Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is just a cash budget analysis. i provided the information in the pictures. BUS 1300 Financial Statement Analysis Final Project Cash Budget Backqround lnformation

It is just a cash budget analysis. i provided the information in the pictures.

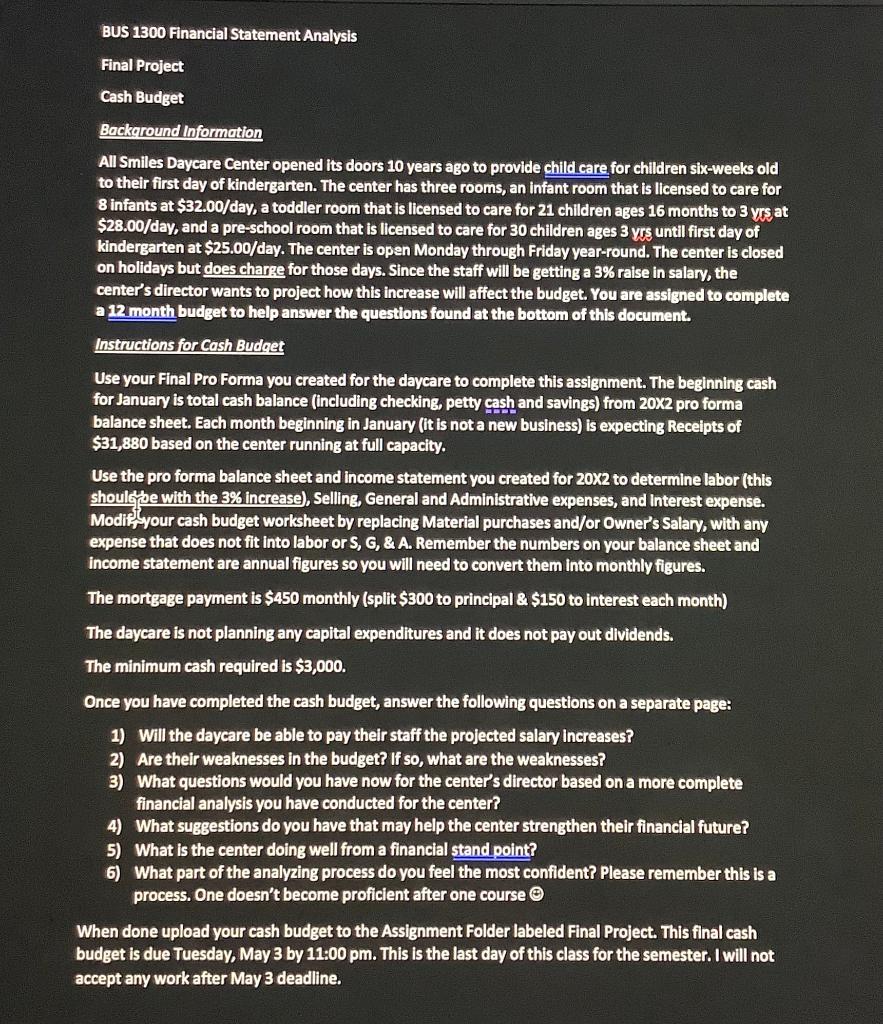

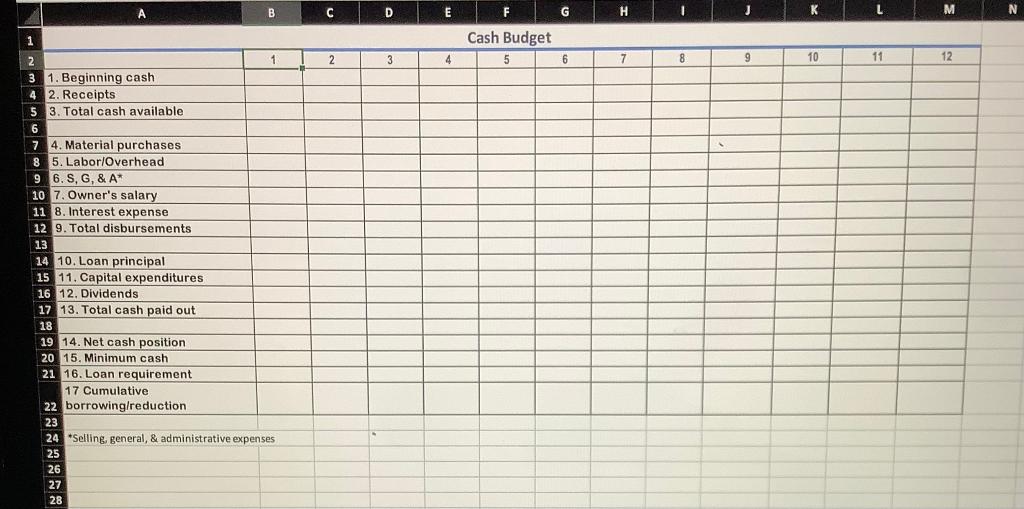

BUS 1300 Financial Statement Analysis Final Project Cash Budget Backqround lnformation All Smiles Daycare Center opened its doors 10 years ago to provide child care for children six-weeks old to their first day of kindergarten. The center has three rooms, an infant room that is licensed to care for 8 infants at $32.00/ day, a toddler room that is licensed to care for 21 children ages 16 months to 3 yrs at $28.00/ day, and a pre-school room that is licensed to care for 30 children ages 3 yrs until first day of kindergarten at $25.00/ day. The center is open Monday through Friday year-round. The center is closed on holidays but does charge for those days. Since the staff will be getting a 3% raise in salary, the center's director wants to project how this increase will affect the budget. You are assigned to complete a 12 month budget to help answer the questions found at the bottom of this document. Instructions for Cash Budget Use your Final Pro Forma you created for the daycare to complete this assignment. The beginning cash for January is total cash balance (including checking, petty cash and savings) from 202 pro forma balance sheet. Each month beginning in January (it is not a new business) is expecting Receipts of $31,880 based on the center running at full capacity. Use the pro forma balance sheet and income statement you created for 202 to determine labor (this shoulgte with the 3% increase), Selling, General and Administrative expenses, and interest expense. Modiif Your cash budget worksheet by replacing Material purchases and/or Owner's Salary, with any expense that does not fit into labor or S, G, \& A. Remember the numbers on your balance sheet and income statement are annual figures so you will need to convert them into monthly figures. The mortgage payment is $450 monthly (split $300 to principal \& $150 to interest each month) The daycare is not planning any capital expenditures and it does not pay out dividends. The minimum cash required is $3,000. Once you have completed the cash budget, answer the following questions on a separate page: 1) Will the daycare be able to pay their staff the projected salary increases? 2) Are their weaknesses in the budget? If so, what are the weaknesses? 3) What questions would you have now for the center's director based on a more complete financial analysis you have conducted for the center? 4) What suggestions do you have that may help the center strengthen their financial future? 5) What is the center doing well from a financial stand point? 6) What part of the analyzing process do you feel the most confident? Please remember this is a process. One doesn't become proficient after one course (+ When done upload your cash budget to the Assignment Folder labeled Final Project. This final cash budget is due Tuesday, May 3 by 11:00 pm. This is the last day of this class for the semester. I will not accept any work after May 3 deadline. *Selling, general, 8 administrative expenses BUS 1300 Financial Statement Analysis Final Project Cash Budget Backqround lnformation All Smiles Daycare Center opened its doors 10 years ago to provide child care for children six-weeks old to their first day of kindergarten. The center has three rooms, an infant room that is licensed to care for 8 infants at $32.00/ day, a toddler room that is licensed to care for 21 children ages 16 months to 3 yrs at $28.00/ day, and a pre-school room that is licensed to care for 30 children ages 3 yrs until first day of kindergarten at $25.00/ day. The center is open Monday through Friday year-round. The center is closed on holidays but does charge for those days. Since the staff will be getting a 3% raise in salary, the center's director wants to project how this increase will affect the budget. You are assigned to complete a 12 month budget to help answer the questions found at the bottom of this document. Instructions for Cash Budget Use your Final Pro Forma you created for the daycare to complete this assignment. The beginning cash for January is total cash balance (including checking, petty cash and savings) from 202 pro forma balance sheet. Each month beginning in January (it is not a new business) is expecting Receipts of $31,880 based on the center running at full capacity. Use the pro forma balance sheet and income statement you created for 202 to determine labor (this shoulgte with the 3% increase), Selling, General and Administrative expenses, and interest expense. Modiif Your cash budget worksheet by replacing Material purchases and/or Owner's Salary, with any expense that does not fit into labor or S, G, \& A. Remember the numbers on your balance sheet and income statement are annual figures so you will need to convert them into monthly figures. The mortgage payment is $450 monthly (split $300 to principal \& $150 to interest each month) The daycare is not planning any capital expenditures and it does not pay out dividends. The minimum cash required is $3,000. Once you have completed the cash budget, answer the following questions on a separate page: 1) Will the daycare be able to pay their staff the projected salary increases? 2) Are their weaknesses in the budget? If so, what are the weaknesses? 3) What questions would you have now for the center's director based on a more complete financial analysis you have conducted for the center? 4) What suggestions do you have that may help the center strengthen their financial future? 5) What is the center doing well from a financial stand point? 6) What part of the analyzing process do you feel the most confident? Please remember this is a process. One doesn't become proficient after one course (+ When done upload your cash budget to the Assignment Folder labeled Final Project. This final cash budget is due Tuesday, May 3 by 11:00 pm. This is the last day of this class for the semester. I will not accept any work after May 3 deadline. *Selling, general, 8 administrative expenses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started