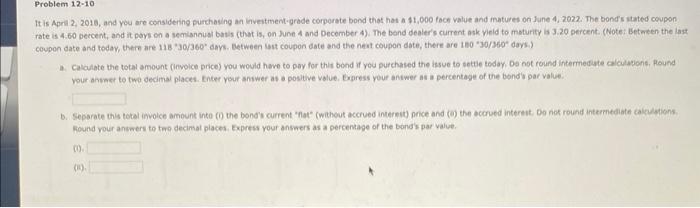

It is April 2, 2018, and you are considering purthasing an laveitment-grade corporate bond that hat a 11,000 foce value and matures on June 4, 2022. The bond's itated covpon rate is 4.60 percent, and it pays on a semisnousl bats (that is, on June 4 and December 4). The band dealer's current ask vieid to moturity is 3.20 percent. (Note. Betaten the iast coupon date and today, there are 118330/360 days. Eetween latt coupon date and the nest coupon date, there are 1n0 "30/360* days.) a. calailbte the total amount (iwvoice brice) you would have to pay for thit bond if you purchased the lisue to setie teday Da not round intermeciate caiculatons, found your ansest to two decimal places. Enter your answer at a poslive value. Eagress your anawer as a percentage of the bond's par value. b. Separate this totel involce amount inte (0) the bond's current "flat" (without accrued intereit) price and (a) the ocorued intereit. Do not round intermediate caiplagiens. Found vour answers to tae decimat places. Express your answers as a percenage of the bond s par value. (1) It is April 2, 2018, and you are considering purthasing an laveitment-grade corporate bond that hat a 11,000 foce value and matures on June 4, 2022. The bond's itated covpon rate is 4.60 percent, and it pays on a semisnousl bats (that is, on June 4 and December 4). The band dealer's current ask vieid to moturity is 3.20 percent. (Note. Betaten the iast coupon date and today, there are 118330/360 days. Eetween latt coupon date and the nest coupon date, there are 1n0 "30/360* days.) a. calailbte the total amount (iwvoice brice) you would have to pay for thit bond if you purchased the lisue to setie teday Da not round intermeciate caiculatons, found your ansest to two decimal places. Enter your answer at a poslive value. Eagress your anawer as a percentage of the bond's par value. b. Separate this totel involce amount inte (0) the bond's current "flat" (without accrued intereit) price and (a) the ocorued intereit. Do not round intermediate caiplagiens. Found vour answers to tae decimat places. Express your answers as a percenage of the bond s par value. (1)