Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is January 15. Tofu Inc., a local tofu processing plant, is looking to protect itself against an increase in the price of soybeans. The

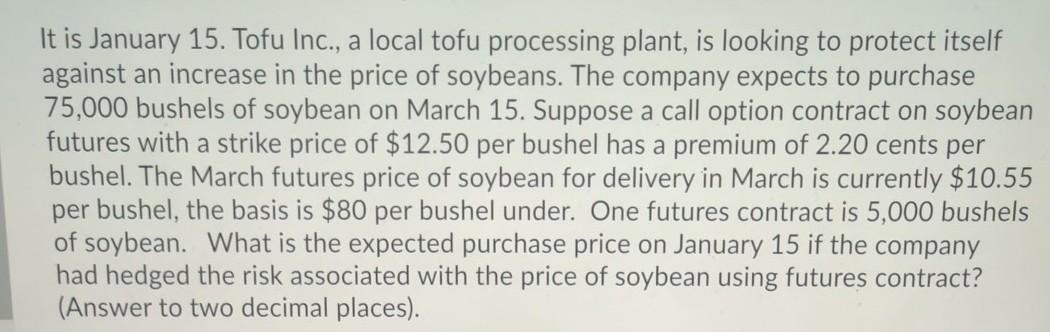

It is January 15. Tofu Inc., a local tofu processing plant, is looking to protect itself against an increase in the price of soybeans. The company expects to purchase 75,000 bushels of soybean on March 15. Suppose a call option contract on soybean futures with a strike price of $12.50 per bushel has a premium of 2.20 cents per bushel. The March futures price of soybean for delivery in March is currently $10.55 per bushel, the basis is $80 per bushel under. One futures contract is 5,000 bushels of soybean. What is the expected purchase price on January 15 if the company had hedged the risk associated with the price of soybean using futures contract? (Answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started