It is important for accountants to understand advanced accounting transactions. For this final project you will complete several advanced accounting transactions related to hedging.

There are several requirements for this Portfolio Project which should be submitted during the weeks when there are Portfolio Project Milestones (in Modules 2, 3, and 5).

Part 1: Journal Entries

Required: 1). Journal entries for hedging an unrecognized foreign currency firm commitment for two situations.

Key component: Use the case information and financial data in the Option 1 template file (linked under this assignment in Module 8). Complete the template, which will help you organize your responses. Also, address any instructor feedback provided in the milestone submissions using Excels comments function. Any written comments must be formatted according to the CSU-Global Guide to Writing & APA. (Links to an external site.)Links to an external site.

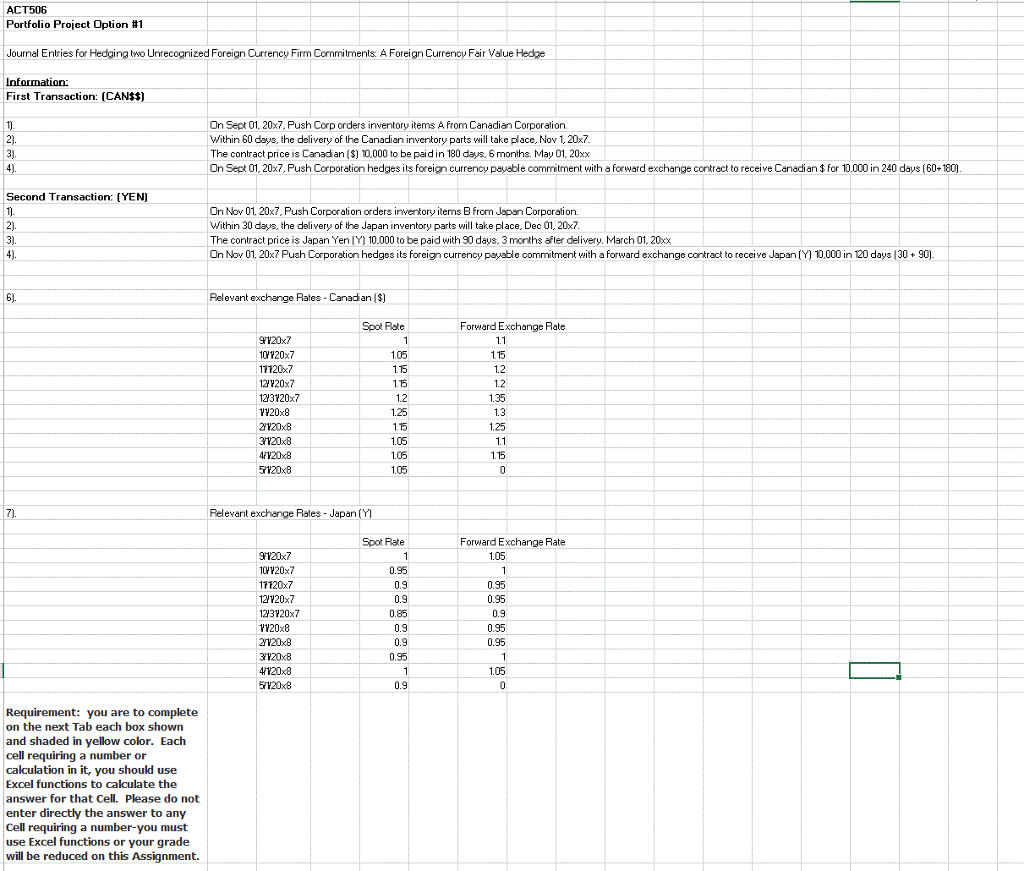

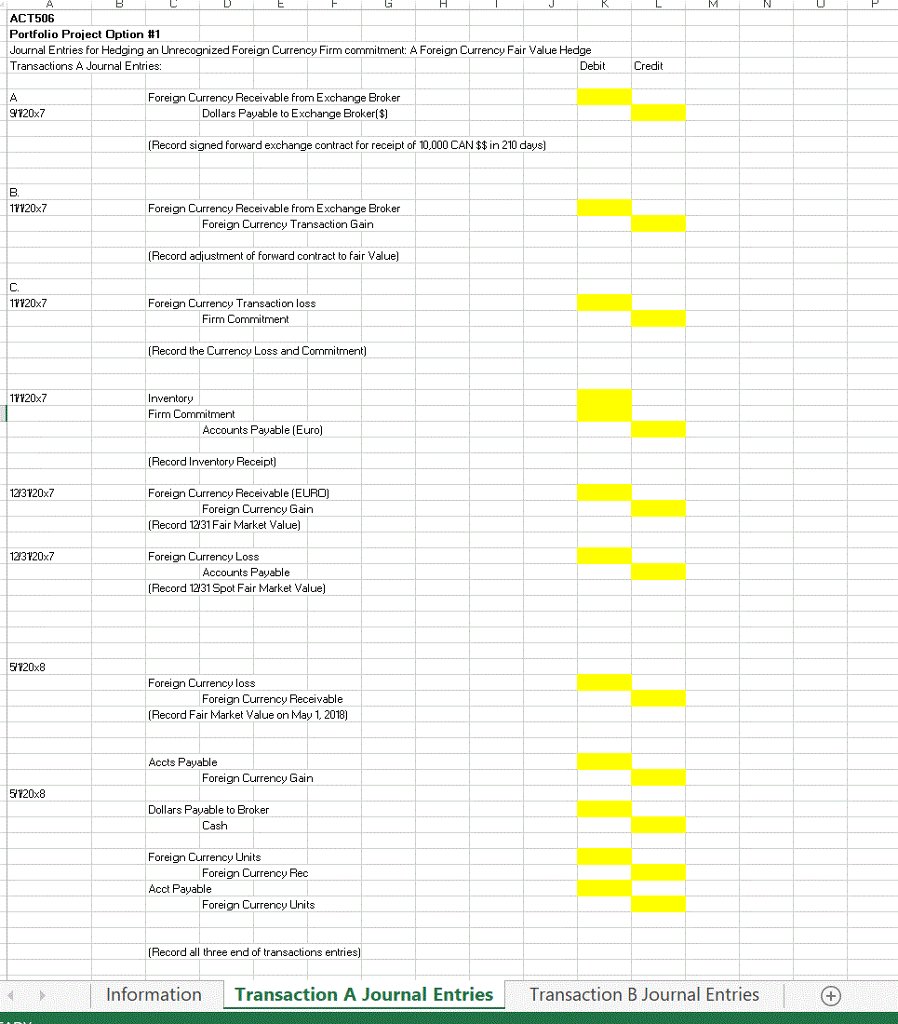

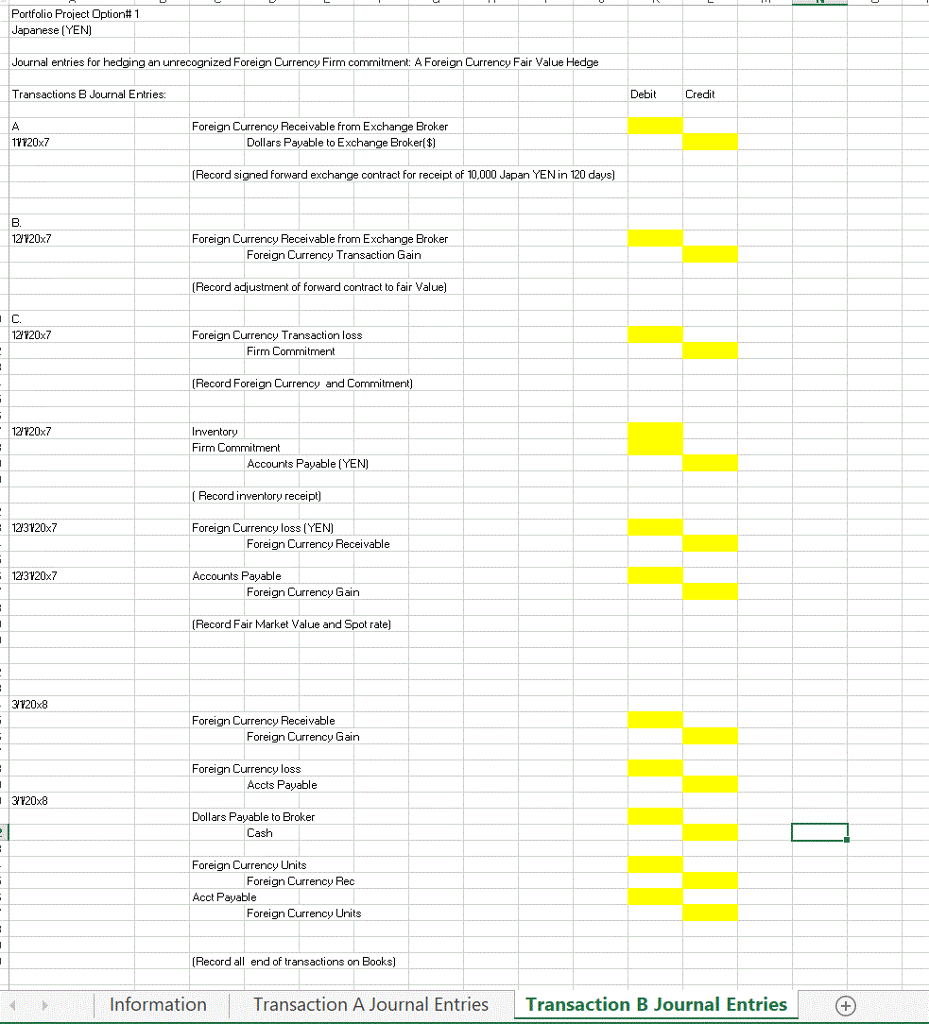

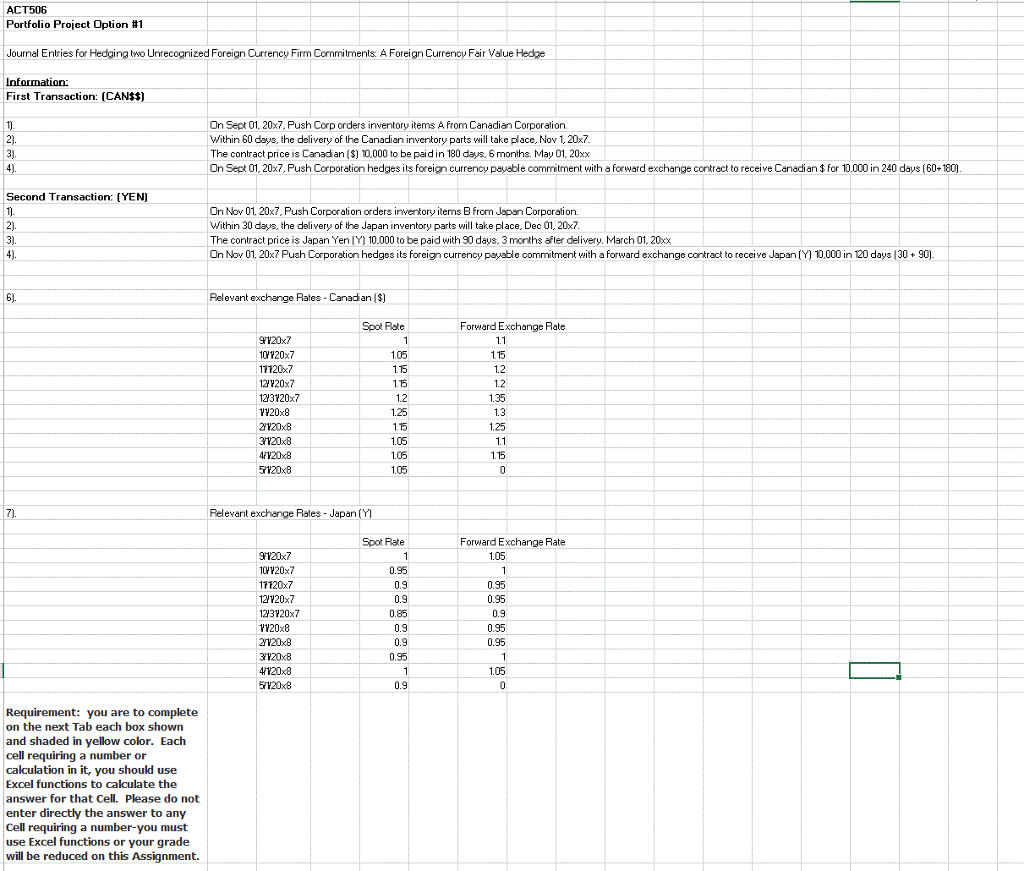

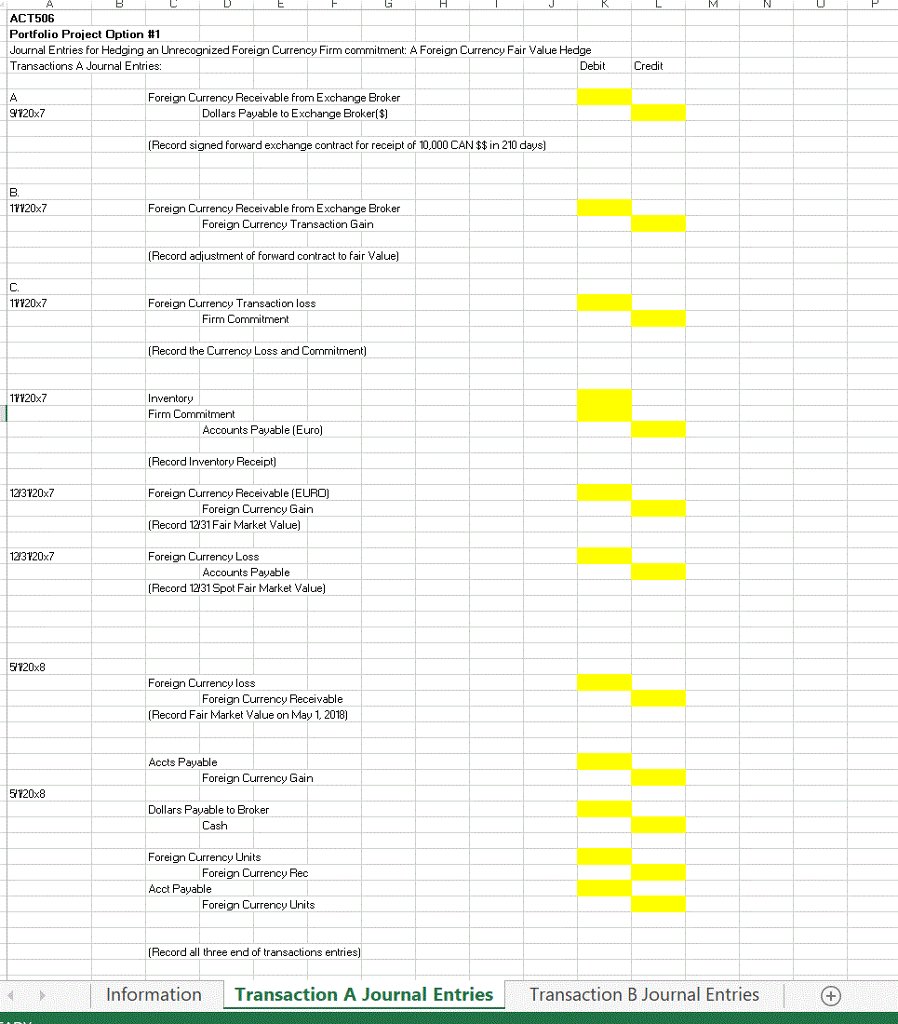

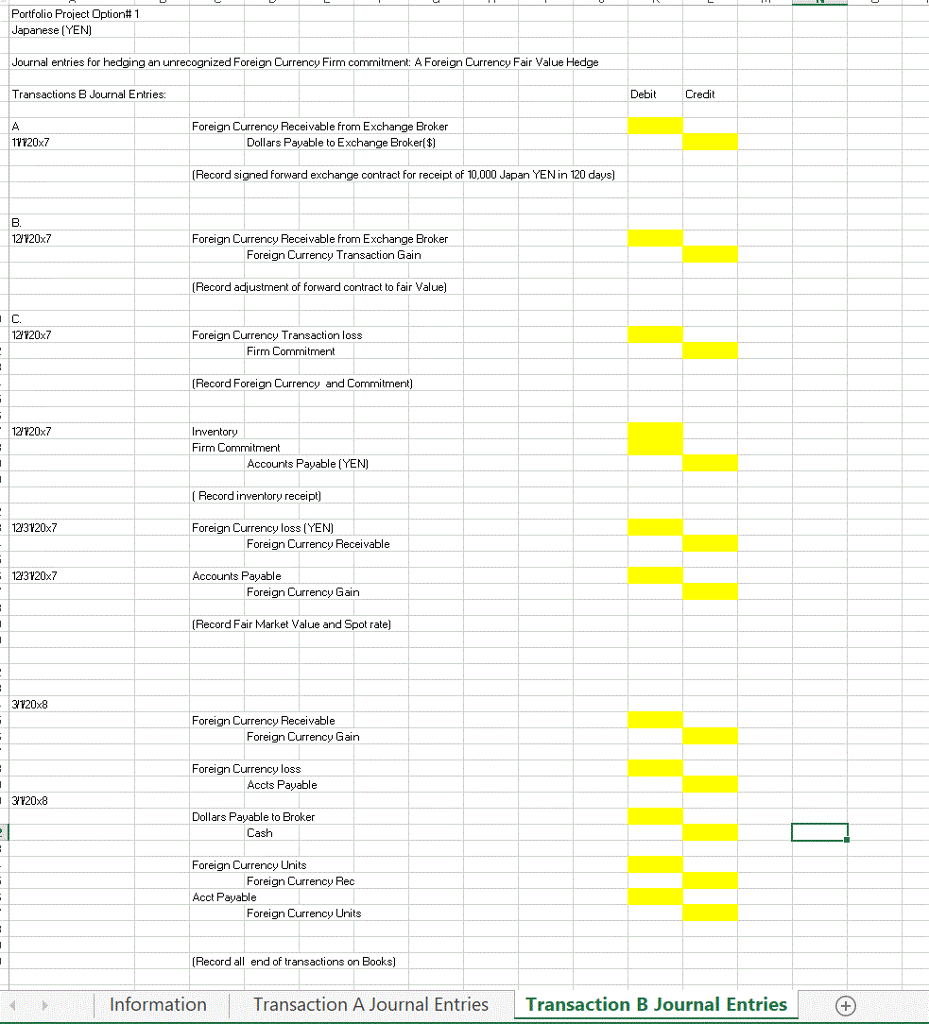

ACT506 Portfolio Project Option #1 Journal Enlries for Hedging two Unrecognized Foreign Currency Firm Commitments A Foreign Currency Fair Value Hedge First Transaction: (CAN$$) On Sept 01, 20x7, Push Corp orders inventory items A from Canadian Corporation. within 60 days, the delivery of the Canadian inventory parts will take place, Nov 1,20k7. The contract price is Canadan ($) 10,000 to be paid in 180 days, 6 months. May 01, 20xx On Sept 01, 20x7, Push Corporation hedges ils foreign currency payeble commitment with a forward exchange contract to receive Canadian $ for 10,000 in 240 days (60+180) Second Transaction: [YEN) On Nov 01. 20x7. Push Corporation orders inventory items B from Japan Corporation. Within 30 days, the delivery of the Japan inventory parts ill take place, Dec 01, 20x7 The contract price is Japan Yen() 10,000 to be paid with S0 days, 3 months after delivery March 01, 20x On Nov 01 207 Push Corporation hedges its foreign currency payable commitment with a forward exchange contract to receive Japan ] 10,000 in 120 days 30 2) 90) Relevant exchange Rates Canadian ($) Spot Rate Forward Exchange Rate T20x7 104720x7 1.05 115 1.15 1.2 1.25 1.15 1.06 1.05 1.05 1.1 1.15 1.2 1.2 1.35 1.3 1.25 1.1 1.15 12T20x7 123120x7 Y120x8 2120x8 120x8 120x8 Relevant exchange Rales -Japan( Spot Rate Forward Exchange Rate 1.05 101120x7 17120x7 12720x7 123720x7 Y120x8 2120x8 0.95 0.9 0.9 0.85 0.95 0.95 0.95 0.95 0.9 0.95 1.05 0.9 Requirement: you are to complete on the next Tab each box shown and shaded in yellow color. Each cell requiring a number or calculation in it, you should use Excel functions to calculate the answer for that Cell. Please do not enter directly the answer to any Cell requiring a number-you must use Excel functions or your grade will be reduced on this Assignment. ACT506 Portfolio Project Option #1 Journal Entries for Hedging an Unrecognized Foreign Currency Firm commitment: A Foreign Currency Fair Value Hedge Transactions A Journal Entries Debi Credit Foreign Currency Receivable from Exchange Broker V120x7 Dollars Payable to Exchange Broker($] Record signed forward exchange contract for receipt of 10,000 CAN $$ in 210 days) B. 11120x7 Foreign Currency Receivable from Exchange Broker Foreign Currency Transaction Gain (Record adjustment of forward contract to fair Value C. 17720x7 Foreign Currency Transaction loss Firm Commitment (Record the Currency Loss and Commitment) 17120x7 Firm Commitment Accounts Payable (Euro) Record Inventory Receipt Foreign Currency Receivable (EURO) (Record 1231 Fair Market Value) Foreign Currency Loss (Record 12131 Spot Fair Market Value) 123120x7 Foreign Currency Gain 123120x7 Accounts Payable E120x8 Foreign Currency loss Foreign Currency Receivable Record Fair Market Value on May 1, 2018) Accts Payable Foreign Currency Gain E20x8 Dollars Payable to Broker Cash Foreign Currency Units Foreign Currency Rec Acct Payable Foreign Currency Units (Record all three end of transactions entries) : Information Transaction A Journal Entries Transaction B Journal Entries Portfolio Project Option# 1 Japanese (YEN Journal entries for hedging an unrecognized Foreign Currency Firm commitment: A Foreign Currency Fair Value Hedge Transactions B Journal Entries: Debi Credit Foreign Currency Receivable from Exchange Broker 1V120x7 Dollars Payable to Exchange Broker($) (Record signed forward exchange contract for receipt of 10,000 Japan YEN in 120 days) 8 12720x7 Foreign Currency Heceivable From Exchange Broker Foreign Currency Transaction Gain (Record adjustment of forward contract to fair Value] C. 12120x7 Foreign Curency Transaction loss Firm Commitment lHecoraForeign Lurrency and Lommitment 12120x7 Inventory Firm Commitment Accounts Payable (YEN Record inventory receipt 123120x7 Foreign Currency loss (YEN) Foreign Currency Receivable 123120x7 Accounts Payable Foreign Currency Gain Record Fair Market Value and Spot rate) 120x8 Foreign Currency Receivable Foreign Currency Gain Foreign Currency loss Accts Payable 120x8 Dollars Payable to Broker Cash Foreign Currency Units Foreign Currency Rec Acct Payable Foreign Currency Units Record all end of transactions on Books Information Transaction A Journal EntriesTransaction B Journal Entries