Question

It is late March 2020 and you are a first-year accounting analyst in the financial reporting area at All World Airways (AWA). You have just

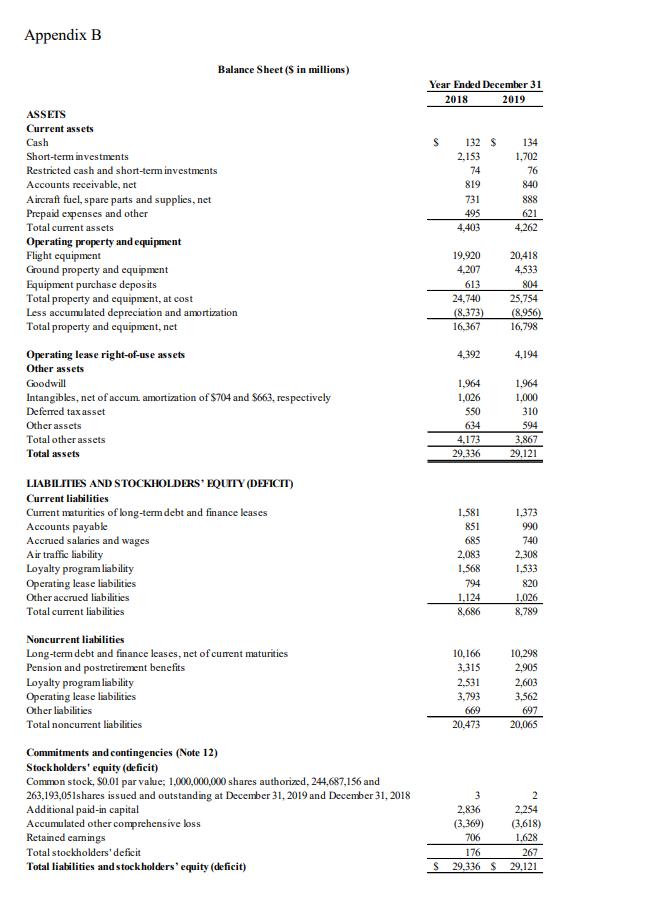

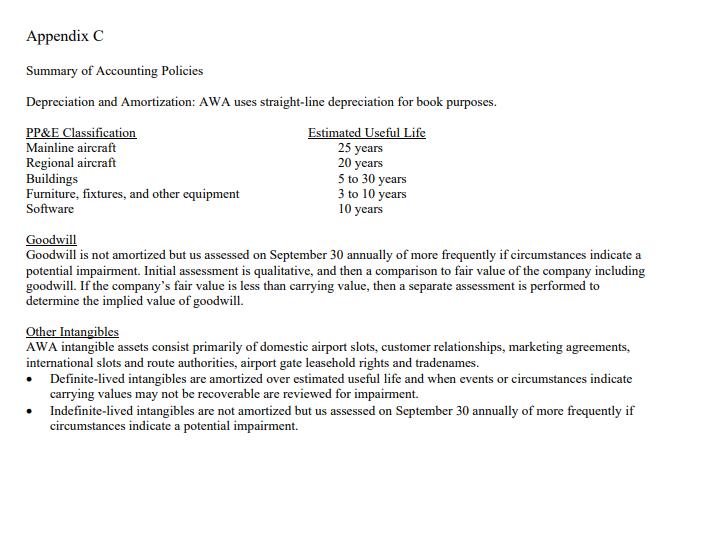

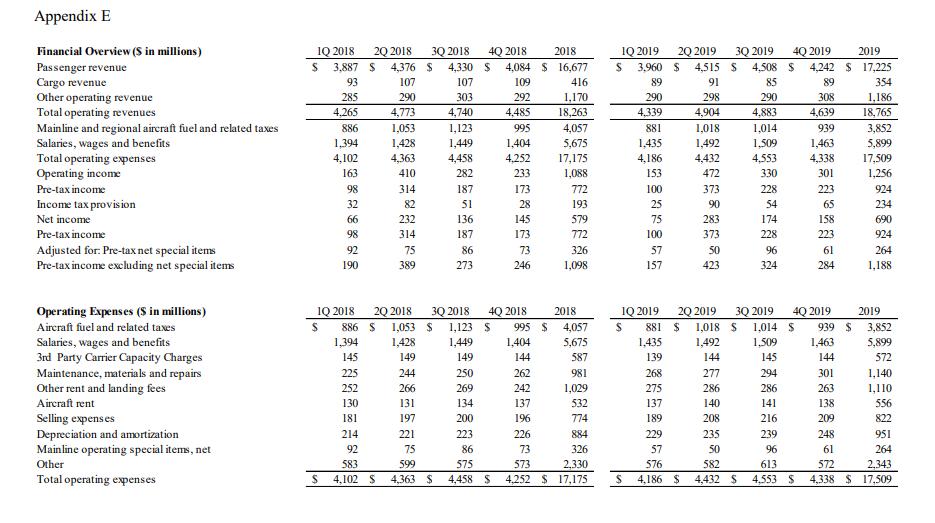

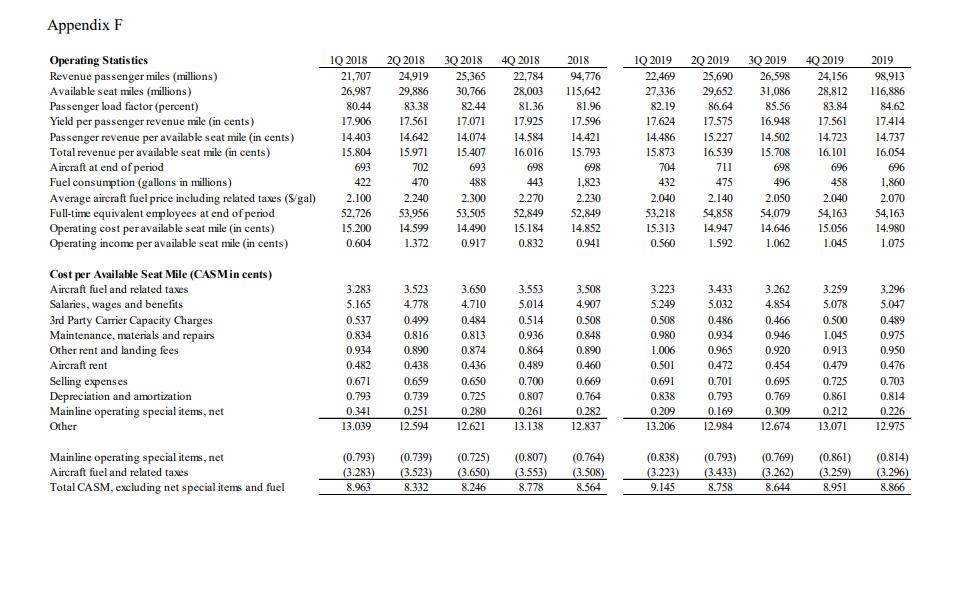

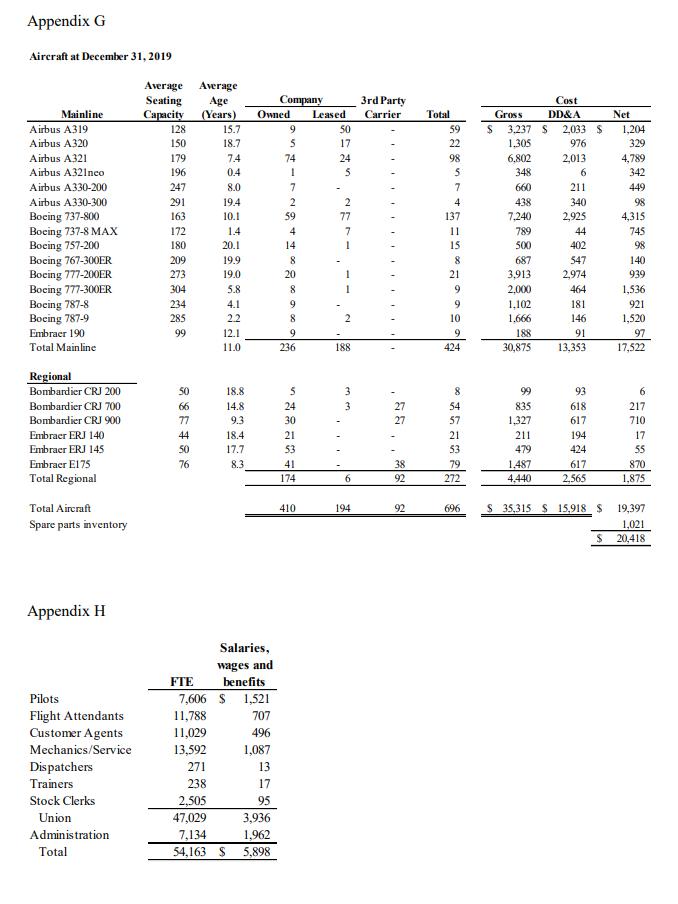

It is late March 2020 and you are a first-year accounting analyst in the financial reporting area at All World Airways (AWA). You have just finished your first yearend close and reporting process. Other staff has told you the yearend activities were more hectic than usual due to concerns about the COVID-19 virus and how it may impact AWA's operations. While the annual report and Form 10-K were being finalized, you and other members of the financial reporting staff were also researching GAAP on impairment and preparing for potential disclosures to be released in a Form 8-K filing and the first quarter 10-Q filing. AWA's controller, Dirk Carre, has asked you to document the process that should be used to determine whether, or which, AWA assets are impaired, to calculate an impairment estimate including support for the discount rate used in your estimates, and draft a report for presentation to executive management and the BOD that supports the analyses and conclusions resulting from your research. Background AWA is a U.S.-based international air carrier. During 2019, AWA achieved profitable operations and significant improvements in its on-time departures and arrivals. AWA increased its passenger load factor by approximately 3% and passenger revenue per available seat mile by approximately 2%. AWA's revenue and operating results are subject to seasonality. Historically, the 2 nd and 3 rd quarters of each year see the highest revenue and operating costs due to the vacation travel season with increased passenger flows in the May through August period. For 2019, AWA's operating income was $ 1.257 billion and net income of $ 691 million on $ 18.765 billion of revenue. AWA financial data and operating statistics are presented in Appendices A, B, C, D, E, and F. At the end of 2019, AWA's fleet consisted of 696 aircraft supported by 54,163 employees. For information on AWA's fleet and employees, see Appendices G and H

The Board of Directors (BOD) has set AWA's priorities as efficient and profitable growth to generate significant free cash flow through customer satisfaction and operational excellence. Based on various studies, the BOD believes becoming the customer's airline of choice is based on operational excellence achieved through reliability and scheduling. In addition, the BOD and AWA management believe operational excellence is dependent on having and maintaining a fuel-efficient fleet.

Over the years, AWA fleet has replaced and upgraded through a significant capital investments program which is achieving desired results. With a future capital investment profile based on maintaining rather than growing a fuel-efficient fleet through replacement of older less efficient aircraft, AWA believes it is well positioned to strategically expand its operations and fleet in high growth and revenue markets. AWA's focus is generating returns to shareholders and de-levering its balance sheet (i.e., reducing debt) through profitable operations in existing markets and growth in new markets. In recent years, AWA has paid dividends that have averaged 1.7% annually. The AWA BOD would like to increase these payouts. Like its competitors, AWA has also been dealing with Boeing 737 MAX aircraft issues. AWA's fleet includes 11 Boeing 737 MAX aircraft with an additional 34 on order for future delivery. Due to safety concerns, on March 13, 2019, the U.S. Federal Aviation Administration (FAA) grounded all U.S. registered Boeing 737 MAX aircraft. AWA cancelled roughly 12,000 flights during the last three quarters of 2019 and removed all Boeing 737 MAX aircraft from its flight schedule through the first two quarters of 2020 while continuing to assess the FAA and Boeing timelines for resolution of the Boeing 737 MAX aircraft issues. Issues and AWA's Planned Approaches In early 2020, the World Health Organization declared COVID-19 which surfaced in nearly all regions of the world to be a global health pandemic. The government imposed and implemented significant measures in attempt to prevent or reduce spread of COVID-19. These measures include travel restrictions, border closings, "shelter in place" orders, and business closures led to an unprecedented decline in the demand for air travel. During the first two months of 2020, AWA's business performed largely as expected; however, a severe reduction in air travel during March 2020 led to AWA's total operating revenues decreasing nearly 25% in the first quarter of 2020 compared to the first quarter of 2019. As a result, AWA expects the deterioration to increase in the second quarter of 2020 with results of operations to be severely impacted for the balance of 2020 and possibly into early 2022. Based on the lack of COVID- 19 information, there is significant uncertainty on the potential length and severity of the pandemic. AWA expects significant business volatility during the pandemic period with future demand for aircraft travel difficult to forecast accurately in the near and long term.

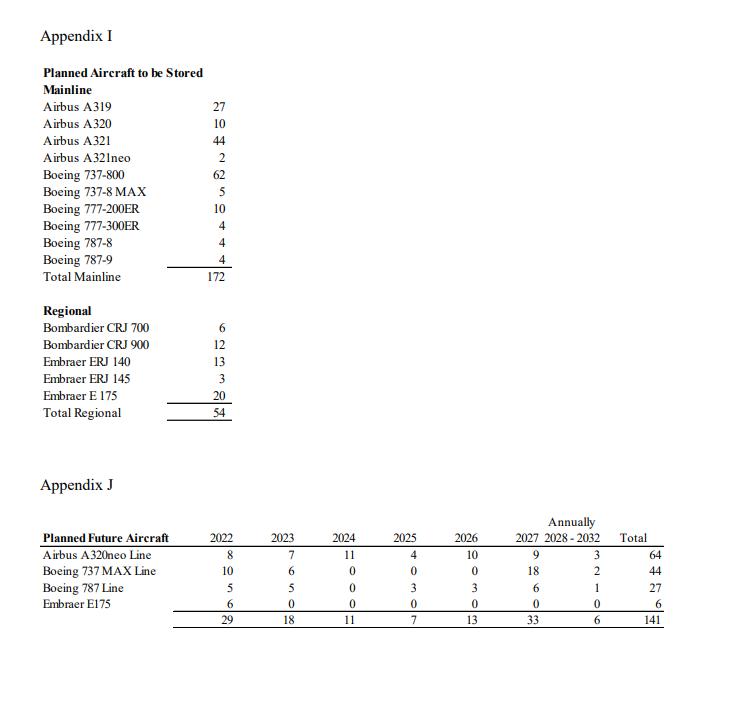

In response to COVID-19, AWA plans on taking forceful actions to reconfigure of fleet, reduce capacity significantly, reduce costs, and improve our liquidity, and preserve cash. Planned changes to capacity are based on the expectation that AWA's demand will be 80%, 70, and 60% lower for the 2 nd , 3 rd , and 4 th quarters of 2020 compared to its 2019 results. For 2021, AWA expects the 1 st quarter to be consistent with the 4 th quarter of 2020 then a recovery beginning in the 2 nd quarter growing demand by 25 to 30% quarterly until full recovery occurs on the 1 st or 2 nd quarter of 2022. After full recovery, AWA expects the future growth of 1 to 2 percent annually (excluding inflation) from its existing fleet with additional growth from planned aircraft additions (see Appendix J). AWA's estimates and forecasts are subject to the conditions and government mandates in the jurisdictions in which AWA operates. Based on the estimates and the forecast, AWA is accelerating the retirement of less efficient mainline aircraft as well as certain regional aircraft.

This action reduces the complexity of AWA's fleet, creates maintenance costs reductions, and brings other savings from operating fewer aircraft types forward in time. Aircraft to be retired include the Airbus A330, Boeing 757 and 767, Embraer 140 and 190, and Bombardier CRJ 200 portions of AWA's fleet. AWA will also temporarily store some AWA-owned aircraft including Boeing 737-800, Bombardier CRJ 700 and 900, and Embraer 145 and 175 aircraft. See Appendix I for planned aircraft storage information. While AWA is retiring some aircraft and storing others due to the forecasted changes in capacity, AWA has decided to maintain its relationships with 3rd party carriers and presence in the various airports serving its markets. In the interim periods, however, AWA plans to consolidate its airport facility space. AWA is also deferring marketing expenses, reducing and deferring maintenance expenses, and reducing contractor, event, and training expenses. To address personnel costs, AWA has implemented a hiring freeze for non-essential positions, paused non-contractual pay raises, implemented both voluntary partially paid leave and early retirement programs, and reduced executive and BOD compensation. These actions will reduce AWA's Administration staffing by 33% and operating staff by 20% for early retirement with a similar reduction for involuntary furloughs. Finally, AWA

Required

- Outline the steps for impairment of intangible assets, then:

- Describe the data from the case that should be used in an impairment test of intangible assets. Explain.

- Indicate whether there may be an impairment of intangible assets. Explain

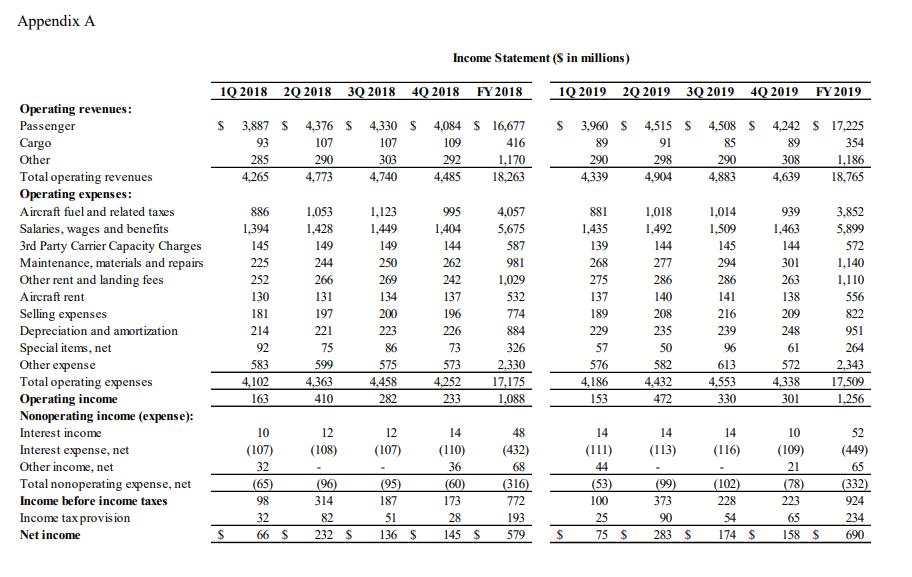

Appendix A Income Statement (S in millions) 1Q 2018 2Q 2018 3Q 2018 4Q 2018 FY 2018 1Q 2019 2Q 2019 3Q 2019 4Q 2019 FY2019 Operating revenues: Passenger Cargo Other 3,887 S 4,376 S 4,330 S 4,084 $ 16,677 $ 3,960 S 4,515 S 4,508 S 4,242 S 17,225 93 107 107 109 416 89 91 85 89 354 285 290 303 292 1,170 18,263 290 298 290 308 1,186 18,765 4,339 4,883 Total operating revenues Operating expenses: 4,265 4,773 4,740 4,485 4,904 4,639 1,018 3,852 5,899 Aircraft fuel and related taxes 886 1,053 1,123 995 4,057 881 1,014 939 1,404 5,675 Salaries, wages and benefits 3rd Party Carrier Capacity Charges Maintenance, materials and repairs Other rent and landing fees 1,394 1,428 1,449 1,435 1,492 1,509 1,463 145 149 149 144 587 139 144 145 144 572 225 244 250 262 981 268 277 294 301 1,140 252 266 269 242 1,029 275 286 286 263 1,110 Aircraft rent 130 131 134 137 532 137 140 141 138 556 200 223 209 Selling expenses Depreciation and amortization Special items, net Other expense 181 197 196 774 189 208 216 822 214 221 226 884 229 235 239 248 951 92 75 86 73 326 57 50 96 61 264 2,343 17,509 1,256 583 599 575 573 2,330 17,175 1,088 576 582 613 572 Total operating expenses Operating income Nonoperating income (expense): 4,102 4,363 4,458 4,252 4,186 4,432 4,553 4,338 163 410 282 233 153 472 330 301 Interest income 10 12 12 14 48 14 14 14 10 52 Interest expense, net (107) (108) (107) (110) (432) (111) (113) (116) (109) (449) Other income, net 32 36 68 44 21 65 Total nonoperating expense, net (65) (96) (95) (60) 173 (99) (316) (53) 100 (102) (78) (332) 924 Income before income taxes 98 314 187 772 373 228 223 Income tax provis ion 32 82 51 28 193 25 90 54 65 234 Net income 66 S 232 $ 136 $ 145 S 579 75 S 283 $ 174 $ 158 S 690

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Year Ended December 31 200119 20565 21450 19555 17054 15609 Income Statement Data in millions except per share data and other data where indica...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started