Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is as per the UK tax laws. kindly do it as per UK tax laws. thanks. 1) Tax question: Clark Tent started business on

it is as per the UK tax laws. kindly do it as per UK tax laws. thanks.

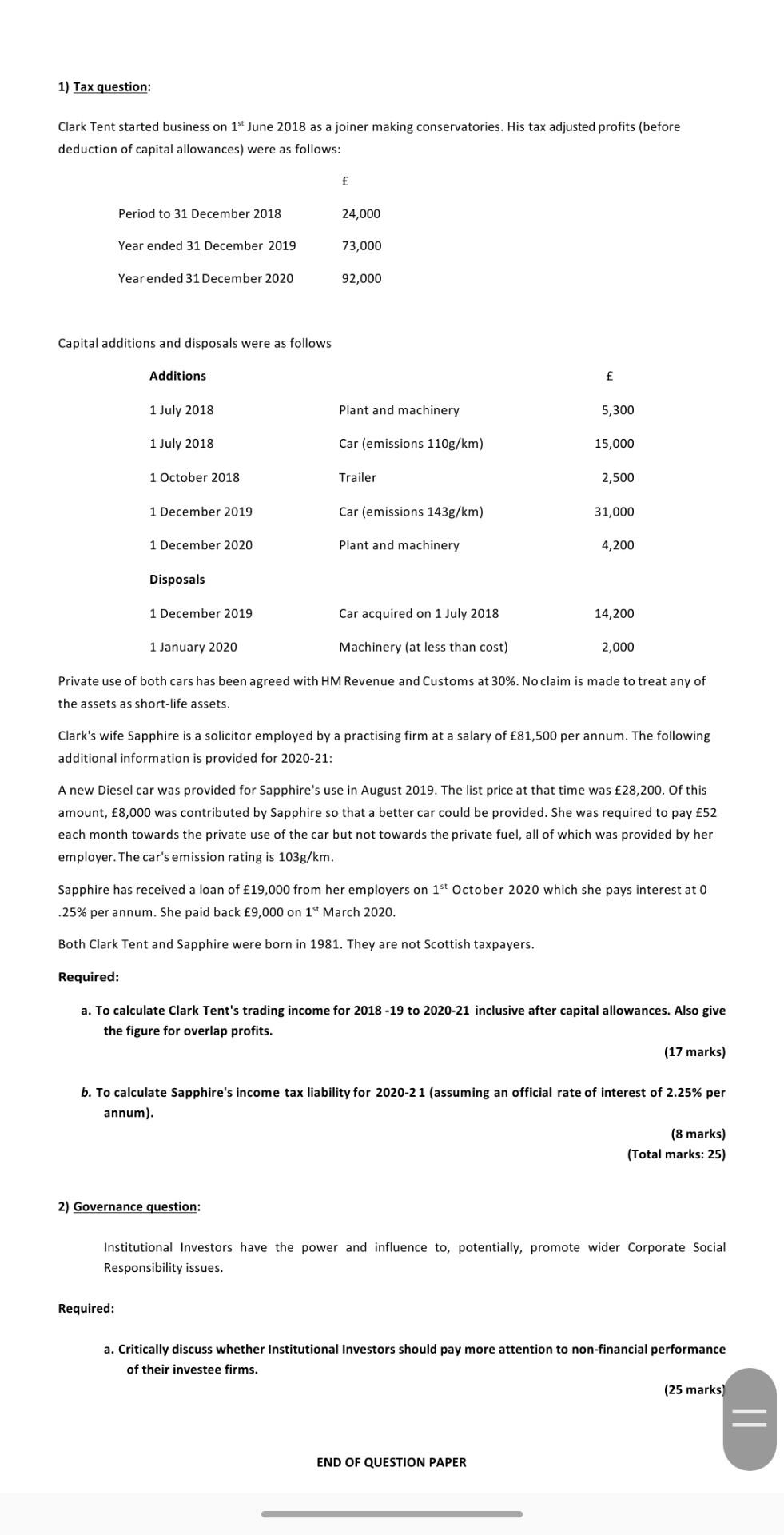

1) Tax question: Clark Tent started business on 1st June 2018 as a joiner making conservatories. His tax adjusted profits (before deduction of capital allowances) were as follows: Period to 31 December 2018 24,000 Year ended 31 December 2019 73,000 Year ended 31 December 2020 92,000 Capital additions and disposals were as follows Additions f 1 July 2018 Plant and machinery 5,300 1 July 2018 Car (emissions 110g/km) 15,000 1 October 2018 Trailer 2,500 1 December 2019 Car (emissions 143g/km) 31,000 1 December 2020 Plant and machinery 4,200 Disposals 1 December 2019 Car acquired on 1 July 2018 14,200 1 January 2020 Machinery (at less than cost) 2,000 Private use of both cars has been agreed with HM Revenue and Customs at 30%. No claim is made to treat any of the assets as short-life assets. Clark's wife Sapphire is a solicitor employed by a practising firm at a salary of 81,500 per annum. The following additional information is provided for 2020-21: A new Diesel car was provided for Sapphire's use in August 2019. The list price at that time was 28,200. Of this amount, 8,000 was contributed by Sapphire so that a better car could be provided. She was required to pay 52 each month towards the private use of the car but not towards the private fuel, all of which was provided by her employer. The car's emission rating is 103g/km. Sapphire has received a loan of 19,000 from her employers on 1st October 2020 which she pays interest at 0 .25% per annum. She paid back 9,000 on 1st March 2020. Both Clark Tent and Sapphire were born in 1981. They are not Scottish taxpayers. Required: a. To calculate Clark Tent's trading income for 2018 - 19 to 2020-21 inclusive after capital allowances. Also give the figure for overlap profits. (17 marks) b. To calculate Sapphire's income tax liability for 2020-21 (assuming an official rate of interest of 2.25% per annum). (8 marks) (Total marks: 25) 2) Governance question: Institutional Investors have the power and influence to, potentially, promote wider Corporate Social Responsibility issues. Required: a. Critically discuss whether Institutional Investors should pay more attention to non-financial performance of their investee firms. (25 marks II END OF QUESTION PAPER 1) Tax question: Clark Tent started business on 1st June 2018 as a joiner making conservatories. His tax adjusted profits (before deduction of capital allowances) were as follows: Period to 31 December 2018 24,000 Year ended 31 December 2019 73,000 Year ended 31 December 2020 92,000 Capital additions and disposals were as follows Additions f 1 July 2018 Plant and machinery 5,300 1 July 2018 Car (emissions 110g/km) 15,000 1 October 2018 Trailer 2,500 1 December 2019 Car (emissions 143g/km) 31,000 1 December 2020 Plant and machinery 4,200 Disposals 1 December 2019 Car acquired on 1 July 2018 14,200 1 January 2020 Machinery (at less than cost) 2,000 Private use of both cars has been agreed with HM Revenue and Customs at 30%. No claim is made to treat any of the assets as short-life assets. Clark's wife Sapphire is a solicitor employed by a practising firm at a salary of 81,500 per annum. The following additional information is provided for 2020-21: A new Diesel car was provided for Sapphire's use in August 2019. The list price at that time was 28,200. Of this amount, 8,000 was contributed by Sapphire so that a better car could be provided. She was required to pay 52 each month towards the private use of the car but not towards the private fuel, all of which was provided by her employer. The car's emission rating is 103g/km. Sapphire has received a loan of 19,000 from her employers on 1st October 2020 which she pays interest at 0 .25% per annum. She paid back 9,000 on 1st March 2020. Both Clark Tent and Sapphire were born in 1981. They are not Scottish taxpayers. Required: a. To calculate Clark Tent's trading income for 2018 - 19 to 2020-21 inclusive after capital allowances. Also give the figure for overlap profits. (17 marks) b. To calculate Sapphire's income tax liability for 2020-21 (assuming an official rate of interest of 2.25% per annum). (8 marks) (Total marks: 25) 2) Governance question: Institutional Investors have the power and influence to, potentially, promote wider Corporate Social Responsibility issues. Required: a. Critically discuss whether Institutional Investors should pay more attention to non-financial performance of their investee firms. (25 marks II END OF QUESTION PAPERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started