Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is clear !! Example One Anderson Ltd purchased a carton manufacturing machine, which has 10 year useful life, for $ 100 000 on 1

it is clear !!

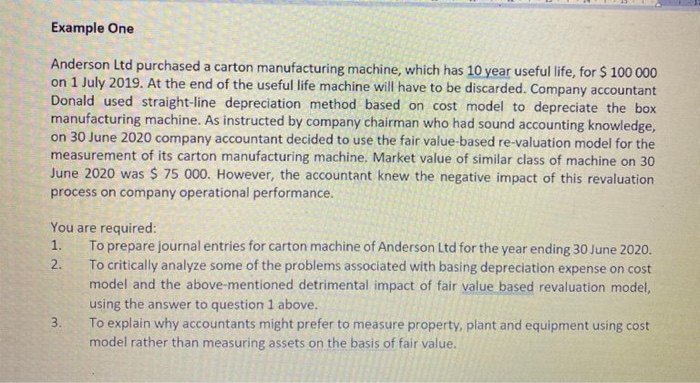

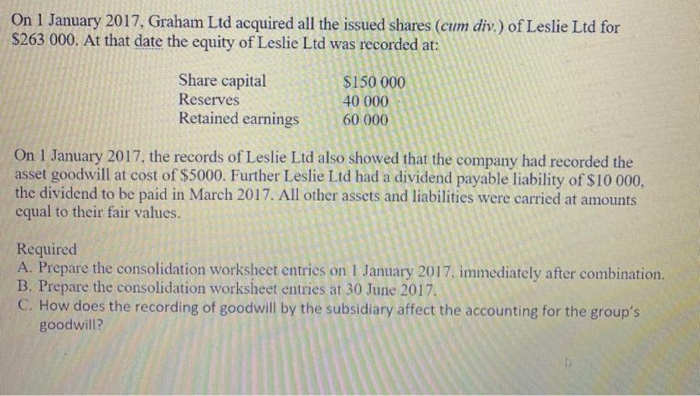

Example One Anderson Ltd purchased a carton manufacturing machine, which has 10 year useful life, for $ 100 000 on 1 July 2019. At the end of the useful life machine will have to be discarded. Company accountant Donald used straight-line depreciation method based on cost model to depreciate the box manufacturing machine. As instructed by company chairman who had sound accounting knowledge, on 30 June 2020 company accountant decided to use the fair value-based re-valuation model for the measurement of its carton manufacturing machine. Market value of similar class of machine on 30 June 2020 was $ 75 000. However, the accountant knew the negative impact of this revaluation process on company operational performance. You are required: 1. To prepare journal entries for carton machine of Anderson Ltd for the year ending 30 June 2020. 2. To critically analyze some of the problems associated with basing depreciation expense on cost model and the above-mentioned detrimental impact of fair value based revaluation model, using the answer to question 1 above. 3. To explain why accountants might prefer to measure property, plant and equipment using cost model rather than measuring assets on the basis of fair value. On 1 January 2017, Graham Ltd acquired all the issued shares (cum div.) of Leslie Ltd for $263 000. At that date the equity of Leslie Ltd was recorded at: Share capital Reserves Retained earnings $150 000 40 000 60 000 On 1 January 2017, the records of Leslie Ltd also showed that the company had recorded the asset goodwill at cost of $5000. Further Leslie Ltd had a dividend payable liability of $10 000, the dividend to be paid in March 2017. All other assets and liabilities were carried at amounts equal to their fair values. Required A. Prepare the consolidation worksheet entries on 1 January 2017, immediately after combination. B. Prepare the consolidation worksheet entries at 30 June 2017 C. How does the recording of goodwill by the subsidiary affect the accounting for the group's goodwill Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started