Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is included already. thanks! Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer for

it is included already. thanks!

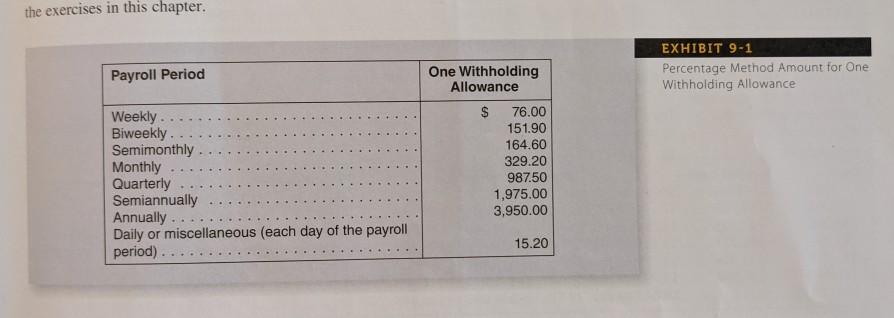

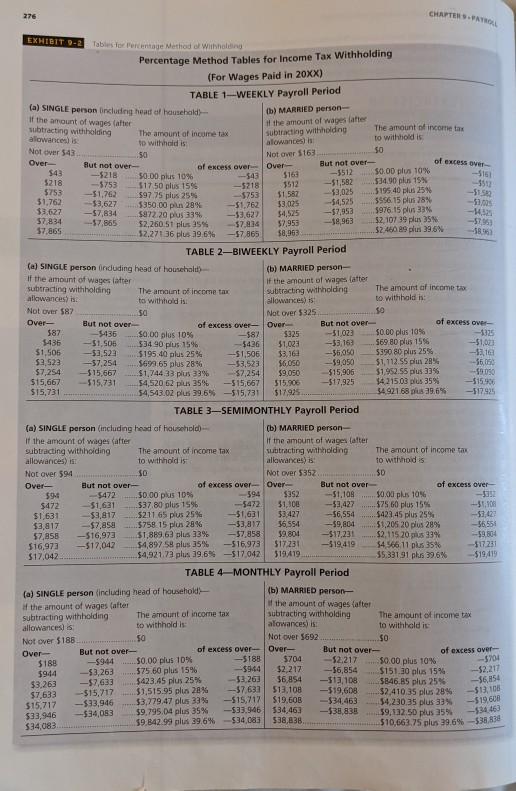

Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer for the short answer questions. 13) Refer to Narrative 9-2. Jane Loprest is self-employed with an annual salary of $49,200.00. In addition to the social security and Medicare tax, her estimated federal income tax rate is 14%. How much quarterly estimated tax must Jane send to the IRS each quarter? (22pts extra credit) the exercises in this chapter. Payroll Period EXHIBIT 9-1 Percentage Method Amount for One Withholding Allowance W eekly ................. Biweekly ....... Semimonthly .. Monthly ..... Quarterly ......... Semiannually ................ Annually ....... Daily or miscellaneous (each day of the payroll period)..................... One Withholding Allowance $ 76.00 151.90 164.60 329.20 987.50 1,975.00 3,950.00 15.20 CHAPTERS.PATROL of excesso EXHIBIT 9-2 Tables for Percentage Method of Withholding Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period (a) SINGLE person including head of household) (b) MARRIED person If the amount of wages after of the amount of wages after Subtracting withholding The amount of income tax The amount of income tax Subtracting withholding alowances) is to withhold is alowances) is: to withholdis: Not over $43. Not over $163.................50 Over But not over of excess over Over But not over- $43 5218 $000 plus 105 5000 plus 10% -543 5512 5163 -5163 $218 -5753 517 50 plus 15% 5340 plus 15% -5218 5512 -51,582 $753 --$1,762 597 75 plus 25% 5753 51.582 -53025 $195.40 plus 25 -515 $1.762 1627 5390 00 plus 28% $1,752 | 53.075 ---54.525 5556.15 plus 28 57.834 5872 20 plus 33% 5976 15 plus -53,627 53.627 5 4.525 -57,953 - 57834 --57.865 52.260 51 plus 355 57.834 $7,953 $2107 19 plus 57.865 52,271 36 plus 39.6% 58.253 52.650 -57,865 plus 96 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person including head of household) (b) MARRIED person- If the amount of wages after If the amount of wages after subtracting withholding The amount of income tax subtracting withholding The amount of income allowances) to withhold is: allowances) is to withhold Not over 587 . 50 Not over $325..................50 Over But not over of excess over Over But not over- of excess over --$436 $0.00 plus 10% -587 $325 -$1023 $0.00 plus 10% $115 5436 --$1.506 $34.90 plus 15% $1,023 -53.163 $69 80 plus 15% ----$1.023 $1,506 --$3.523 $195 40 plus 25% -$1.506 $3.163 --$6,050 $390 80 plus 25% 93.163 $3.523 ---$7.254 ... $699.65 plus 28% -$3,523 56.050 -$9,950 $1,112.55 plus 28% $6,090 $7,254 $15,667 51.744.33 plus 33% 57,254 $9.050 $15,906 $1.952.55 plus 33% -59090 $15,667 $15.731 54,520.62 plus 35% -$15,667 $15.906 -$17,925 14 21503 plus 35% ---$15906 $15,731 .............................. $4,543.02 plus 39.6% -$15,731 $17.925. $4.921 68 plus 39.6% 1998 $87 5436 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of waves after Subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is to withhold is: allowances) is to withhold is Not over $94................... Not over $352 Over- But not over of excess over Over But not over of excess over- 5472 5000 plus 10% -594 $352 -$1,109 .50.00 plus 10% - 5472 -51,631 537 80 plus 15% -5472 $1,108 -$3,427 575 60 plus 155 -5 $1.631 S1817 5211 65 plus 25% -$1,631 53.427 --$6,554 ....$423.45 plus 25% -53.42 $3,817 ---$7,858 $758 15 plus 28 -53.817 5554 --$9,804 51,205 20 plus 28% 57.858 516 973 $1.889 63 plus 33% -$7.858 59.804 -$17,231 12.115 20 plus 33% 59804 516,973 $17.042 54 897 58 plus 35% 516 973 517 231 -$19,419 54 566 11 plus 35% $17.042 $4.921.73 plus 39.6% -517.042 519.419 55.331.91 96 519 419 TABLE 4-MONTHLY Payroll Period (a) SINGLE person including head of household (b) MARRIED person- if the amount of wages after of the amount of wages (after subtracting withholding the amount of income tax Subtracting withholding The amount of income tax allowances) is to withhold is alowances) is to withhold is Not over 5188 ....... Not Over $692 Over But not over- of excess over Over But not over- of excess over- $183 5944 $0.00 plus 10% -5188 5704 52.217 50.00 plus 10% 5704 5944 -53.263 .575.60 plus 15% 59.44 $2,217 -56,854 S151.20 alus 154 $2,217 $326 52,633 $423.45 plus 25% 53.263 $6.854 -$13.108 $13.10 5846 85 plus 25 -56,854 $7633 $15.717 $1,515.95 plus 28% 57.633 513.108 -$19,608 52.410 35 plus 2 513.108 $15 712 $33.946 ....$3,779 47 plus 33% -$15,717 $19.50B 534.463 54.230.35 plus 33 519 608 22 046 534083 59.795.04 plus 35% -533,946 $34,463 $38.838 19.112 5 5 34463 $34,083..... .. .39.842.99 plus 39.6% $34,083 538, ....510,663 75 plus 39.6% -$38,838 Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer for the short answer questions. 13) Refer to Narrative 9-2. Jane Loprest is self-employed with an annual salary of $49,200.00. In addition to the social security and Medicare tax, her estimated federal income tax rate is 14%. How much quarterly estimated tax must Jane send to the IRS each quarter? (22pts extra credit) the exercises in this chapter. Payroll Period EXHIBIT 9-1 Percentage Method Amount for One Withholding Allowance W eekly ................. Biweekly ....... Semimonthly .. Monthly ..... Quarterly ......... Semiannually ................ Annually ....... Daily or miscellaneous (each day of the payroll period)..................... One Withholding Allowance $ 76.00 151.90 164.60 329.20 987.50 1,975.00 3,950.00 15.20 CHAPTERS.PATROL of excesso EXHIBIT 9-2 Tables for Percentage Method of Withholding Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period (a) SINGLE person including head of household) (b) MARRIED person If the amount of wages after of the amount of wages after Subtracting withholding The amount of income tax The amount of income tax Subtracting withholding alowances) is to withhold is alowances) is: to withholdis: Not over $43. Not over $163.................50 Over But not over of excess over Over But not over- $43 5218 $000 plus 105 5000 plus 10% -543 5512 5163 -5163 $218 -5753 517 50 plus 15% 5340 plus 15% -5218 5512 -51,582 $753 --$1,762 597 75 plus 25% 5753 51.582 -53025 $195.40 plus 25 -515 $1.762 1627 5390 00 plus 28% $1,752 | 53.075 ---54.525 5556.15 plus 28 57.834 5872 20 plus 33% 5976 15 plus -53,627 53.627 5 4.525 -57,953 - 57834 --57.865 52.260 51 plus 355 57.834 $7,953 $2107 19 plus 57.865 52,271 36 plus 39.6% 58.253 52.650 -57,865 plus 96 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person including head of household) (b) MARRIED person- If the amount of wages after If the amount of wages after subtracting withholding The amount of income tax subtracting withholding The amount of income allowances) to withhold is: allowances) is to withhold Not over 587 . 50 Not over $325..................50 Over But not over of excess over Over But not over- of excess over --$436 $0.00 plus 10% -587 $325 -$1023 $0.00 plus 10% $115 5436 --$1.506 $34.90 plus 15% $1,023 -53.163 $69 80 plus 15% ----$1.023 $1,506 --$3.523 $195 40 plus 25% -$1.506 $3.163 --$6,050 $390 80 plus 25% 93.163 $3.523 ---$7.254 ... $699.65 plus 28% -$3,523 56.050 -$9,950 $1,112.55 plus 28% $6,090 $7,254 $15,667 51.744.33 plus 33% 57,254 $9.050 $15,906 $1.952.55 plus 33% -59090 $15,667 $15.731 54,520.62 plus 35% -$15,667 $15.906 -$17,925 14 21503 plus 35% ---$15906 $15,731 .............................. $4,543.02 plus 39.6% -$15,731 $17.925. $4.921 68 plus 39.6% 1998 $87 5436 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of waves after Subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is to withhold is: allowances) is to withhold is Not over $94................... Not over $352 Over- But not over of excess over Over But not over of excess over- 5472 5000 plus 10% -594 $352 -$1,109 .50.00 plus 10% - 5472 -51,631 537 80 plus 15% -5472 $1,108 -$3,427 575 60 plus 155 -5 $1.631 S1817 5211 65 plus 25% -$1,631 53.427 --$6,554 ....$423.45 plus 25% -53.42 $3,817 ---$7,858 $758 15 plus 28 -53.817 5554 --$9,804 51,205 20 plus 28% 57.858 516 973 $1.889 63 plus 33% -$7.858 59.804 -$17,231 12.115 20 plus 33% 59804 516,973 $17.042 54 897 58 plus 35% 516 973 517 231 -$19,419 54 566 11 plus 35% $17.042 $4.921.73 plus 39.6% -517.042 519.419 55.331.91 96 519 419 TABLE 4-MONTHLY Payroll Period (a) SINGLE person including head of household (b) MARRIED person- if the amount of wages after of the amount of wages (after subtracting withholding the amount of income tax Subtracting withholding The amount of income tax allowances) is to withhold is alowances) is to withhold is Not over 5188 ....... Not Over $692 Over But not over- of excess over Over But not over- of excess over- $183 5944 $0.00 plus 10% -5188 5704 52.217 50.00 plus 10% 5704 5944 -53.263 .575.60 plus 15% 59.44 $2,217 -56,854 S151.20 alus 154 $2,217 $326 52,633 $423.45 plus 25% 53.263 $6.854 -$13.108 $13.10 5846 85 plus 25 -56,854 $7633 $15.717 $1,515.95 plus 28% 57.633 513.108 -$19,608 52.410 35 plus 2 513.108 $15 712 $33.946 ....$3,779 47 plus 33% -$15,717 $19.50B 534.463 54.230.35 plus 33 519 608 22 046 534083 59.795.04 plus 35% -533,946 $34,463 $38.838 19.112 5 5 34463 $34,083..... .. .39.842.99 plus 39.6% $34,083 538, ....510,663 75 plus 39.6% -$38,838Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started