Question

It is nearing the end of the year and your client, Amy Smith, approaches you about the treatment of the income and losses she will

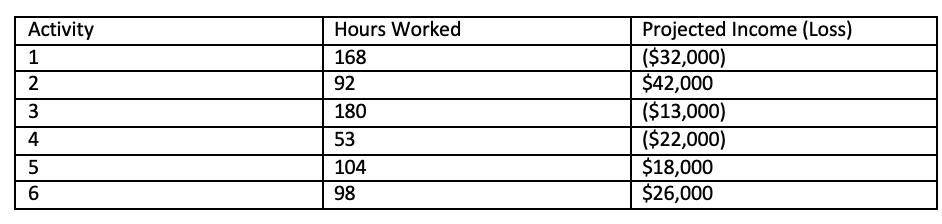

It is nearing the end of the year and your client, Amy Smith, approaches you about the treatment of the income and losses she will earn from her nonrental activities this year. She provides you with information for each activity including the total number of hours she has spent to date and the total projected income or loss from each activity. No other individual has worked more than Amy in any of these activities.

Draft a tax research memo to arrive at a conclusion and make a recommendation to Amy, citing appropriate primary authority.

Projected Income (Loss) ($32,000) $42,000 ($13,000) ($22,000) $18,000 $26,000 Activity Hours Worked 1 168 2 92 3 180 4 53 104 98

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To Amy Smith From Your tax advisor Re Treatment of income and losses from nonrental activities Based on the information you have provided it appears t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started