Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is a Problem with Compound Interest. It contains 4 questions with sub questions. Case Study - Planning Ahead Precision Machining Corporation has been growing

It is a Problem with Compound Interest.

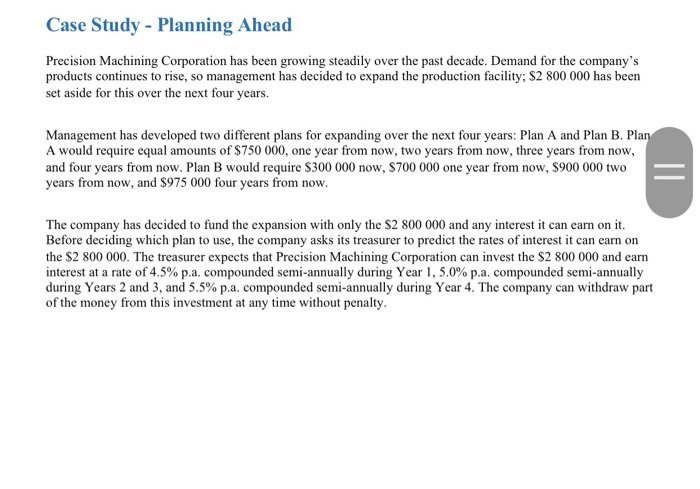

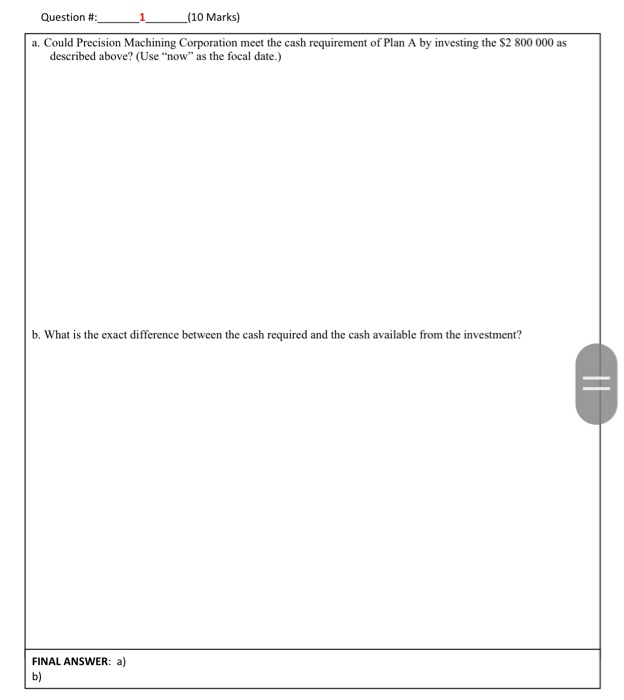

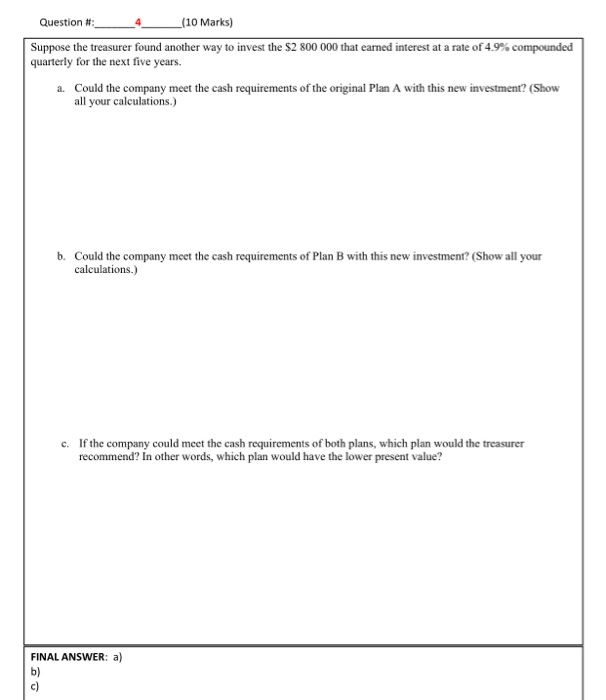

Case Study - Planning Ahead Precision Machining Corporation has been growing steadily over the past decade. Demand for the company's products continues to rise, so management has decided to expand the production facility; $2 800 000 has been set aside for this over the next four years. Management has developed two different plans for expanding over the next four years: Plan A and Plan B. Plan A would require equal amounts of $750 000, one year from now, two years from now, three years from now, and four years from now. Plan B would require $300 000 now, $700 000 one year from now, $900 000 two years from now, and $975 000 four years from now. The company has decided to fund the expansion with only the $2 800 000 and any interest it can earn on it. Before deciding which plan to use, the company asks its treasurer to predict the rates of interest it can earn on the $2 800 000. The treasurer expects that Precision Machining Corporation can invest the $2 800 000 and earn interest at a rate of 4.5% p.a. compounded semi-annually during Year 1, 5.0% p.a. compounded semi-annually during Years 2 and 3, and 5.5% p.a. compounded semi-annually during Year 4. The company can withdraw part of the money from this investment at any time without penalty. Question #: 1 (10 Marks) a. Could Precision Machining Corporation meet the cash requirement of Plan A by investing the S2 800 000 as described above? (Use "now" as the focal date.) b. What is the exact difference between the cash required and the cash available from the investment? FINAL ANSWER: a) Question #:_ 2_ _(10 Marks) c. Could Precision Machining Corporation meet the cash requirement of Plan B by investing the S2 800 000 as described above? (Use "now" as the focal date.) d. What is the exact difference between the cash required and the cash available from the investment? FINAL ANSWER: a) Question #:_ ___3__ (10 Marks) a. Suppose Plan A was changed so that it required equal amounts of $750 000 now, one year from now, two years from now, and four years from now. Could Precision Machining Corporation meet the cash requirements of the new Plan A by investing the $2 800 000 as described above? (Use "now" as the focal date.) b. What is the difference between the cash required and the cash available from the investment? FINAL ANSWER: a) Question #: (10 Marks) Suppose the treasurer found another way to invest the S2 800 000 that earned interest at a rate of 4.9% compounded quarterly for the next five years a. Could the company meet the cash requirements of the original Plan A with this new investment? (Show all your calculations.) b. Could the company meet the cash requirements of Plan B with this new investment? (Show all your calculations.) c. If the company could meet the cash requirements of both plans, which plan would the treasurer recommend? In other words, which plan would have the lower present value? FINAL ANSWER: a) It contains 4 questions with sub questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started