Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is December 1, 2020. Robert is your client and has just sent you the following email. I have two issues I need your

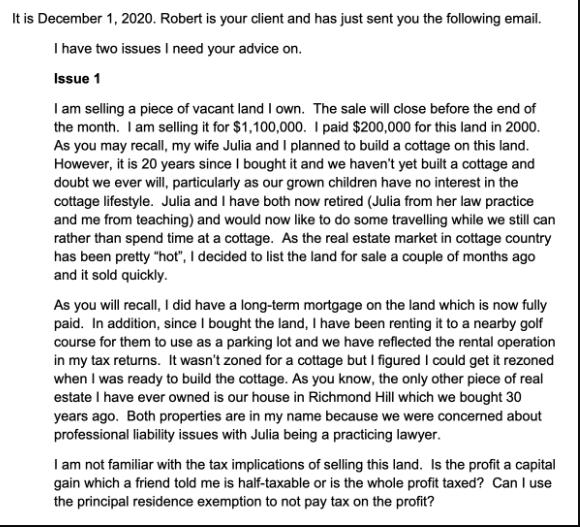

It is December 1, 2020. Robert is your client and has just sent you the following email. I have two issues I need your advice on. Issue 1 I am selling a piece of vacant land I own. The sale will close before the end of the month. I am selling it for $1,100,000. I paid $200,000 for this land in 2000. As you may recall, my wife Julia and I planned to build a cottage on this land. However, it is 20 years since I bought it and we haven't yet built a cottage and doubt we ever will, particularly as our grown children have no interest in the cottage lifestyle. Julia and I have both now retired (Julia from her law practice and me from teaching) and would now like to do some travelling while we still can rather than spend time at a cottage. As the real estate market in cottage country has been pretty "hot", I decided to list the land for sale a couple of months ago and it sold quickly. As you will recall, I did have a long-term mortgage on the land which is now fully paid. In addition, since I bought the land, I have been renting it to a nearby golf course for them to use as a parking lot and we have reflected the rental operation in my tax returns. It wasn't zoned for a cottage but I figured I could get it rezoned when I was ready to build the cottage. As you know, the only other piece of real estate I have ever owned is our house in Richmond Hill which we bought 30 years ago. Both properties are in my name because we were concerned about professional liability issues with Julia being a practicing lawyer. I am not familiar with the tax implications of selling this land. Is the profit a capital gain which a friend told me is half-taxable or is the whole profit taxed? Can I use the principal residence exemption to not pay tax on the profit?

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Dear Robert Thank you for reaching out with your questions regarding the sale of your vacant land I ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started