Question

It is January 1 and Justin Case, chief counsel for Chemgoo, is faced with a difficult challenge. It seems that the firm has two related

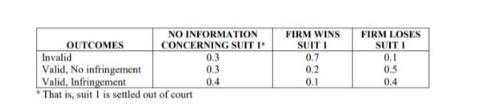

It is January 1 and Justin Case, chief counsel for Chemgoo, is faced with a difficult challenge. It seems that the firm has two related lawsuits for patent infringement. For each suit, the firm has the option of going to trial or settling out of court. The trial date for one of the suits, which we will cleverly identify as suit 1, is scheduled for July 15 and the second (suit 2, of course) is scheduled for January 8, next year. Preparation costs for either trial are estimated at $10,000. However, if the firm prepares for both trials, the preparation costs of the second trial will be only $6,000. These costs can be avoided by settling out of court. If the firm wins suit 1, it pays no penalty. If it loses, it pays a $200,000 penalty. Lawyers for the firm assess the probability of winning suit 1 as 0.5. The firm has the option to settle suit 1 out of court for $100,000. Suit 2 can be settled out of court for a cost of $60,000. If you don’t settle suite 2 out of courts then a trial will result in one of three possible outcomes: (1) The suit 2 is declared invalid and the firm pays no penalty; (2) the suit 2 is found valid but with no infringement, and the firm pays a penalty of $50,000; or (3) the suit 2 is found valid with infringement, and the firm pays a penalty of $90,000. The likelihood of these outcomes depends in general on the result of suit 1. The judge will certainly view suit 1 as an important precedent. The lawyers’ assessment of the probability of the three possible outcomes of suit 2 under three sets of possible conditions (relating to suit 1) are presented in the table.

a. Represent the firm’s model with a decision tree. Solve to find the optimal strategy for the firm and the expected loss that the firm will incur if it follows the optimal strategy? Hint: Since all the figures are costs, you may find it easier to work with the cost figures and minimize the expected cost.

b. What decisions would be made if the firm treated each suit independently, ignoring any interactions between the two? What is the expected savings from the decision analysis of this scenario?

NO INFORMATION FIRM WINS FIRM LOSES SUIT I OUTCOMES Invalid Valid, No infringement Valid, Infringement That is, suit I is settled out of court CONCERNING SUIT I 0.3 0.3 SUIT I 0.7 0.2 0.1 0.5 0.4 0.1 0.4

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A The following is the choice tree that has been turned out based on the information given Note Deci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started