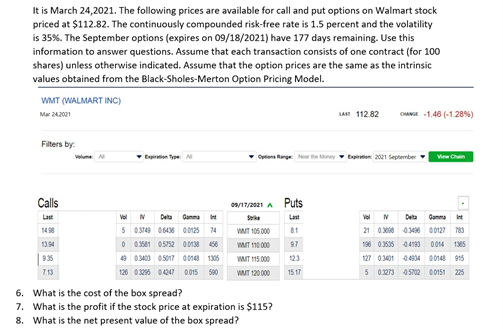

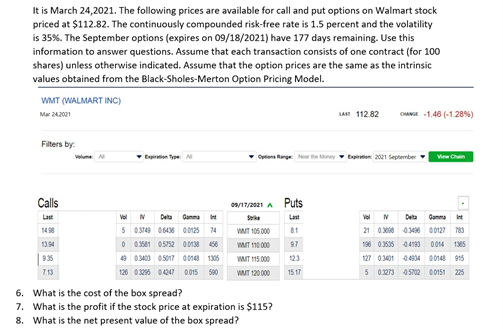

It is March 24,2021. The following prices are available for call and put options on Walmart stock priced at $112.82. The continuously compounded risk-free rate is 1.5 percent and the volatility is 35%. The September options (expires on 09/18/2021) have 177 days remaining. Use this information to answer questions. Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated. Assume that the option prices are the same as the intrinsic values obtained from the Black-Sholes-Merton Option Pricing Model. WMT (WALMART INC) Mar 24.2021 LAST 112.82 CHANGE -1.48 (-1.28%) Filters by Options are the one on 2021 September View Calls 8/17/2021 A Puts 1490 81 M 5 0.3749 06438 00125 74 003561 05752 0013456 49 03400 0507 004 1805 128 03296 0047 0015590 VINT 106.000 WWT 110 000 1394 935 7.13 Vol Delta 21 0.0980498 0.0127783 196 0355 041900014 1305 12703401 04934 00143 915 5 0227395702 00151 WT 115.000 VINT 120.000 15.17 6. What is the cost of the box spread? 7. What is the profit if the stock price at expiration is $115? 8. What is the net present value of the box spread? It is March 24,2021. The following prices are available for call and put options on Walmart stock priced at $112.82. The continuously compounded risk-free rate is 1.5 percent and the volatility is 35%. The September options (expires on 09/18/2021) have 177 days remaining. Use this information to answer questions. Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated. Assume that the option prices are the same as the intrinsic values obtained from the Black-Sholes-Merton Option Pricing Model. WMT (WALMART INC) Mar 24.2021 LAST 112.82 CHANGE -1.48 (-1.28%) Filters by Options are the one on 2021 September View Calls 8/17/2021 A Puts 1490 81 M 5 0.3749 06438 00125 74 003561 05752 0013456 49 03400 0507 004 1805 128 03296 0047 0015590 VINT 106.000 WWT 110 000 1394 935 7.13 Vol Delta 21 0.0980498 0.0127783 196 0355 041900014 1305 12703401 04934 00143 915 5 0227395702 00151 WT 115.000 VINT 120.000 15.17 6. What is the cost of the box spread? 7. What is the profit if the stock price at expiration is $115? 8. What is the net present value of the box spread