It is important to review HBR case - Olynpic rent a car case to solve this.

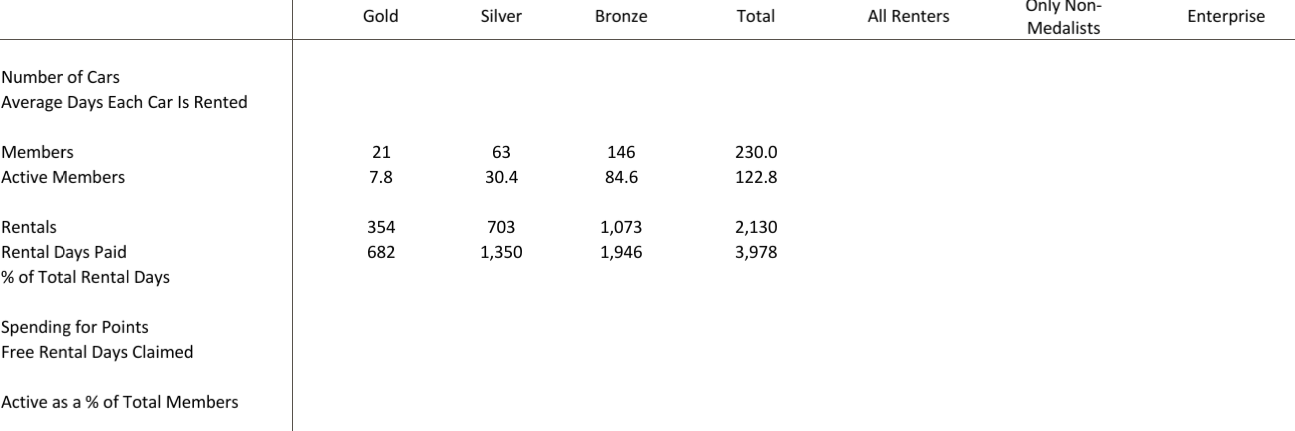

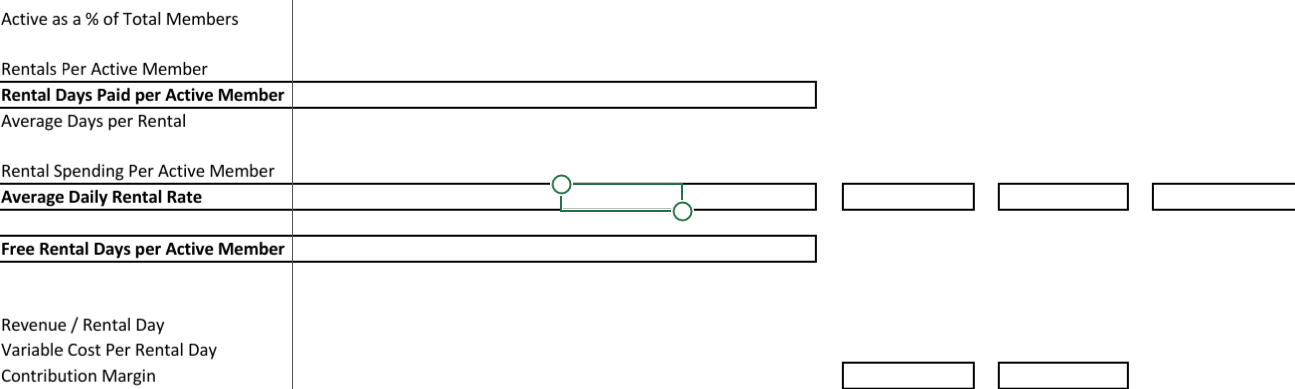

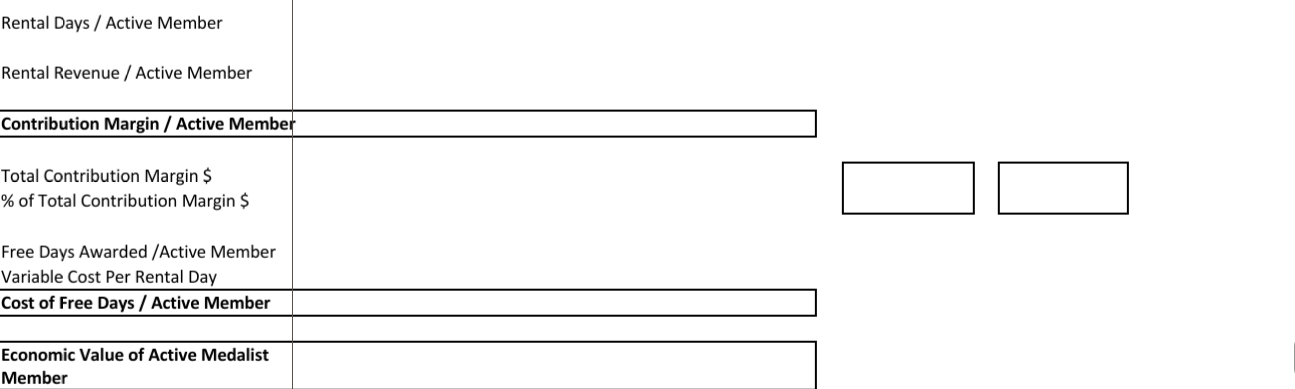

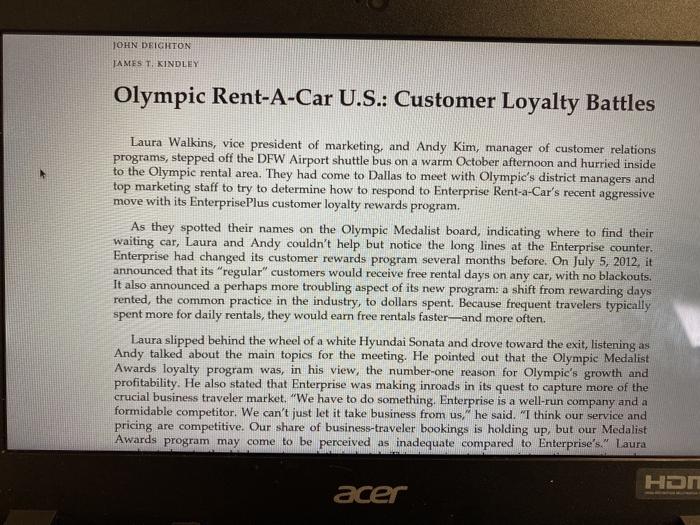

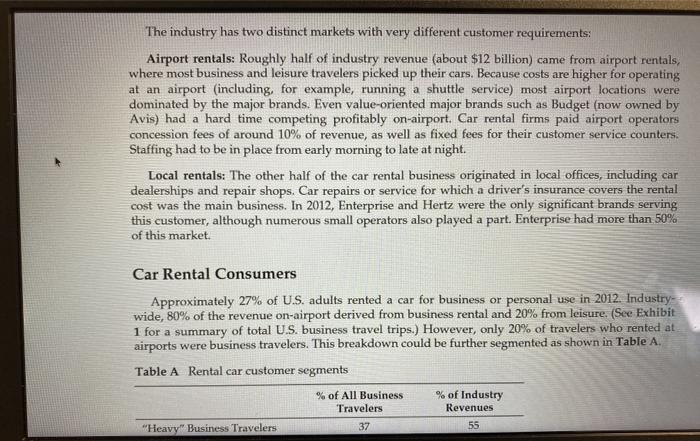

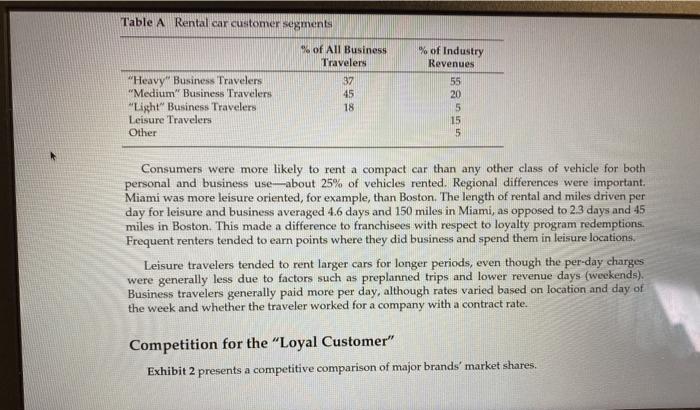

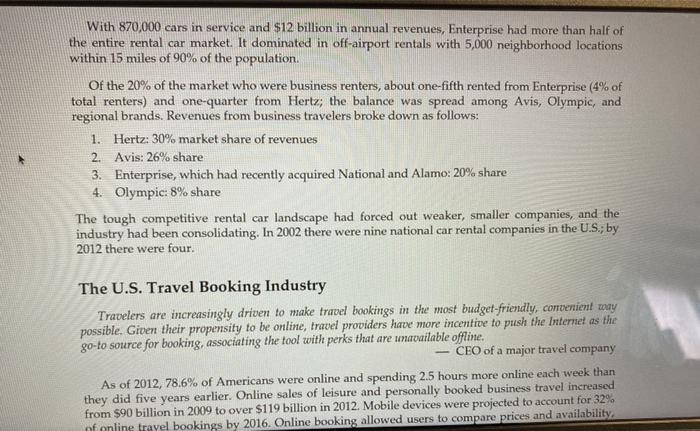

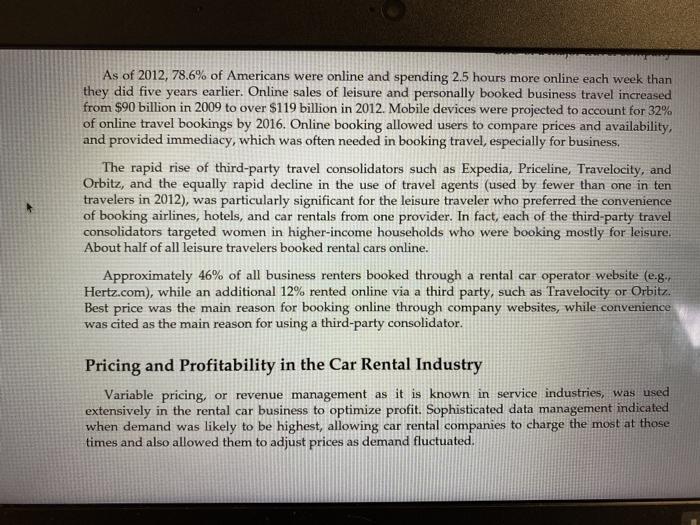

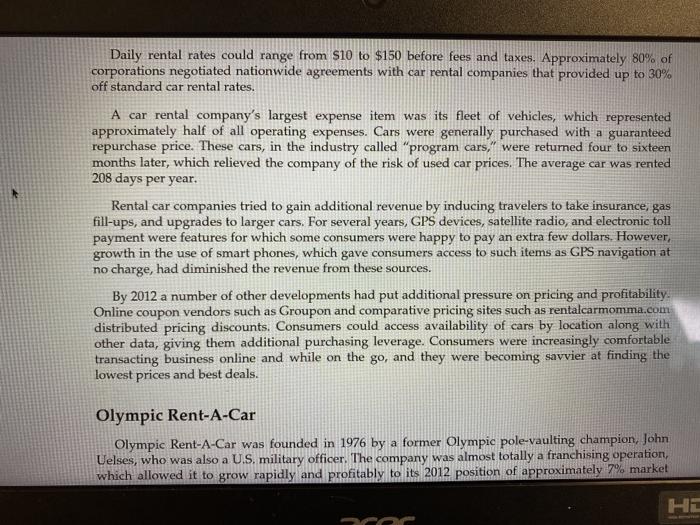

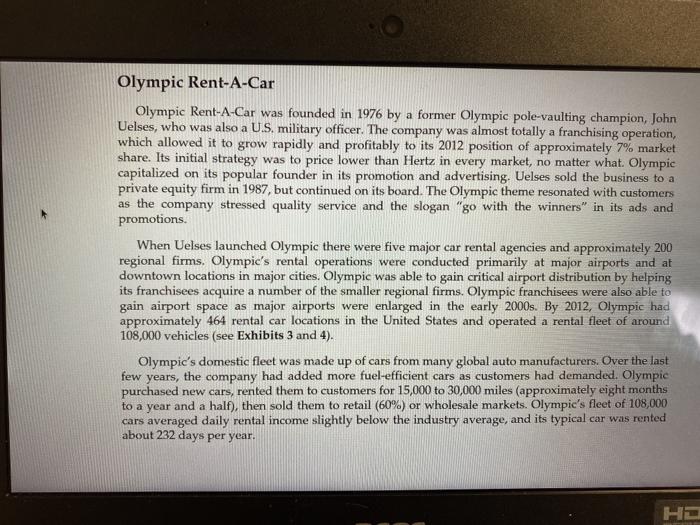

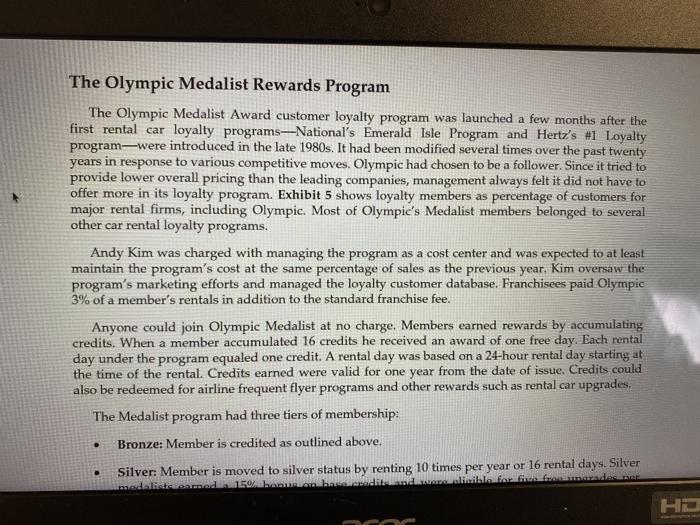

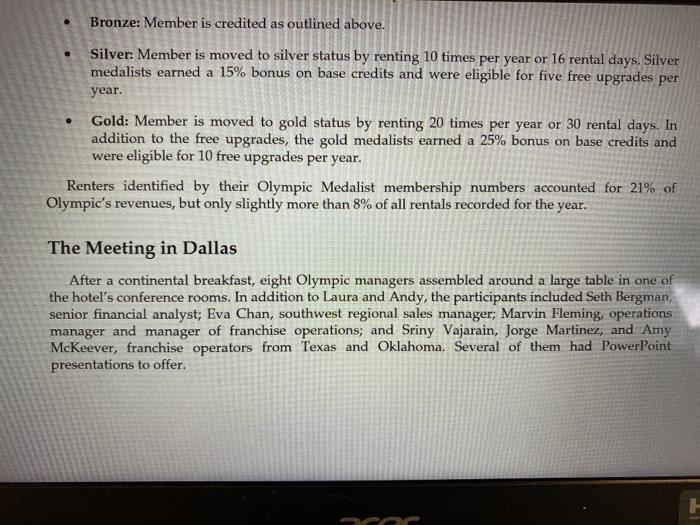

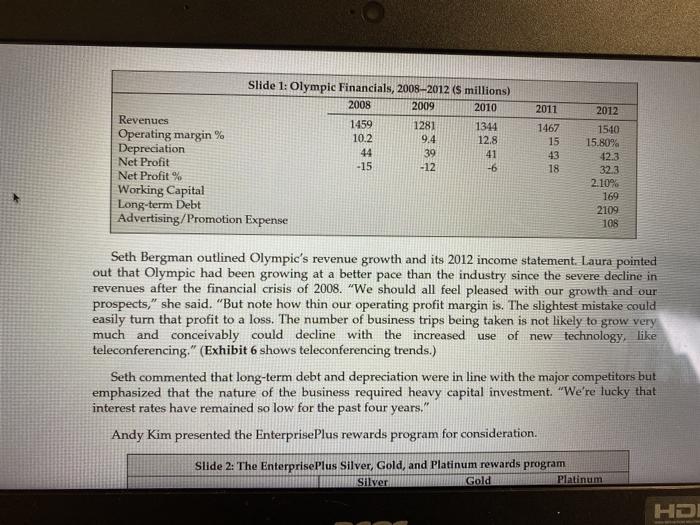

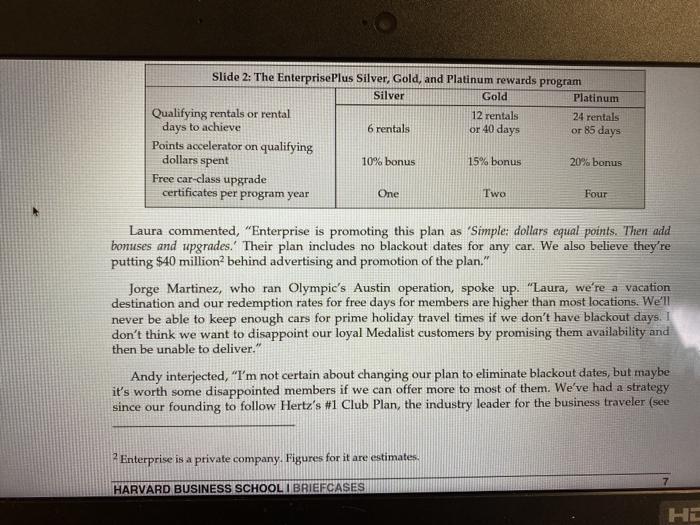

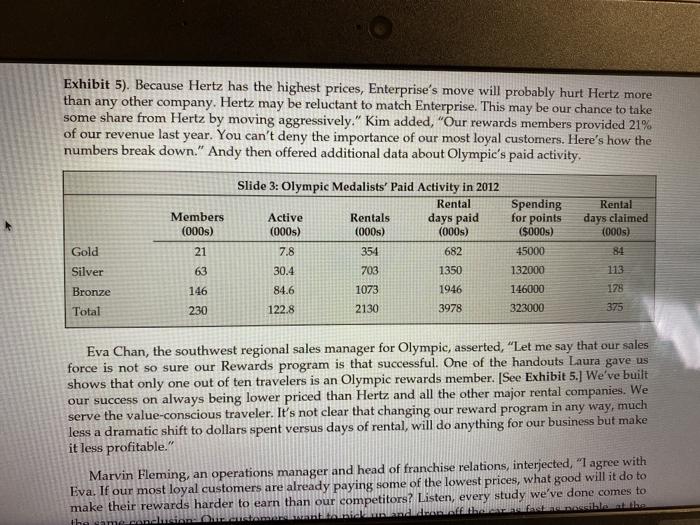

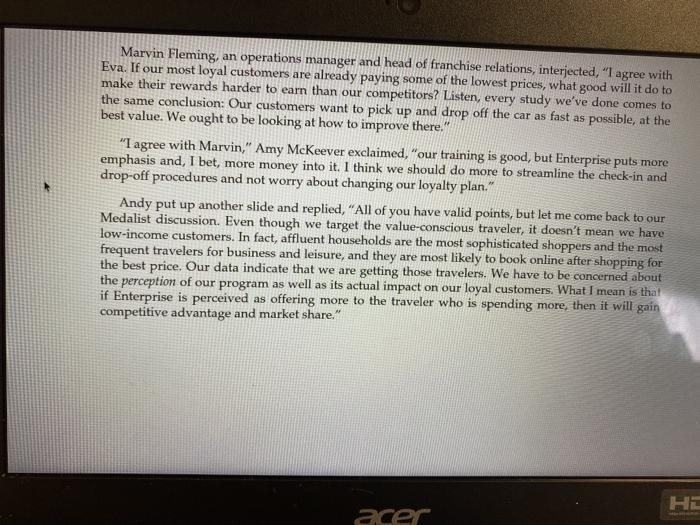

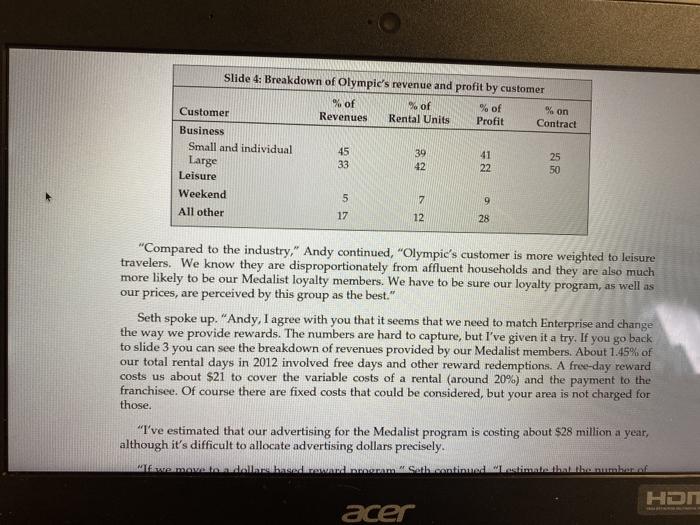

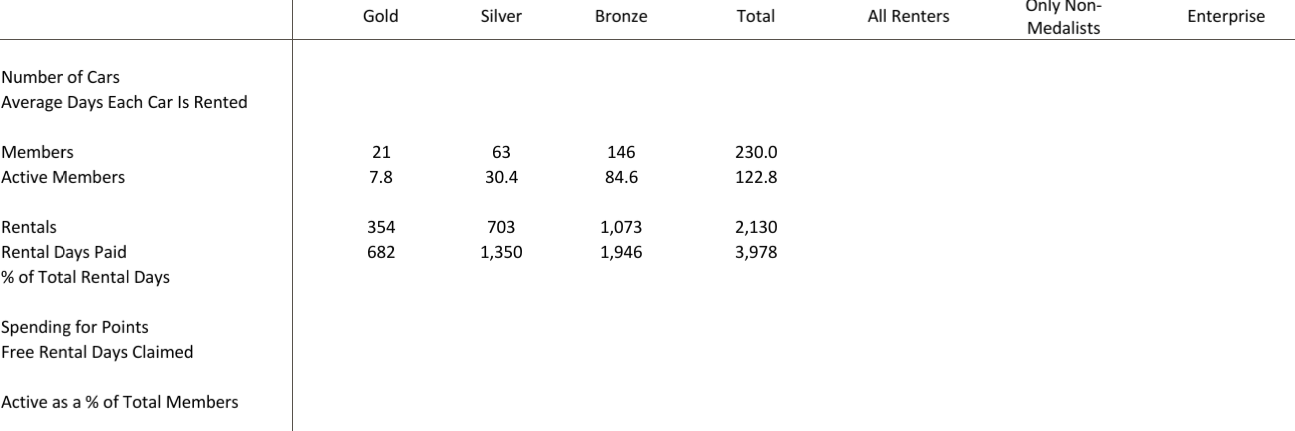

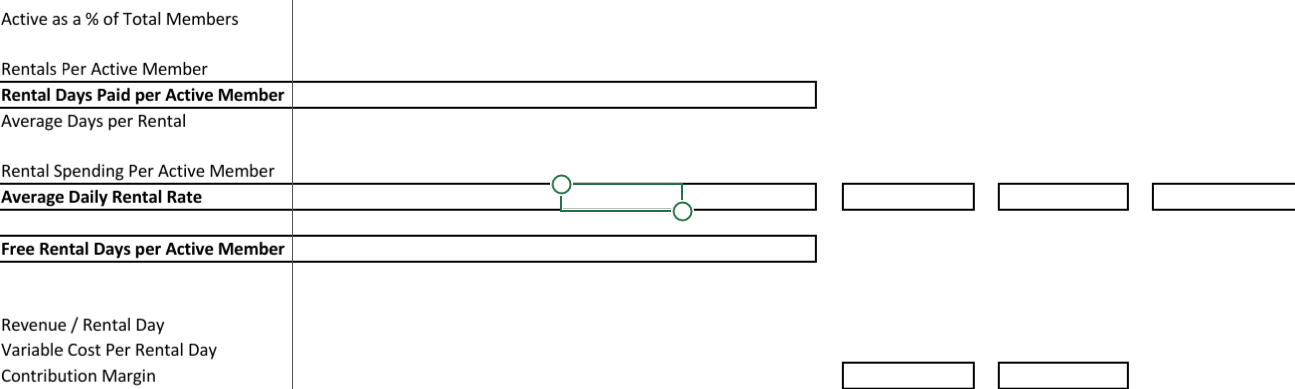

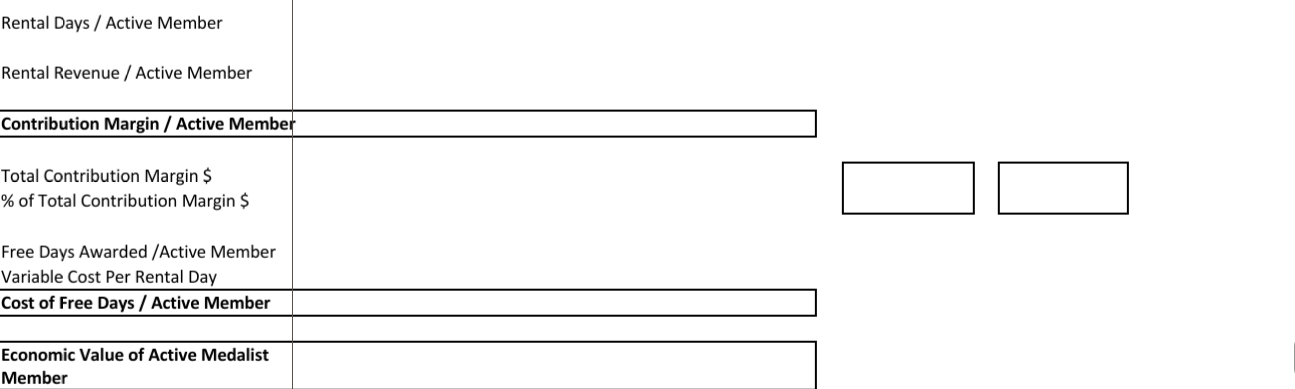

Gold Silver Bronze Total All Renters Only Non- Medalists Enterprise Number of Cars Average Days Each Car Is Rented 63 146 Members Active Members 21 7.8 230.0 122.8 30.4 84.6 Rentals Rental Days Paid % of Total Rental Days 354 682 703 1,350 1,073 1,946 2,130 3,978 Spending for Points Free Rental Days Claimed Active as a % of Total Members Active as a % of Total Members Rentals Per Active Member Rental Days Paid per Active Member Average Days per Rental Rental Spending Per Active Member Average Daily Rental Rate Free Rental Days per Active Member Revenue / Rental Day Variable Cost Per Rental Day Contribution Margin Rental Days / Active Member Rental Revenue / Active Member Contribution Margin / Active Member Total Contribution Margin $ % of Total Contribution Margin $ Free Days Awarded /Active Member Variable Cost Per Rental Day Cost of Free Days / Active Member Economic Value of Active Medalist Member JOHN DEIGHTON JAMES T. KINDLEY Olympic Rent-A-Car U.S.: Customer Loyalty Battles Laura Walkins, vice president of marketing, and Andy Kim, manager of customer relations programs, stepped off the DFW Airport shuttle bus on a warm October afternoon and hurried inside to the Olympic rental area. They had come to Dallas to meet with Olympic's district managers and top marketing staff to try to determine how to respond to Enterprise Rent-a-Car's recent aggressive move with its EnterprisePlus customer loyalty rewards program. As they spotted their names on the Olympic Medalist board, indicating where to find their waiting car, Laura and Andy couldn't help but notice the long lines at the Enterprise counter. Enterprise had changed its customer rewards program several months before. On July 5, 2012, it announced that its "regular" customers would receive free rental days on any car, with no blackouts. It also announced a perhaps more troubling aspect of its new program: a shift from rewarding days rented, the common practice in the industry, to dollars spent. Because frequent travelers typically spent more for daily rentals, they would earn free rentals faster and more often. Laura slipped behind the wheel of a white Hyundai Sonata and drove toward the exit, listening as Andy talked about the main topics for the meeting. He pointed out that the Olympic Medalist Awards loyalty program was, in his view, the number one reason for Olympie's growth and profitability. He also stated that Enterprise was making inroads in its quest to capture more of the crucial business traveler market. "We have to do something. Enterprise is a well-run company and a formidable competitor. We can't just let it take business from us," he said. "I think our service and pricing are competitive. Our share of business-traveler bookings is holding up, but our Medalist Awards program may come to be perceived as inadequate compared to Enterprise's." Laura HON acer WERP PORSLITE accelerated onto the highway toward their hotel. This is going to be an interesting meeting, she thought Loyalty Marketing Programs Customer loyalty programs are direct efforts by companies to gain long-term business from their best customers. These programs also provide considerable information about customers that enable companies to maintain a more knowledgeable and "personal relationship-ideally similar to those customers develop with many small, local businesses like dry cleaners and hair salons. HBS Professor John Deighton and College of Charleston professor James T. Kindley prepared this case volely as a basis for class discusion and not as an endorsement, a source of primary data, or an illustration of effective or ineffective management. Although based on real events and despite occasional references to actual companies, this case is fictitious and any resemblance to actual persons or entities is coincidental. Copyright 2013 President and Fellowes of Harvard College. To order copies or request permission to reproduce materials, call 1-800-515 7685, write Harvard Business Publishing Boston, MA 02163, or go to http://www.hbsp harvard.edu. This publication may not be digitized. photocopied, or otherwise reproduced, posted, or transmitted, without the permission of Harvard Business School This document is authorized for use only by Mohammed Alameer in Marketing Analytics taught by Dr. Gerardo Moreira, Sacred Heart University from April 2018 to June 2018 913-566 Olymnir Rent-A-Car ITS Customer avall Battles The idea of rewarding loyalty is not new. As self-service businesses began to grow in the early 1900s, mass loyalty programs, built around coupons and trading stamps appeared. Retailers would give customers small adhesive stamps in proportion to the amount of their purchases, to be pasted into books and eventually redeemed for merchandise. The best-known provider had been the S&H Green Stamp Company. These first programs were popular until about 1930. They reemerged in the 1950s and ended in the 1960s as consumers tired of them. American Airlines created the first major travel loyalty marketing program in 1981 when it introduced the AAdvantage frequent-flyer program (FFP), giving "miles" redeemable for free travel based on paid miles traveled. The program succeeded because it had high perceived value for the frequent traveler and it cost American very little to provide a free seat that otherwise would not have been occupied. The heaviest travelers usually paid the most for their tickets-meaning that American also received the highest revenue for rewarded miles. American's program administrators quickly realized they had a tool that did not only rewarded loyalty but also identified the individuals who accounted for most of aviation's revenues. The technology facilitated a way to tailor programs and offerings to individual customers. Airline frequent flyer programs (FFPs) became so popular that credit card companies and other businesses began offering them as inducements to their customers, paying the airlines around one cent per mile toward a customer's preferred FFP, thus yielding large additional profits to the airlines. FFP rewards, like other loyalty programs that followed, also received favorable tax treatment, as they were not counted as income. Companies mostly viewed the rewards as an affordable employee perk, even though they were paying for the airlines, hotels, and rental cars. This encouraged travelers to opt for their favorite providers even though it may have cost their company more. As the decade ended, computer-based customer loyalty programs were widespread in many industries, including hotels, department stores, video and book retailing, credit cards, movie theaters, and the car rental industry HDMI acer The U.S. Car Rental Industry: From 10 cents a mile to a $24 billion industry The U.S. car rental industry was born in 1916 when Josiah Ellis Saunders, of Omaha, Nebraska, ran a seven-line classified ad offering "Automobiles for Hire." Saunders's fleet consisted of one Model T Ford that he rented for ten cents a mile. The industry Saunders created grew slowly at first, then took off with the boom in commercial air travel after World War II. The rental car business is closely tied to the state of the overall economy as business, and especially leisure, travel tends to be somewhat discretionary. In 2009, total market revenue fell 6.5% from 2008, but revenue was up 2.5% in 2010 as business and consumer confidence slowly returned. The growth rate was about 2-3% per year in 2011-2012. While business travel had increased from its lows in 2009, the climb in customer spending on travel was due more to increased prices than to a rise in bookings. Unlike airline seats and hotel rooms, car rental fleets can be increased or decreased in response to demand factors. This takes time, but in 2012 there were 1.6 million rental cars in service, 0.5% fewer than in 2009 but higher than in 2010. Car rental fleets seemed to have reached a level in balance with demand. Matching fleet size to demand is a key element in car rental profitability. 1 These programs did, however, often help companies steer their employees to preferred vendors with whom they had discounts 2 BRIEFCASES THARVARD BUSINESS SCHOOL This document is authorized for use only by Mohammed Alameer in Marketing Analytics taught by Dr Gerardo Moreira Sacred Heart University from April 2018 to June 201 Table A Rental car customer segments "Heavy" Business Travelers "Medium" Business Travelers "Light" Business Travelers Leisure Travelers Other % of All Business Travelers 37 45 18 % of Industry Revenues 55 20 5 15 5 Consumers were more likely to rent a compact car than any other class of vehicle for both personal and business useabout 25% of vehicles rented. Regional differences were important Miami was more leisure oriented, for example, than Boston. The length of rental and miles driven per day for leisure and business averaged 4.6 days and 150 miles in Miami, as opposed to 2.3 days and 45 miles in Boston. This made a difference to franchisees with respect to loyalty program redemptions. Frequent renters tended to earn points where they did business and spend them in leisure locations. Leisure travelers tended to rent larger cars for longer periods, even though the per-day charges were generally less due to factors such as preplanned trips and lower revenue days (weekends). Business travelers generally paid more per day, although rates varied based on location and day of the week and whether the traveler worked for a company with a contract rate. Competition for the "Loyal Customer" Exhibit 2 presents a competitive comparison of major brands' market shares. With 870,000 cars in service and $12 billion in annual revenues, Enterprise had more than half of the entire rental car market. It dominated in off-airport rentals with 5,000 neighborhood locations within 15 miles of 90% of the population Of the 20% of the market who were business renters, about one-fifth rented from Enterprise (4% of total renters) and one-quarter from Hertz, the balance was spread among Avis, Olympic, and regional brands. Revenues from business travelers broke down as follows: 1. Hertz: 30% market share of revenues 2. Avis: 26% share 3. Enterprise, which had recently acquired National and Alamo: 20% share 4. Olympic: 8% share The tough competitive rental car landscape had forced out weaker, smaller companies, and the industry had been consolidating. In 2002 there were nine national car rental companies in the U.S.; by 2012 there were four. The U.S. Travel Booking Industry Travelers are increasingly driven to make travel bookings in the most budget-friendly, convenient way possible. Given their propensity to be online, travel providers have more incentive to push the Internet as the go-to source for booking, associating the tool with perks that are unavailable offline. - CEO of a major travel company As of 2012, 78.6% of Americans were online and spending 2.5 hours more online each week than they did five years earlier. Online sales of leisure and personally booked business travel increased from $90 billion in 2009 to over $119 billion in 2012. Mobile devices were projected to account for 32% nf online travel bookings by 2016. Online booking allowed users to compare prices and availability As of 2012, 78.6% of Americans were online and spending 2.5 hours more online each week than they did five years earlier. Online sales of leisure and personally booked business travel increased from $90 billion in 2009 to over $119 billion in 2012. Mobile devices were projected to account for 32% of online travel bookings by 2016. Online booking allowed users to compare prices and availability, and provided immediacy, which was often needed in booking travel, especially for business, The rapid rise of third-party travel consolidators such as Expedia, Priceline, Travelocity, and Orbitz, and the equally rapid decline in the use of travel agents (used by fewer than one in ten travelers in 2012), was particularly significant for the leisure traveler who preferred the convenience of booking airlines, hotels, and car rentals from one provider. In fact, each of the third-party travel consolidators targeted women in higher-income households who were booking mostly for leisure, About half of all leisure travelers booked rental cars online. Approximately 46% of all business renters booked through a rental car operator website (e.gr Hertz.com), while an additional 12% rented online via a third party, such as Travelocity or Orbitz. Best price was the main reason for booking online through company websites, while convenience was cited as the main reason for using a third-party consolidator. Pricing and Profitability in the Car Rental Industry Variable pricing, or revenue management as it is known in service industries, was used extensively in the rental car business to optimize profit. Sophisticated data management indicated when demand was likely to be highest, allowing car rental companies to charge the most at those times and also allowed them to adjust prices as demand fluctuated. Daily rental rates could range from $10 to $150 before fees and taxes. Approximately 80% of corporations negotiated nationwide agreements with car rental companies that provided up to 30% off standard car rental rates. A car rental company's largest expense item was its fleet of vehicles, which represented approximately half of all operating expenses. Cars were generally purchased with a guaranteed repurchase price. These cars, in the industry called "program cars, were returned four to sixteen months later, which relieved the company of the risk of used car prices. The average car was rented 208 days per year. Rental car companies tried to gain additional revenue by inducing travelers to take insurance, gas fill-ups, and upgrades to larger cars. For several years, GPS devices, satellite radio, and electronic toll payment were features for which some consumers were happy to pay an extra few dollars. However, growth in the use of smart phones, which gave consumers access to such items as GPS navigation at no charge, had diminished the revenue from these sources. By 2012 a number of other developments had put additional pressure on pricing and profitability. Online coupon vendors such as Groupon and comparative pricing sites such as rentalcarmomma.com distributed pricing discounts. Consumers could access availability of cars by location along with other data, giving them additional purchasing leverage. Consumers were increasingly comfortable transacting business online and while on the go, and they were becoming savvier at finding the lowest prices and best deals. Olympic Rent-A-Car Olympic Rent-A-Car was founded in 1976 by a former Olympic pole-vaulting champion, John Uelses, who was also a U.S. military officer. The company was almost totally a franchising operation, which allowed it to grow rapidly and profitably to its 2012 position of approximately 7% market HE Olympic Rent-A-Car Olympic Rent-A-Car was founded in 1976 by a former Olympic pole-vaulting champion, John Uelses, who was also a U.S. military officer. The company was almost totally a franchising operation, which allowed it to grow rapidly and profitably to its 2012 position of approximately 7% market share. Its initial strategy was to price lower than Hertz in every market, no matter what. Olympic capitalized on its popular founder in its promotion and advertising, Uelses sold the business to a private equity firm in 1987, but continued on its board. The Olympic theme resonated with customers as the company stressed quality service and the slogan "go with the winners" in its ads and promotions When Uelses launched Olympic there were five major car rental agencies and approximately 200 regional firms. Olympic's rental operations were conducted primarily at major airports and at downtown locations in major cities. Olympic was able to gain critical airport distribution by helping its franchisees acquire a number of the smaller regional firms. Olympic franchisees were also able to gain airport space as major airports were enlarged in the early 2000s. By 2012, Olympic had approximately 464 rental car locations in the United States and operated a rental fleet of around 108,000 vehicles (see Exhibits 3 and 4). Olympic's domestic fleet was made up of cars from many global auto manufacturers. Over the last few years, the company had added more fuel-efficient cars as customers had demanded. Olympic purchased new cars, rented them to customers for 15,000 to 30,000 miles (approximately eight months to a year and a half), then sold them to retail (60%) or wholesale markets. Olympic's fleet of 108,000 cars averaged daily rental income slightly below the industry average, and its typical car was rented about 232 days per year. The Olympic Medalist Rewards Program The Olympic Medalist Award customer loyalty program was launched a few months after the first rental car loyalty programs-National's Emerald Isle Program and Hertz's #1 Loyalty program-were introduced in the late 1980s. It had been modified several times over the past twenty years in response to various competitive moves. Olympic had chosen to be a follower. Since it tried to provide lower overall pricing than the leading companies, management always felt it did not have to offer more in its loyalty program. Exhibit 5 shows loyalty members as percentage of customers for major rental firms, including Olympic. Most of Olympic's Medalist members belonged to several other car rental loyalty programs. Andy Kim was charged with managing the program as a cost center and was expected to at least maintain the program's cost at the same percentage of sales as the previous year. Kim oversaw the program's marketing efforts and managed the loyalty customer database. Franchisees paid Olympic 3% of a member's rentals in addition to the standard franchise fee. Anyone could join Olympic Medalist at no charge. Members earned rewards by accumulating credits. When a member accumulated 16 credits he received an award of one free day. Each rental day under the program equaled one credit. A rental day was based on a 24-hour rental day starting at the time of the rental. Credits earned were valid for one year from the date of issue. Credits could also be redeemed for airline frequent flyer programs and other rewards such as rental car upgrades. The Medalist program had three tiers of membership: . Bronze: Member is credited as outlined above. Silver: Member is moved to silver status by renting 10 times per year or 16 rental days. Silver msdalinnad 16/bannenbanderades se HJ Bronze: Member is credited as outlined above. Silver: Member is moved to silver status by renting 10 times per year or 16 rental days. Silver medalists earned a 15% bonus on base credits and were eligible for five free upgrades per year. Gold: Member is moved to gold status by renting 20 times per year or 30 rental days. In addition to the free upgrades, the gold medalists earned a 25% bonus on base credits and were eligible for 10 free upgrades per year. Renters identified by their Olympic Medalist membership numbers accounted for 21% of Olympic's revenues, but only slightly more than 8% of all rentals recorded for the year. The Meeting in Dallas After a continental breakfast, eight Olympic managers assembled around a large table in one of the hotel's conference rooms. In addition to Laura and Andy, the participants included Seth Bergman, senior financial analyst; Eva Chan, southwest regional sales manager; Marvin Fleming, operations manager and manager of franchise operations; and Sriny Vajarain, Jorge Martinez, and Amy McKeever, franchise operators from Texas and Oklahoma. Several of them had PowerPoint presentations to offer. 2012 Slide 1: Olympic Financials, 2008-2012 (millions) 2008 2009 2010 Revenues 1459 1281 1344 Operating margin% 10.2 9.4 12.8 Depreciation 44 39 41 Net Profit -15 -12 -6 Net Profit % Working Capital Long-term Debt Advertising/Promotion Expense 2011 1467 15 43 18 1540 15.80% 42.3 32.3 2.10% 169 2109 108 Seth Bergman outlined Olympic's revenue growth and its 2012 income statement. Laura pointed out that Olympic had been growing at a better pace than the industry since the severe decline in revenues after the financial crisis of 2008. "We should all feel pleased with our growth and our prospects," she said. "But note how thin our operating profit margin is. The slightest mistake could easily turn that profit to a loss. The number of business trips being taken is not likely to grow very much and conceivably could decline with the increased use of new technology, like teleconferencing." (Exhibit 6 shows teleconferencing trends.) Seth commented that long-term debt and depreciation were in line with the major competitors but emphasized that the nature of the business required heavy capital investment. "We're lucky that interest rates have remained so low for the past four years." Andy Kim presented the EnterprisePlus rewards program for consideration. Slide 2: The Enterprise Plus Silver, Gold, and Platinum rewards program Silver Gold Platinum Slide 2: The EnterprisePlus Silver, Gold, and Platinum rewards program Silver Gold Platinum Qualifying rentals or rental 12 rentals 24 rentals days to achieve 6 rentals or 40 days or 85 days Points accelerator on qualifying dollars spent 10% bonus 15% bonus 20% bonus Free car-class upgrade certificates per program year One Two Four Laura commented, "Enterprise is promoting this plan as 'Simple: dollars equal points. Then add bonuses and upgrades.' Their plan includes no blackout dates for any car. We also believe they're putting $40 million behind advertising and promotion of the plan." Jorge Martinez, who ran Olympic's Austin operation, spoke up. "Laura, we're a vacation destination and our redemption rates for free days for members are higher than most locations. Well never be able to keep enough cars for prime holiday travel times if we don't have blackout days. I don't think we want to disappoint our loyal Medalist customers by promising them availability and then be unable to deliver." Andy interjected, I'm not certain about changing our plan to eliminate blackout dates, but maybe it's worth some disappointed members if we can offer more to most of them. We've had a strategy since our founding to follow Hertz's #1 Club Plan, the industry leader for the business traveler (see Enterprise is a private company. Figures for it are estimates HARVARD BUSINESS SCHOOL I BRIEFCASES Exhibit 5). Because Hertz has the highest prices, Enterprise's move will probably hurt Hertz more than any other company. Hertz may be reluctant to match Enterprise. This may be our chance to take some share from Hertz by moving aggressively." Kim added, "Our rewards members provided 21% of our revenue last year. You can't deny the importance of our most loyal customers. Here's how the numbers break down." Andy then offered additional data about Olympic's paid activity, Members (000s) Spending for points ($000s) 45000 132000 Rental days claimed (0005) Gold Slide 3: Olympic Medalists' Paid Activity in 2012 Rental Active Rentals days paid (000s) (000s) (000s) 7.8 354 682 30.4 703 1350 84.6 1073 1946 122.8 2130 3978 21 Silver 63 113 Bronze 146 178 146000 323000 230 Total 375 Eva Chan, the southwest regional sales manager for Olympic, asserted, "Let me say that our sales force is not so sure our Rewards program is that successful. One of the handouts Laura gave us shows that only one out of ten travelers is an Olympic rewards member. [See Exhibit 5.] We've built our success on always being lower priced than Hertz and all the other major rental companies. We serve the value-conscious traveler. It's not clear that changing our reward program in any way, much less a dramatic shift to dollars spent versus days of rental, will do anything for our business but make it less profitable." Marvin Fleming, an operations manager and head of franchise relations, interjected, "I agree with Eva. If our most loyal customers are already paying some of the lowest prices, what good will it do to make their rewards harder to earn than our competitors? Listen, every study we've done comes to Bossible the the same amerama Marvin Fleming, an operations manager and head of franchise relations, interjected, "I agree with Eva. If our most loyal customers are already paying some of the lowest prices, what good will it do to make their rewards harder to earn than our competitors? Listen, every study we've done comes to the same conclusion: Our customers want to pick up and drop off the car as fast as possible, at the best value. We ought to be looking at how to improve there." "I agree with Marvin," Amy McKeever exclaimed, "our training is good, but Enterprise puts more emphasis and, I bet, more money into it. I think we should do more to streamline the check-in and drop-off procedures and not worry about changing our loyalty plan." Andy put up another slide and replied, "All of you have valid points, but let me come back to our Medalist discussion. Even though we target the value-conscious traveler, it doesn't mean we have low-income customers. In fact, affluent households are the most sophisticated shoppers and the most frequent travelers for business and leisure, and they are most likely to book online after shopping for the best price. Our data indicate that we are getting those travelers. We have to be concerned about the perception of our program as well as its actual impact on our loyal customers. What I mean is that if Enterprise is perceived as offering more to the traveler who is spending more, then it will gain competitive advantage and market share." HE acer % on Slide 4: Breakdown of Olympic's revenue and profit by customer % of % of % of Customer Revenues Rental Units Profit Contract Business Small and individual 45 39 41 25 Large 33 42 22 50 Leisure Weekend 5 7 9 All other 17 12 28 "Compared to the industry," Andy continued, "Olympic's customer is more weighted to leisure travelers. We know they are disproportionately from affluent households and they are also much more likely to be our Medalist loyalty members. We have to be sure our loyalty program, as well as our prices, are perceived by this group as the best." Seth spoke up. "Andy, I agree with you that it seems that we need to match Enterprise and change the way we provide rewards. The numbers are hard to capture, but I've given it a try. If you go back to slide 3 you can see the breakdown of revenues provided by our Medalist members. About 1.45% of our total rental days in 2012 involved free days and other reward redemptions. A free-day reward costs us about $21 to cover the variable costs of a rental (around 20%) and the payment to the franchisee. Of course there are fixed costs that could be considered, but your area is not charged for those. "I've estimated that our advertising for the Medalist program is costing about $28 million a year, although it's difficult to allocate advertising dollars precisely. Mwemave te ndaliacerende Sath continued Waste bale number of HON acer "I've estimated that our advertising for the Medalist program is costing about $28 million a year, although it's difficult to allocate advertising dollars precisely. "If we move to a dollars based reward program," Seth continued, "I estimate that the number of free days and redemptions will increase to somewhere between 1.65% and 1.95% of total rentals, as more of our members earn rewards faster. We are forecasting an increase in revenues next year, but the number of rental days should be only slightly more than this year. An increase in free days has to be offset by an increase in revenue so that the Medalist program continues to equal its present percentage of cost to revenues." "Is it worth it? Can we afford it?" Laura asked the group. "What value are we really getting from the Medalist Awards? If every company moves to the Enterprise type of program will it result in any change in market shares or increased business or just lower profitability? Eva, you and Marvin have said you think that we might be better off eliminating the rewards program altogether? Our ad agency has considered this." Laura noted what the agency had proposed. Slide 5: Ad agency's proposed repositioning At Olympic, Everyone's a Winner! Announcing Olympic's new low-price guarantee. Olympic is mixing the gimmicks, the coupons, the impossible and complicated rewards... HARVARD BUSINESS SCHOOLPRERASIES 913-568 Olympic Rent-A-Car U.S.: Customer Loyalty Battles "Would Olympic's customer possibly respond favorably to this "best prices guarantee"? Could it be the key to gaining market share? Would our competitors follow?" Laura asked. "I know I've questioned the value of the Medalist program," Eva said, "and I think most of our customers might be in favor of a no-gimmick, low-price guarantee. We might even be able to gain other customers who are not reward club members with any car rental agency, especially if we advertised and promoted this properly." Andy was quick to respond, "Olympic could never make a move like this since it's not the market leader. We need to follow Enterprise, and quickly. If anything, we should be more aggressive with our reward program. We need to attract more Medalist members. The payoff would be huge." "We need to make some decisions," Laura asserted. "Do we change our Medalist program, and if so, how? How much should we spend to advertise and promote it if we do change? When do we implement a change if we decide to do it?" Laura continued, "Perhaps the more important question is, How do we form a truly distinctive competitive strategy when it seems that most anything we, or our competitors, do can be so easily duplicated?" Gold Silver Bronze Total All Renters Only Non- Medalists Enterprise Number of Cars Average Days Each Car Is Rented 63 146 Members Active Members 21 7.8 230.0 122.8 30.4 84.6 Rentals Rental Days Paid % of Total Rental Days 354 682 703 1,350 1,073 1,946 2,130 3,978 Spending for Points Free Rental Days Claimed Active as a % of Total Members Active as a % of Total Members Rentals Per Active Member Rental Days Paid per Active Member Average Days per Rental Rental Spending Per Active Member Average Daily Rental Rate Free Rental Days per Active Member Revenue / Rental Day Variable Cost Per Rental Day Contribution Margin Rental Days / Active Member Rental Revenue / Active Member Contribution Margin / Active Member Total Contribution Margin $ % of Total Contribution Margin $ Free Days Awarded /Active Member Variable Cost Per Rental Day Cost of Free Days / Active Member Economic Value of Active Medalist Member JOHN DEIGHTON JAMES T. KINDLEY Olympic Rent-A-Car U.S.: Customer Loyalty Battles Laura Walkins, vice president of marketing, and Andy Kim, manager of customer relations programs, stepped off the DFW Airport shuttle bus on a warm October afternoon and hurried inside to the Olympic rental area. They had come to Dallas to meet with Olympic's district managers and top marketing staff to try to determine how to respond to Enterprise Rent-a-Car's recent aggressive move with its EnterprisePlus customer loyalty rewards program. As they spotted their names on the Olympic Medalist board, indicating where to find their waiting car, Laura and Andy couldn't help but notice the long lines at the Enterprise counter. Enterprise had changed its customer rewards program several months before. On July 5, 2012, it announced that its "regular" customers would receive free rental days on any car, with no blackouts. It also announced a perhaps more troubling aspect of its new program: a shift from rewarding days rented, the common practice in the industry, to dollars spent. Because frequent travelers typically spent more for daily rentals, they would earn free rentals faster and more often. Laura slipped behind the wheel of a white Hyundai Sonata and drove toward the exit, listening as Andy talked about the main topics for the meeting. He pointed out that the Olympic Medalist Awards loyalty program was, in his view, the number one reason for Olympie's growth and profitability. He also stated that Enterprise was making inroads in its quest to capture more of the crucial business traveler market. "We have to do something. Enterprise is a well-run company and a formidable competitor. We can't just let it take business from us," he said. "I think our service and pricing are competitive. Our share of business-traveler bookings is holding up, but our Medalist Awards program may come to be perceived as inadequate compared to Enterprise's." Laura HON acer WERP PORSLITE accelerated onto the highway toward their hotel. This is going to be an interesting meeting, she thought Loyalty Marketing Programs Customer loyalty programs are direct efforts by companies to gain long-term business from their best customers. These programs also provide considerable information about customers that enable companies to maintain a more knowledgeable and "personal relationship-ideally similar to those customers develop with many small, local businesses like dry cleaners and hair salons. HBS Professor John Deighton and College of Charleston professor James T. Kindley prepared this case volely as a basis for class discusion and not as an endorsement, a source of primary data, or an illustration of effective or ineffective management. Although based on real events and despite occasional references to actual companies, this case is fictitious and any resemblance to actual persons or entities is coincidental. Copyright 2013 President and Fellowes of Harvard College. To order copies or request permission to reproduce materials, call 1-800-515 7685, write Harvard Business Publishing Boston, MA 02163, or go to http://www.hbsp harvard.edu. This publication may not be digitized. photocopied, or otherwise reproduced, posted, or transmitted, without the permission of Harvard Business School This document is authorized for use only by Mohammed Alameer in Marketing Analytics taught by Dr. Gerardo Moreira, Sacred Heart University from April 2018 to June 2018 913-566 Olymnir Rent-A-Car ITS Customer avall Battles The idea of rewarding loyalty is not new. As self-service businesses began to grow in the early 1900s, mass loyalty programs, built around coupons and trading stamps appeared. Retailers would give customers small adhesive stamps in proportion to the amount of their purchases, to be pasted into books and eventually redeemed for merchandise. The best-known provider had been the S&H Green Stamp Company. These first programs were popular until about 1930. They reemerged in the 1950s and ended in the 1960s as consumers tired of them. American Airlines created the first major travel loyalty marketing program in 1981 when it introduced the AAdvantage frequent-flyer program (FFP), giving "miles" redeemable for free travel based on paid miles traveled. The program succeeded because it had high perceived value for the frequent traveler and it cost American very little to provide a free seat that otherwise would not have been occupied. The heaviest travelers usually paid the most for their tickets-meaning that American also received the highest revenue for rewarded miles. American's program administrators quickly realized they had a tool that did not only rewarded loyalty but also identified the individuals who accounted for most of aviation's revenues. The technology facilitated a way to tailor programs and offerings to individual customers. Airline frequent flyer programs (FFPs) became so popular that credit card companies and other businesses began offering them as inducements to their customers, paying the airlines around one cent per mile toward a customer's preferred FFP, thus yielding large additional profits to the airlines. FFP rewards, like other loyalty programs that followed, also received favorable tax treatment, as they were not counted as income. Companies mostly viewed the rewards as an affordable employee perk, even though they were paying for the airlines, hotels, and rental cars. This encouraged travelers to opt for their favorite providers even though it may have cost their company more. As the decade ended, computer-based customer loyalty programs were widespread in many industries, including hotels, department stores, video and book retailing, credit cards, movie theaters, and the car rental industry HDMI acer The U.S. Car Rental Industry: From 10 cents a mile to a $24 billion industry The U.S. car rental industry was born in 1916 when Josiah Ellis Saunders, of Omaha, Nebraska, ran a seven-line classified ad offering "Automobiles for Hire." Saunders's fleet consisted of one Model T Ford that he rented for ten cents a mile. The industry Saunders created grew slowly at first, then took off with the boom in commercial air travel after World War II. The rental car business is closely tied to the state of the overall economy as business, and especially leisure, travel tends to be somewhat discretionary. In 2009, total market revenue fell 6.5% from 2008, but revenue was up 2.5% in 2010 as business and consumer confidence slowly returned. The growth rate was about 2-3% per year in 2011-2012. While business travel had increased from its lows in 2009, the climb in customer spending on travel was due more to increased prices than to a rise in bookings. Unlike airline seats and hotel rooms, car rental fleets can be increased or decreased in response to demand factors. This takes time, but in 2012 there were 1.6 million rental cars in service, 0.5% fewer than in 2009 but higher than in 2010. Car rental fleets seemed to have reached a level in balance with demand. Matching fleet size to demand is a key element in car rental profitability. 1 These programs did, however, often help companies steer their employees to preferred vendors with whom they had discounts 2 BRIEFCASES THARVARD BUSINESS SCHOOL This document is authorized for use only by Mohammed Alameer in Marketing Analytics taught by Dr Gerardo Moreira Sacred Heart University from April 2018 to June 201 Table A Rental car customer segments "Heavy" Business Travelers "Medium" Business Travelers "Light" Business Travelers Leisure Travelers Other % of All Business Travelers 37 45 18 % of Industry Revenues 55 20 5 15 5 Consumers were more likely to rent a compact car than any other class of vehicle for both personal and business useabout 25% of vehicles rented. Regional differences were important Miami was more leisure oriented, for example, than Boston. The length of rental and miles driven per day for leisure and business averaged 4.6 days and 150 miles in Miami, as opposed to 2.3 days and 45 miles in Boston. This made a difference to franchisees with respect to loyalty program redemptions. Frequent renters tended to earn points where they did business and spend them in leisure locations. Leisure travelers tended to rent larger cars for longer periods, even though the per-day charges were generally less due to factors such as preplanned trips and lower revenue days (weekends). Business travelers generally paid more per day, although rates varied based on location and day of the week and whether the traveler worked for a company with a contract rate. Competition for the "Loyal Customer" Exhibit 2 presents a competitive comparison of major brands' market shares. With 870,000 cars in service and $12 billion in annual revenues, Enterprise had more than half of the entire rental car market. It dominated in off-airport rentals with 5,000 neighborhood locations within 15 miles of 90% of the population Of the 20% of the market who were business renters, about one-fifth rented from Enterprise (4% of total renters) and one-quarter from Hertz, the balance was spread among Avis, Olympic, and regional brands. Revenues from business travelers broke down as follows: 1. Hertz: 30% market share of revenues 2. Avis: 26% share 3. Enterprise, which had recently acquired National and Alamo: 20% share 4. Olympic: 8% share The tough competitive rental car landscape had forced out weaker, smaller companies, and the industry had been consolidating. In 2002 there were nine national car rental companies in the U.S.; by 2012 there were four. The U.S. Travel Booking Industry Travelers are increasingly driven to make travel bookings in the most budget-friendly, convenient way possible. Given their propensity to be online, travel providers have more incentive to push the Internet as the go-to source for booking, associating the tool with perks that are unavailable offline. - CEO of a major travel company As of 2012, 78.6% of Americans were online and spending 2.5 hours more online each week than they did five years earlier. Online sales of leisure and personally booked business travel increased from $90 billion in 2009 to over $119 billion in 2012. Mobile devices were projected to account for 32% nf online travel bookings by 2016. Online booking allowed users to compare prices and availability As of 2012, 78.6% of Americans were online and spending 2.5 hours more online each week than they did five years earlier. Online sales of leisure and personally booked business travel increased from $90 billion in 2009 to over $119 billion in 2012. Mobile devices were projected to account for 32% of online travel bookings by 2016. Online booking allowed users to compare prices and availability, and provided immediacy, which was often needed in booking travel, especially for business, The rapid rise of third-party travel consolidators such as Expedia, Priceline, Travelocity, and Orbitz, and the equally rapid decline in the use of travel agents (used by fewer than one in ten travelers in 2012), was particularly significant for the leisure traveler who preferred the convenience of booking airlines, hotels, and car rentals from one provider. In fact, each of the third-party travel consolidators targeted women in higher-income households who were booking mostly for leisure, About half of all leisure travelers booked rental cars online. Approximately 46% of all business renters booked through a rental car operator website (e.gr Hertz.com), while an additional 12% rented online via a third party, such as Travelocity or Orbitz. Best price was the main reason for booking online through company websites, while convenience was cited as the main reason for using a third-party consolidator. Pricing and Profitability in the Car Rental Industry Variable pricing, or revenue management as it is known in service industries, was used extensively in the rental car business to optimize profit. Sophisticated data management indicated when demand was likely to be highest, allowing car rental companies to charge the most at those times and also allowed them to adjust prices as demand fluctuated. Daily rental rates could range from $10 to $150 before fees and taxes. Approximately 80% of corporations negotiated nationwide agreements with car rental companies that provided up to 30% off standard car rental rates. A car rental company's largest expense item was its fleet of vehicles, which represented approximately half of all operating expenses. Cars were generally purchased with a guaranteed repurchase price. These cars, in the industry called "program cars, were returned four to sixteen months later, which relieved the company of the risk of used car prices. The average car was rented 208 days per year. Rental car companies tried to gain additional revenue by inducing travelers to take insurance, gas fill-ups, and upgrades to larger cars. For several years, GPS devices, satellite radio, and electronic toll payment were features for which some consumers were happy to pay an extra few dollars. However, growth in the use of smart phones, which gave consumers access to such items as GPS navigation at no charge, had diminished the revenue from these sources. By 2012 a number of other developments had put additional pressure on pricing and profitability. Online coupon vendors such as Groupon and comparative pricing sites such as rentalcarmomma.com distributed pricing discounts. Consumers could access availability of cars by location along with other data, giving them additional purchasing leverage. Consumers were increasingly comfortable transacting business online and while on the go, and they were becoming savvier at finding the lowest prices and best deals. Olympic Rent-A-Car Olympic Rent-A-Car was founded in 1976 by a former Olympic pole-vaulting champion, John Uelses, who was also a U.S. military officer. The company was almost totally a franchising operation, which allowed it to grow rapidly and profitably to its 2012 position of approximately 7% market HE Olympic Rent-A-Car Olympic Rent-A-Car was founded in 1976 by a former Olympic pole-vaulting champion, John Uelses, who was also a U.S. military officer. The company was almost totally a franchising operation, which allowed it to grow rapidly and profitably to its 2012 position of approximately 7% market share. Its initial strategy was to price lower than Hertz in every market, no matter what. Olympic capitalized on its popular founder in its promotion and advertising, Uelses sold the business to a private equity firm in 1987, but continued on its board. The Olympic theme resonated with customers as the company stressed quality service and the slogan "go with the winners" in its ads and promotions When Uelses launched Olympic there were five major car rental agencies and approximately 200 regional firms. Olympic's rental operations were conducted primarily at major airports and at downtown locations in major cities. Olympic was able to gain critical airport distribution by helping its franchisees acquire a number of the smaller regional firms. Olympic franchisees were also able to gain airport space as major airports were enlarged in the early 2000s. By 2012, Olympic had approximately 464 rental car locations in the United States and operated a rental fleet of around 108,000 vehicles (see Exhibits 3 and 4). Olympic's domestic fleet was made up of cars from many global auto manufacturers. Over the last few years, the company had added more fuel-efficient cars as customers had demanded. Olympic purchased new cars, rented them to customers for 15,000 to 30,000 miles (approximately eight months to a year and a half), then sold them to retail (60%) or wholesale markets. Olympic's fleet of 108,000 cars averaged daily rental income slightly below the industry average, and its typical car was rented about 232 days per year. The Olympic Medalist Rewards Program The Olympic Medalist Award customer loyalty program was launched a few months after the first rental car loyalty programs-National's Emerald Isle Program and Hertz's #1 Loyalty program-were introduced in the late 1980s. It had been modified several times over the past twenty years in response to various competitive moves. Olympic had chosen to be a follower. Since it tried to provide lower overall pricing than the leading companies, management always felt it did not have to offer more in its loyalty program. Exhibit 5 shows loyalty members as percentage of customers for major rental firms, including Olympic. Most of Olympic's Medalist members belonged to several other car rental loyalty programs. Andy Kim was charged with managing the program as a cost center and was expected to at least maintain the program's cost at the same percentage of sales as the previous year. Kim oversaw the program's marketing efforts and managed the loyalty customer database. Franchisees paid Olympic 3% of a member's rentals in addition to the standard franchise fee. Anyone could join Olympic Medalist at no charge. Members earned rewards by accumulating credits. When a member accumulated 16 credits he received an award of one free day. Each rental day under the program equaled one credit. A rental day was based on a 24-hour rental day starting at the time of the rental. Credits earned were valid for one year from the date of issue. Credits could also be redeemed for airline frequent flyer programs and other rewards such as rental car upgrades. The Medalist program had three tiers of membership: . Bronze: Member is credited as outlined above. Silver: Member is moved to silver status by renting 10 times per year or 16 rental days. Silver msdalinnad 16/bannenbanderades se HJ Bronze: Member is credited as outlined above. Silver: Member is moved to silver status by renting 10 times per year or 16 rental days. Silver medalists earned a 15% bonus on base credits and were eligible for five free upgrades per year. Gold: Member is moved to gold status by renting 20 times per year or 30 rental days. In addition to the free upgrades, the gold medalists earned a 25% bonus on base credits and were eligible for 10 free upgrades per year. Renters identified by their Olympic Medalist membership numbers accounted for 21% of Olympic's revenues, but only slightly more than 8% of all rentals recorded for the year. The Meeting in Dallas After a continental breakfast, eight Olympic managers assembled around a large table in one of the hotel's conference rooms. In addition to Laura and Andy, the participants included Seth Bergman, senior financial analyst; Eva Chan, southwest regional sales manager; Marvin Fleming, operations manager and manager of franchise operations; and Sriny Vajarain, Jorge Martinez, and Amy McKeever, franchise operators from Texas and Oklahoma. Several of them had PowerPoint presentations to offer. 2012 Slide 1: Olympic Financials, 2008-2012 (millions) 2008 2009 2010 Revenues 1459 1281 1344 Operating margin% 10.2 9.4 12.8 Depreciation 44 39 41 Net Profit -15 -12 -6 Net Profit % Working Capital Long-term Debt Advertising/Promotion Expense 2011 1467 15 43 18 1540 15.80% 42.3 32.3 2.10% 169 2109 108 Seth Bergman outlined Olympic's revenue growth and its 2012 income statement. Laura pointed out that Olympic had been growing at a better pace than the industry since the severe decline in revenues after the financial crisis of 2008. "We should all feel pleased with our growth and our prospects," she said. "But note how thin our operating profit margin is. The slightest mistake could easily turn that profit to a loss. The number of business trips being taken is not likely to grow very much and conceivably could decline with the increased use of new technology, like teleconferencing." (Exhibit 6 shows teleconferencing trends.) Seth commented that long-term debt and depreciation were in line with the major competitors but emphasized that the nature of the business required heavy capital investment. "We're lucky that interest rates have remained so low for the past four years." Andy Kim presented the EnterprisePlus rewards program for consideration. Slide 2: The Enterprise Plus Silver, Gold, and Platinum rewards program Silver Gold Platinum Slide 2: The EnterprisePlus Silver, Gold, and Platinum rewards program Silver Gold Platinum Qualifying rentals or rental 12 rentals 24 rentals days to achieve 6 rentals or 40 days or 85 days Points accelerator on qualifying dollars spent 10% bonus 15% bonus 20% bonus Free car-class upgrade certificates per program year One Two Four Laura commented, "Enterprise is promoting this plan as 'Simple: dollars equal points. Then add bonuses and upgrades.' Their plan includes no blackout dates for any car. We also believe they're putting $40 million behind advertising and promotion of the plan." Jorge Martinez, who ran Olympic's Austin operation, spoke up. "Laura, we're a vacation destination and our redemption rates for free days for members are higher than most locations. Well never be able to keep enough cars for prime holiday travel times if we don't have blackout days. I don't think we want to disappoint our loyal Medalist customers by promising them availability and then be unable to deliver." Andy interjected, I'm not certain about changing our plan to eliminate blackout dates, but maybe it's worth some disappointed members if we can offer more to most of them. We've had a strategy since our founding to follow Hertz's #1 Club Plan, the industry leader for the business traveler (see Enterprise is a private company. Figures for it are estimates HARVARD BUSINESS SCHOOL I BRIEFCASES Exhibit 5). Because Hertz has the highest prices, Enterprise's move will probably hurt Hertz more than any other company. Hertz may be reluctant to match Enterprise. This may be our chance to take some share from Hertz by moving aggressively." Kim added, "Our rewards members provided 21% of our revenue last year. You can't deny the importance of our most loyal customers. Here's how the numbers break down." Andy then offered additional data about Olympic's paid activity, Members (000s) Spending for points ($000s) 45000 132000 Rental days claimed (0005) Gold Slide 3: Olympic Medalists' Paid Activity in 2012 Rental Active Rentals days paid (000s) (000s) (000s) 7.8 354 682 30.4 703 1350 84.6 1073 1946 122.8 2130 3978 21 Silver 63 113 Bronze 146 178 146000 323000 230 Total 375 Eva Chan, the southwest regional sales manager for Olympic, asserted, "Let me say that our sales force is not so sure our Rewards program is that successful. One of the handouts Laura gave us shows that only one out of ten travelers is an Olympic rewards member. [See Exhibit 5.] We've built our success on always being lower priced than Hertz and all the other major rental companies. We serve the value-conscious traveler. It's not clear that changing our reward program in any way, much less a dramatic shift to dollars spent versus days of rental, will do anything for our business but make it less profitable." Marvin Fleming, an operations manager and head of franchise relations, interjected, "I agree with Eva. If our most loyal customers are already paying some of the lowest prices, what good will it do to make their rewards harder to earn than our competitors? Listen, every study we've done comes to Bossible the the same amerama Marvin Fleming, an operations manager and head of franchise relations, interjected, "I agree with Eva. If our most loyal customers are already paying some of the lowest prices, what good will it do to make their rewards harder to earn than our competitors? Listen, every study we've done comes to the same conclusion: Our customers want to pick up and drop off the car as fast as possible, at the best value. We ought to be looking at how to improve there." "I agree with Marvin," Amy McKeever exclaimed, "our training is good, but Enterprise puts more emphasis and, I bet, more money into it. I think we should do more to streamline the check-in and drop-off procedures and not worry about changing our loyalty plan." Andy put up another slide and replied, "All of you have valid points, but let me come back to our Medalist discussion. Even though we target the value-conscious traveler, it doesn't mean we have low-income customers. In fact, affluent households are the most sophisticated shoppers and the most frequent travelers for business and leisure, and they are most likely to book online after shopping for the best price. Our data indicate that we are getting those travelers. We have to be concerned about the perception of our program as well as its actual impact on our loyal customers. What I mean is that if Enterprise is perceived as offering more to the traveler who is spending more, then it will gain competitive advantage and market share." HE acer % on Slide 4: Breakdown of Olympic's revenue and profit by customer % of % of % of Customer Revenues Rental Units Profit Contract Business Small and individual 45 39 41 25 Large 33 42 22 50 Leisure Weekend 5 7 9 All other 17 12 28 "Compared to the industry," Andy continued, "Olympic's customer is more weighted to leisure travelers. We know they are disproportionately from affluent households and they are also much more likely to be our Medalist loyalty members. We have to be sure our loyalty program, as well as our prices, are perceived by this group as the best." Seth spoke up. "Andy, I agree with you that it seems that we need to match Enterprise and change the way we provide rewards. The numbers are hard to capture, but I've given it a try. If you go back to slide 3 you can see the breakdown of revenues provided by our Medalist members. About 1.45% of our total rental days in 2012 involved free days and other reward redemptions. A free-day reward costs us about $21 to cover the variable costs of a rental (around 20%) and the payment to the franchisee. Of course there are fixed costs that could be considered, but your area is not charged for those. "I've estimated that our advertising for the Medalist program is costing about $28 million a year, although it's difficult to allocate advertising dollars precisely. Mwemave te ndaliacerende Sath continued Waste bale number of HON acer "I've estimated that our advertising for the Medalist program is costing about $28 million a year, although it's difficult to allocate advertising dollars precisely. "If we move to a dollars based reward program," Seth continued, "I estimate that the number of free days and redemptions will increase to somewhere between 1.65% and 1.95% of total rentals, as more of our members earn rewards faster. We are forecasting an increase in revenues next year, but the number of rental days should be only slightly more than this year. An increase in free days has to be offset by an increase in revenue so that the Medalist program continues to equal its present percentage of cost to revenues." "Is it worth it? Can we afford it?" Laura asked the group. "What value are we really getting from the Medalist Awards? If every company moves to the Enterprise type of program will it result in any change in market shares or increased business or just lower profitability? Eva, you and Marvin have said you think that we might be better off eliminating the rewards program altogether? Our ad agency has considered this." Laura noted what the agency had proposed. Slide 5: Ad agency's proposed repositioning At Olympic, Everyone's a Winner! Announcing Olympic's new low-price guarantee. Olympic is mixing the gimmicks, the coupons, the impossible and complicated rewards... HARVARD BUSINESS SCHOOLPRERASIES 913-568 Olympic Rent-A-Car U.S.: Customer Loyalty Battles "Would Olympic's customer possibly respond favorably to this "best prices guarantee"? Could it be the key to gaining market share? Would our competitors follow?" Laura asked. "I know I've questioned the value of the Medalist program," Eva said, "and I think most of our customers might be in favor of a no-gimmick, low-price guarantee. We might even be able to gain other customers who are not reward club members with any car rental agency, especially if we advertised and promoted this properly." Andy was quick to respond, "Olympic could never make a move like this since it's not the market leader. We need to follow Enterprise, and quickly. If anything, we should be more aggressive with our reward program. We need to attract more Medalist members. The payoff would be huge." "We need to make some decisions," Laura asserted. "Do we change our Medalist program, and if so, how? How much should we spend to advertise and promote it if we do change? When do we implement a change if we decide to do it?" Laura continued, "Perhaps the more important question is, How do we form a truly distinctive competitive strategy when it seems that most anything we, or our competitors, do can be so easily duplicated