Answered step by step

Verified Expert Solution

Question

1 Approved Answer

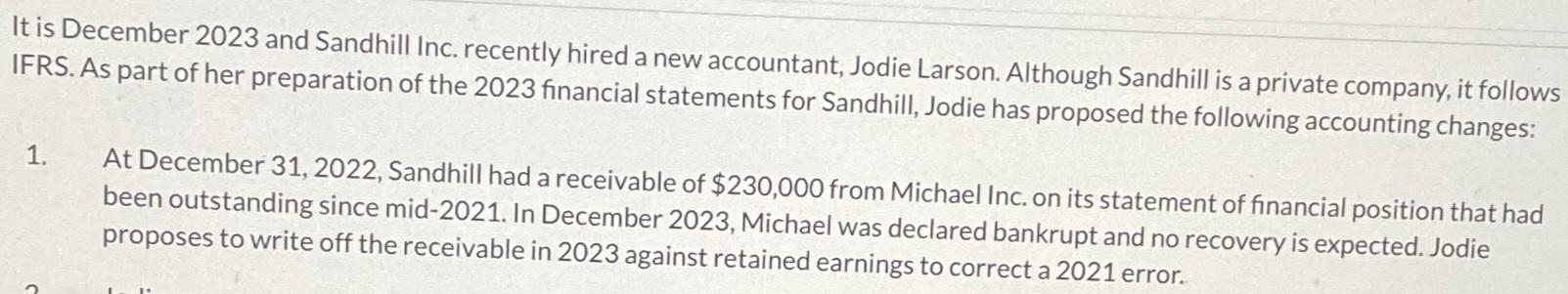

It is December 2023 and Sandhill Inc. recently hired a new accountant, Jodie Larson. Although Sandhill is a private company, it follows IFRS. As

It is December 2023 and Sandhill Inc. recently hired a new accountant, Jodie Larson. Although Sandhill is a private company, it follows IFRS. As part of her preparation of the 2023 financial statements for Sandhill, Jodie has proposed the following accounting changes: 1. At December 31, 2022, Sandhill had a receivable of $230,000 from Michael Inc. on its statement of financial position that had been outstanding since mid-2021. In December 2023, Michael was declared bankrupt and no recovery is expected. Jodie proposes to write off the receivable in 2023 against retained earnings to correct a 2021 error.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Jodies proposal to write off the receivable from Michael Inc against retained earnings in 2023 to co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d68ef53159_967355.pdf

180 KBs PDF File

663d68ef53159_967355.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started