 shares@$210/share) Additional Paid In Capital Common Stock Dividends Declared Treasury Stock Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses 300 2,200 1,125 134,725 64,330 34,840 3,260 15 1,780 160 Bad Debt Expense Bank Charges Depreciation Expense Insurance Expense Interest Expense 5,750 1,200 15,500 Rent Expense Supplies Expense Wages Expense Totals 261,268 261,268 Requiredr Reference the Financial Statements from Project #11 Prepare a Statement of Cash Flows using the indireet method. 1. cash Clow sfafemen operating ngFinanCing Example Income Statement Revenue Expenses (Other Than Depreciation) Depreciation Expense Net Income 1000 -529 Statement of Retained Earnings Beginning of the Period Plus Net Income End of the Period 561 #12: Stater Statement of Cash Flows example Indireet Method Operating Activites Notes (from Income statement) (from Income Statement, added back to net Net Income Plus: Depreciation Change in Accounts Receivable 444 27 income - no cash used) Balance Sheet Change Balance Sheet Change Balance Sheet Change -14 100 34 Change in Inventory Change in Accounts Payable Change in Taxes Payable 8 Balance Sheet Change Cash from Operating Activities Investing Activities Equipment Purchased Balance Sheet Change -110 Cash Used for Investing Activities Financing Activities -110 Increase in Notes Payable Increase in Common Stock 88 50 138 627 253 880 Balance Sheet Change Balance Sheet Change Cash from Financing Activities Change in Cash for the Period Beginning of the Period Cash Sum of Above From Balance Sheet (Beginning Balance) From Balance Sheet (Ending Balance) End of the Period Cash Note: Asset Changes are recorded opposite ofhow they are calculated.If the asset account is increased during the period, it is subtracted on the Statement of Cash Flows. For changes in Liabilites and Equity accounts, increased and decreased maintain the same mathmetical operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started