Question

It is April 1, 2022, and a manager of Interstate Truckers, Inc. anticipates buying 1,000,000gal of diesel fuel on May 30, 2022. Diesel fuel currently

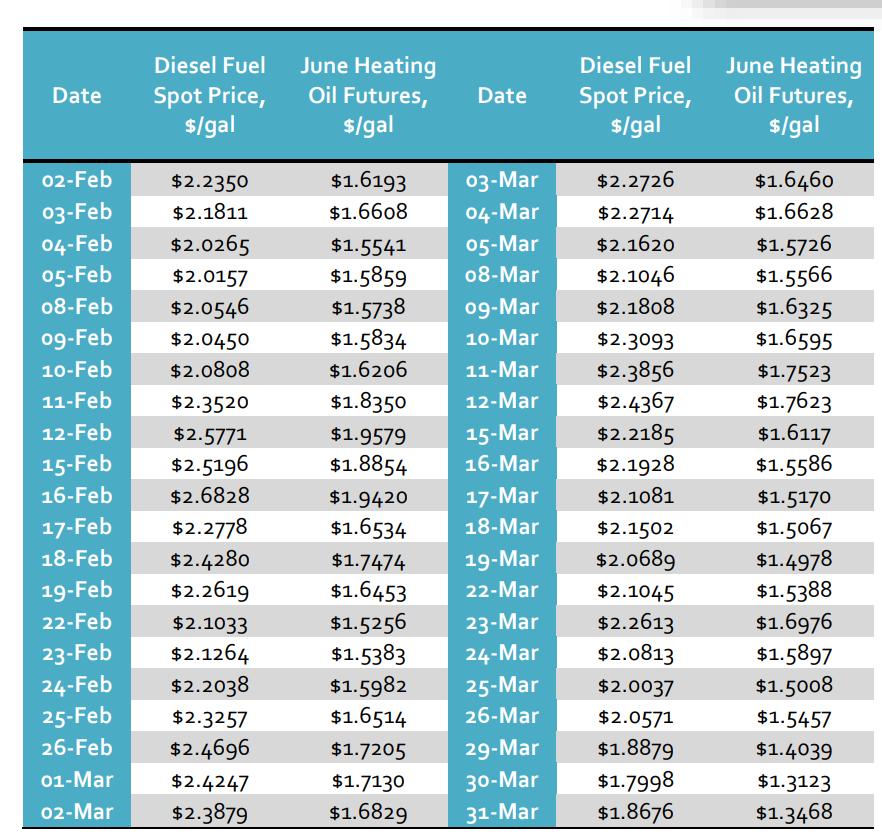

It is April 1, 2022, and a manager of Interstate Truckers, Inc. anticipates buying 1,000,000gal of diesel fuel on May 30, 2022. Diesel fuel currently sells on the spot market at $2.1742/gal. The manager is concerned about variability of the spot prices between April 1 and May 30 and wants to hedge this risk exposure. There is no futures market for diesel fuel, but the spot prices of diesel fuel tend to correlate with the prices of heating oil futures. The following table summarizes data on the spot prices of diesel fuel and futures prices of June heating oil contracts for the preceding two months Â

Â

a. Use the data above to find the standard deviations of spot and futures prices and the coefficient of correlation between the two. You might want to copy the table into Excel and perform calculations there.Â

b. Using the results from part a., find the variance-minimizing hedge ratio for hedging the volatility of diesel fuel spot price with the heating oil futures on April 1, 2022. Round your results to four decimal places.Â

c. Using the results from part b., find the optimal number of contracts that the manager has to buy on April 1, 2022, in order to hedge the purchase of 1,000,000gal of diesel fuel. The size of one heating oil futures contract is 42,000gal. Keep in mind that the exchange does not sell fractions of a contract.Â

d. Determine the actual hedge ratio that the manager will use if she ends up buying the number of contracts found in part c.

Date Diesel Fuel Spot Price, $/gal 02-Feb $2.2350 03-Feb $2.1811 04-Feb $2.0265 05-Feb $2.0157 08-Feb $2.0546 og-Feb $2.0450 10-Feb $2.0808 11-Feb 12-Feb 15-Feb 16-Feb 23-Feb 24-Feb $2.3520 $2.5771 $2.5196 $2.6828 17-Feb $2.2778 18-Feb $2.4280 19-Feb $2.2619 22-Feb $2.1033 $2.1264 $2.2038 25-Feb $2.3257 26-Feb $2.4696 01-Mar $2.4247 02-Mar $2.3879 June Heating Oil Futures, $/gal $1.6193 $1.6608 $1.5738 $1.5834 $1.6206 $1.8350 $1.9579 $1.8854 Date $1.5541 05-Mar $1.5859 08-Mar 03-Mar 04-Mar og-Mar 10-Mar 11-Mar 12-Mar 15-Mar 16-Mar $1.9420 17-Mar $1.6534 18-Mar $1.7130 $1.6829 $1.7474 $1.6453 $1.5256 23-Mar $1.5383 24-Mar $1.5982 25-Mar $1.6514 26-Mar 19-Mar 22-Mar Diesel Fuel Spot Price, $/gal 30-Mar 31-Mar $2.2726 $2.2714 $2.1620 $2.1046 $2.1808 $2.3093 $2.3856 $2.4367 $2.2185 $2.1928 $2.1081 $2.1045 $2.2613 $2.0813 $2.0037 $2.0571 $1.7205 29-Mar $1.8879 $1.7998 $1.8676 $2.1502 $2.0689 June Heating Oil Futures, $/gal $1.6460 $1.6628 $1.5726 $1.5566 $1.6325 $1.6595 $1.7523 $1.7623 $1.6117 $1.5586 $1.5170 $1.5067 $1.4978 $1.5388 $1.6976 $1.5897 $1.5008 $1.5457 $1.4039 $1.3123 $1.3468

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a To find the standard deviations of spot and futures prices and the coefficient of correlation betw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started