Answered step by step

Verified Expert Solution

Question

1 Approved Answer

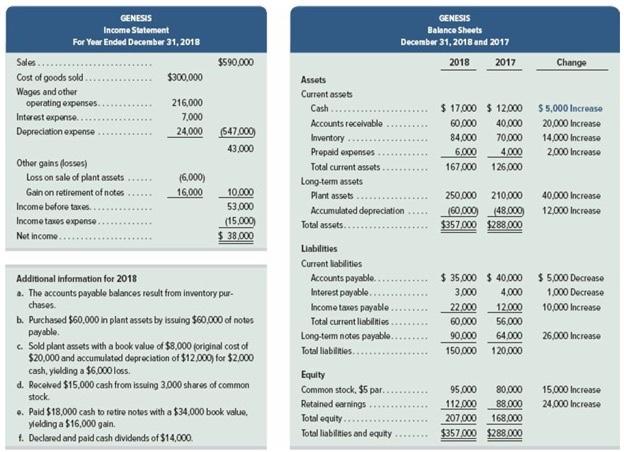

it is given in the additional information $590.000 GENESIS Income Statement For Year Ended December 31, 2018 Sales Cost of goods sold $300,000 Wages and

it is given in the additional information

$590.000 GENESIS Income Statement For Year Ended December 31, 2018 Sales Cost of goods sold $300,000 Wages and other operating expenses 216,000 Interest expense. 7,000 Depreciation expense 24,000 (547.000 43,000 Other gains fosses) Loss on sale of plant assets Gain on retirement of notes Income before taxes. Income taxes expense Net Income.. 16,000) 16,000 10,000 53,000 (15.000 $ 38,000 GENESIS Balance Sheets December 31, 2018 and 2017 2018 2017 Change Assets Current assets Cash $17.000 $ 12,000 $5,000 Increase Accounts receivable 60,000 40.000 20,000 Increase Inventory 84.000 70.000 14.000 Increase Prepaid expenses 6.000 4.000 2.000 Increase Total current assets 167.000 126,000 Long-term assets Plant assets 250,000 210,000 40,000 Increase Accumulated depreciation 160,000 (48.000 12,000 Increase Total assets. $357,000 $288,000 Liabilities Current liabilities Accounts payable $ 35,000 $40,000 $5,000 Decreaso Interest payable. 3,000 4.000 1.000 Decreaso Income taxes payable 22.000 12.000 10,000 Increase Total current liabilities 60,000 56,000 Long-term notes payable 90.000 64.000 26,000 Increase Total liabilities 150.000 120,000 Equity Common stock. $5 par 95.000 80,000 15,000 Increase Retained earnings 112.000 88.000 24.000 Increase Total equity 207.000 168,000 Total liabilities and equity $357,000 $288,000 Additional information for 2018 a. The accounts payablo balonces result from inventory pur- chases b. Purchased $60,000 in plant assets by issuing $60,000 of notes payable c. Sold plant assets with a book value of $8,000 (original cost of $20,000 and accumulated depreciation of $12.000 for $2.000 cash, yielding a $6.000 loss. d. Received $15,000 cash from Issuing 3,000 shares of common stock .. Paid $18.000 cash to retiro notes with a $34.000 book value, Yolding a $16,000 gain 1. Declared and paid cash dividends of $14,000 $590.000 GENESIS Income Statement For Year Ended December 31, 2018 Sales Cost of goods sold $300,000 Wages and other operating expenses 216,000 Interest expense. 7,000 Depreciation expense 24,000 (547.000 43,000 Other gains fosses) Loss on sale of plant assets Gain on retirement of notes Income before taxes. Income taxes expense Net Income.. 16,000) 16,000 10,000 53,000 (15.000 $ 38,000 GENESIS Balance Sheets December 31, 2018 and 2017 2018 2017 Change Assets Current assets Cash $17.000 $ 12,000 $5,000 Increase Accounts receivable 60,000 40.000 20,000 Increase Inventory 84.000 70.000 14.000 Increase Prepaid expenses 6.000 4.000 2.000 Increase Total current assets 167.000 126,000 Long-term assets Plant assets 250,000 210,000 40,000 Increase Accumulated depreciation 160,000 (48.000 12,000 Increase Total assets. $357,000 $288,000 Liabilities Current liabilities Accounts payable $ 35,000 $40,000 $5,000 Decreaso Interest payable. 3,000 4.000 1.000 Decreaso Income taxes payable 22.000 12.000 10,000 Increase Total current liabilities 60,000 56,000 Long-term notes payable 90.000 64.000 26,000 Increase Total liabilities 150.000 120,000 Equity Common stock. $5 par 95.000 80,000 15,000 Increase Retained earnings 112.000 88.000 24.000 Increase Total equity 207.000 168,000 Total liabilities and equity $357,000 $288,000 Additional information for 2018 a. The accounts payablo balonces result from inventory pur- chases b. Purchased $60,000 in plant assets by issuing $60,000 of notes payable c. Sold plant assets with a book value of $8,000 (original cost of $20,000 and accumulated depreciation of $12.000 for $2.000 cash, yielding a $6.000 loss. d. Received $15,000 cash from Issuing 3,000 shares of common stock .. Paid $18.000 cash to retiro notes with a $34.000 book value, Yolding a $16,000 gain 1. Declared and paid cash dividends of $14,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started