Question

It is early June and a British exporter is expecting to receive a payment of 50 million in early October. The treasurer of the

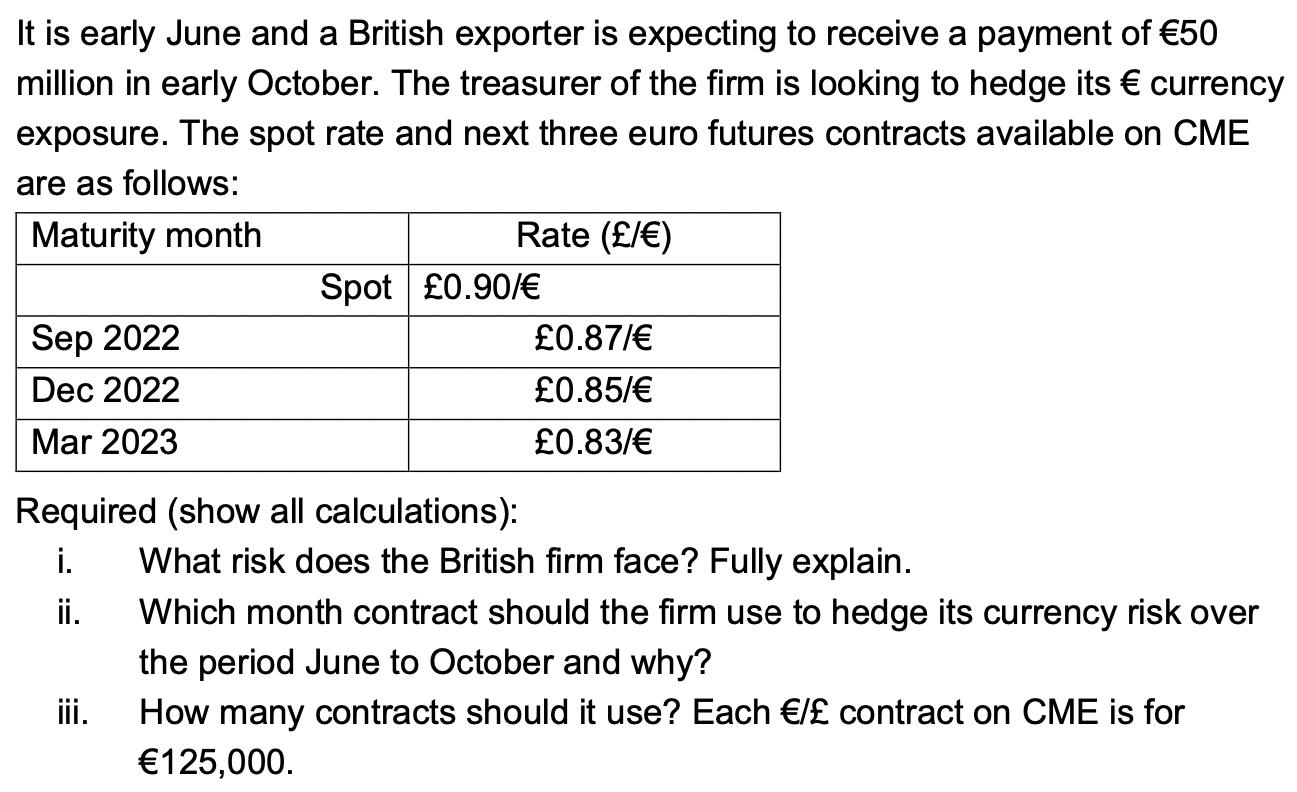

It is early June and a British exporter is expecting to receive a payment of 50 million in early October. The treasurer of the firm is looking to hedge its currency exposure. The spot rate and next three euro futures contracts available on CME are as follows: Maturity month Sep 2022 Dec 2022 Mar 2023 Rate (/) iii. Spot 0.90/ Required (show all calculations): i. ii. 0.87/ 0.85/ 0.83/ What risk does the British firm face? Fully explain. Which month contract should the firm use to hedge its currency risk over the period June to October and why? How many contracts should it use? Each / contract on CME is for 125,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i The British firm faces exchange rate risk which is the risk of loss due to changes in the exchange ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik

10th edition

0-07-794127-6, 978-0-07-79412, 978-0077431808

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App