Question

It is January, 2017 and you have just been hired as the financial reporting guru for TECHNOGYM, a diversified exercise/fitness corporation that has just finished

It is January, 2017 and you have just been hired as the financial reporting guru for TECHNOGYM, a diversified exercise/fitness corporation that has just finished a very fast-paced, dynamic year. TECHNOGYM began as the sole distributor of TechTone, a full-body fitness machine sold to fitness centers and hospitals. This remains the main operation of TECHNOGYMs business.

Your predecessor left the firm in a hurry. Your primary responsibility is to finish the 2016 year-end financial statements. Luckily, there is still time to make any necessary correcting and/or adjusting journal entries for the 2016 fiscal year. To give you a better understanding of the decisions made by your predecessor, at time you will be asked to reproduce results from 2015.

Throughout the semester you will work on different aspects of the companys financial records. This exercise relates to discontinued operations. Future exercises will relate to: revenue recognition, accounts receivable, and inventory. Near the end of the semester, you will combine these exercises in a comprehensive financial reporting and analysis exercise.

General Information

TECHNOGYM uses a Jan. 1 Dec. 31 financial year

TECHNOGYMs effective income tax rate and the number of shares of common stock outstanding are shown below each trial balance

You should assume that Revenue From Other Products and Cost of Other Products should be included with TechTone as primary operations

You should assume that all Depreciation Expense and General and Admin Expenses are considered operating expenses

Exercise for a Discontinued Operation - the West Coast Division:

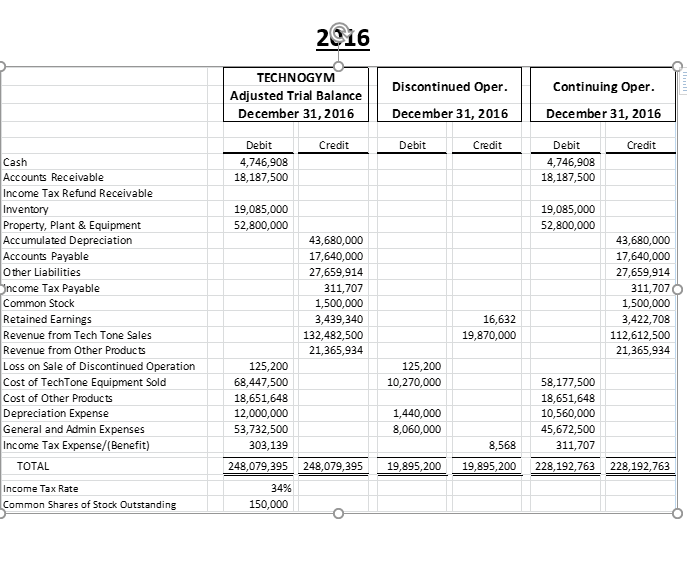

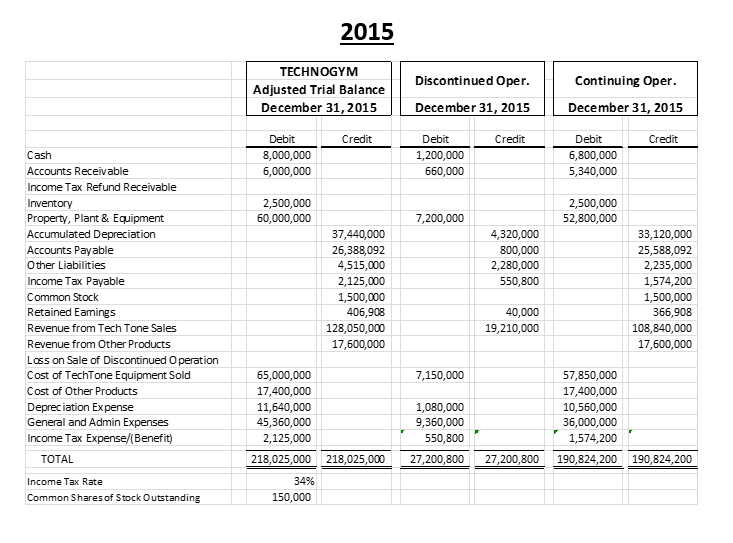

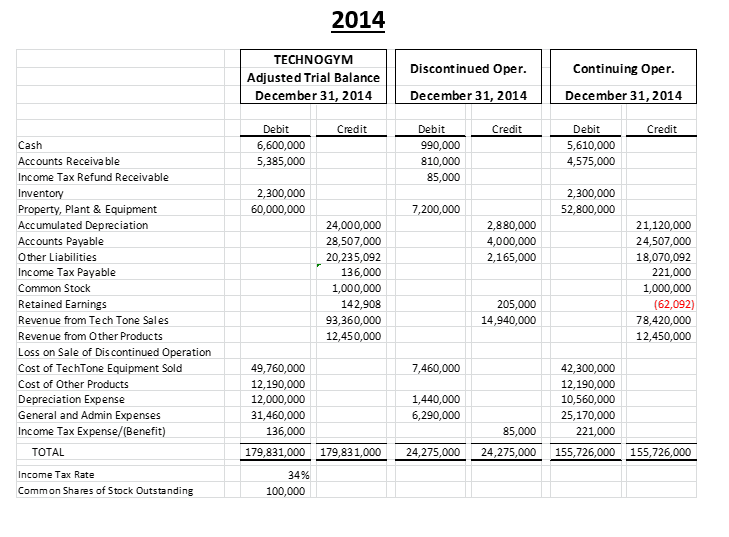

A spreadsheet has been prepared (3401 FinSt DiscOps.xlsx) that contains information you will need for this exercise related to a discontinued operation. A copy of the adjusted trial balances for 2016, 2015, and 2014 is also attached to this document. You have gathered the following information that will be helpful in completing this part of your responsibilities. You (of course) will include supporting documentation (including calculations) for verifiability of your answers. Good luck!

2015 Activities:

On October 1, 2015, TECHNOGYM made and announced a decision to sell its West Coast operations (considered a component according to the GAAP definition) to an unaffiliated company and the sale was expected to close on November 30, 2016. TECHNOGYM management estimated at the end of 2015 that the division would sell for $1,400,000, and that legal fees for the sale would be $200,000. The notes left behind by your predecessor include a breakout of the financial records for the West Coast division compared to the rest of the company for 2016, 2015, and 2014.

Journal entries to record the West Coast divisions normal operating revenues and expenses for 2015 were completed properly during the year, and normal adjusting entries were also recorded. As indicated in the documentation, the net carrying value of the division (assets minus liabilities) at the end of 2015 was $1,109,200.

Requirement (a) Complete the following tasks related to 2015 results:

Prepare the complete multi-step income statement that would have been prepared at the end of 2015, showing only 2015 and 2014 (note: a normal income statement shows 3 years of results, but we are omitting the 2013 results from this requirement).

2016 Activities:

On December 31, 2016, the West Coast division was sold, but actual result of the sale was a $125,200 loss (instead of the gain that had been estimated in 2015). The journal entries related to the sale were recorded already, along with all other normal 2016 adjusting entries.

Requirement (b) - Complete the following tasks for 2016:

Prepare the complete 2016 multi-step income statement (containing a column of results for all 3 years).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started