Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is March 1 , and you are the manager of the lumber mill. You know that you will have an order for 300,000 feet

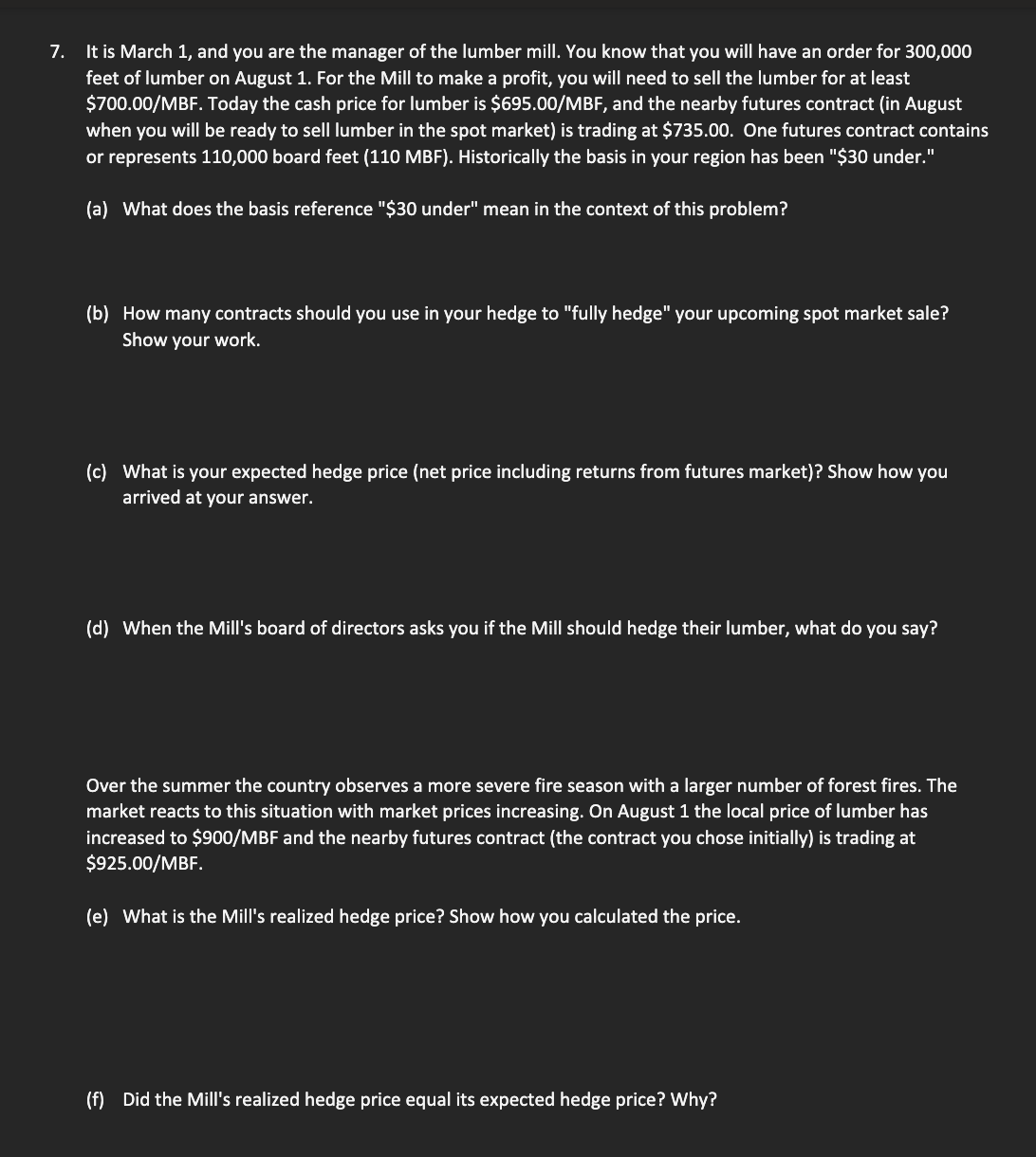

It is March 1 , and you are the manager of the lumber mill. You know that you will have an order for 300,000 feet of lumber on August 1. For the Mill to make a profit, you will need to sell the lumber for at least $700.00/MBF. Today the cash price for lumber is $695.00/MBF, and the nearby futures contract (in August when you will be ready to sell lumber in the spot market) is trading at $735.00. One futures contract contains or represents 110,000 board feet (110 MBF). Historically the basis in your region has been "\$30 under." (a) What does the basis reference "\$30 under" mean in the context of this problem? (b) How many contracts should you use in your hedge to "fully hedge" your upcoming spot market sale? Show your work. (c) What is your expected hedge price (net price including returns from futures market)? Show how you arrived at your answer. (d) When the Mill's board of directors asks you if the Mill should hedge their lumber, what do you say? Over the summer the country observes a more severe fire season with a larger number of forest fires. The market reacts to this situation with market prices increasing. On August 1 the local price of lumber has increased to $900/MBF and the nearby futures contract (the contract you chose initially) is trading at $925.00/MBF. (e) What is the Mill's realized hedge price? Show how you calculated the price. (f) Did the Mill's realized hedge price equal its expected hedge price? Why

It is March 1 , and you are the manager of the lumber mill. You know that you will have an order for 300,000 feet of lumber on August 1. For the Mill to make a profit, you will need to sell the lumber for at least $700.00/MBF. Today the cash price for lumber is $695.00/MBF, and the nearby futures contract (in August when you will be ready to sell lumber in the spot market) is trading at $735.00. One futures contract contains or represents 110,000 board feet (110 MBF). Historically the basis in your region has been "\$30 under." (a) What does the basis reference "\$30 under" mean in the context of this problem? (b) How many contracts should you use in your hedge to "fully hedge" your upcoming spot market sale? Show your work. (c) What is your expected hedge price (net price including returns from futures market)? Show how you arrived at your answer. (d) When the Mill's board of directors asks you if the Mill should hedge their lumber, what do you say? Over the summer the country observes a more severe fire season with a larger number of forest fires. The market reacts to this situation with market prices increasing. On August 1 the local price of lumber has increased to $900/MBF and the nearby futures contract (the contract you chose initially) is trading at $925.00/MBF. (e) What is the Mill's realized hedge price? Show how you calculated the price. (f) Did the Mill's realized hedge price equal its expected hedge price? Why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started