Answered step by step

Verified Expert Solution

Question

1 Approved Answer

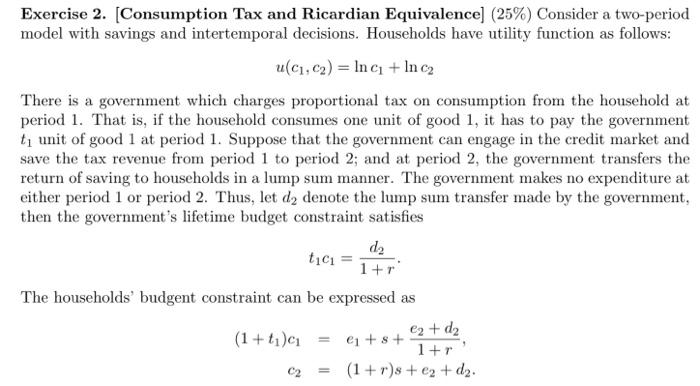

It is not blurry Exercise 2. [Consumption Tax and Ricardian Equivalence] (25%) Consider a two-period model with savings and intertemporal decisions. Households have utility function

It is not blurry

Exercise 2. [Consumption Tax and Ricardian Equivalence] (25%) Consider a two-period model with savings and intertemporal decisions. Households have utility function as follows: uC1,C2) = Inc + Inca There is a government which charges proportional tax on consumption from the household at period 1. That is, if the household consumes one unit of good 1, it has to pay the government ty unit of good 1 at period 1. Suppose that the government can engage in the credit market and save the tax revenue from period 1 to period 2; and at period 2, the government transfers the return of saving to households in a lump sum manner. The government makes no expenditure at either period 1 or period 2. Thus, let d2 denote the lump sum transfer made by the government, then the government's lifetime budget constraint satisfies de tici 1+r The households' budgent constraint can be expressed as (1+) e + 8 + e2 + d 1+1 = (1 + r)s + e +d2. C2 (a) (15%) Solve for the consumption (C1,C2) in the competitive equilibrium (b) (10%) Compare the consumption when t > 1 and when t1 = 0 the policy. Does Ricardian Equivalence hold under this policy? Exercise 2. [Consumption Tax and Ricardian Equivalence] (25%) Consider a two-period model with savings and intertemporal decisions. Households have utility function as follows: uC1,C2) = Inc + Inca There is a government which charges proportional tax on consumption from the household at period 1. That is, if the household consumes one unit of good 1, it has to pay the government ty unit of good 1 at period 1. Suppose that the government can engage in the credit market and save the tax revenue from period 1 to period 2; and at period 2, the government transfers the return of saving to households in a lump sum manner. The government makes no expenditure at either period 1 or period 2. Thus, let d2 denote the lump sum transfer made by the government, then the government's lifetime budget constraint satisfies de tici 1+r The households' budgent constraint can be expressed as (1+) e + 8 + e2 + d 1+1 = (1 + r)s + e +d2. C2 (a) (15%) Solve for the consumption (C1,C2) in the competitive equilibrium (b) (10%) Compare the consumption when t > 1 and when t1 = 0 the policy. Does Ricardian Equivalence hold under this policy Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started