Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is not NO ENTRY Required! ! Required information Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory system (LO6-8)

It is not NO ENTRY Required!

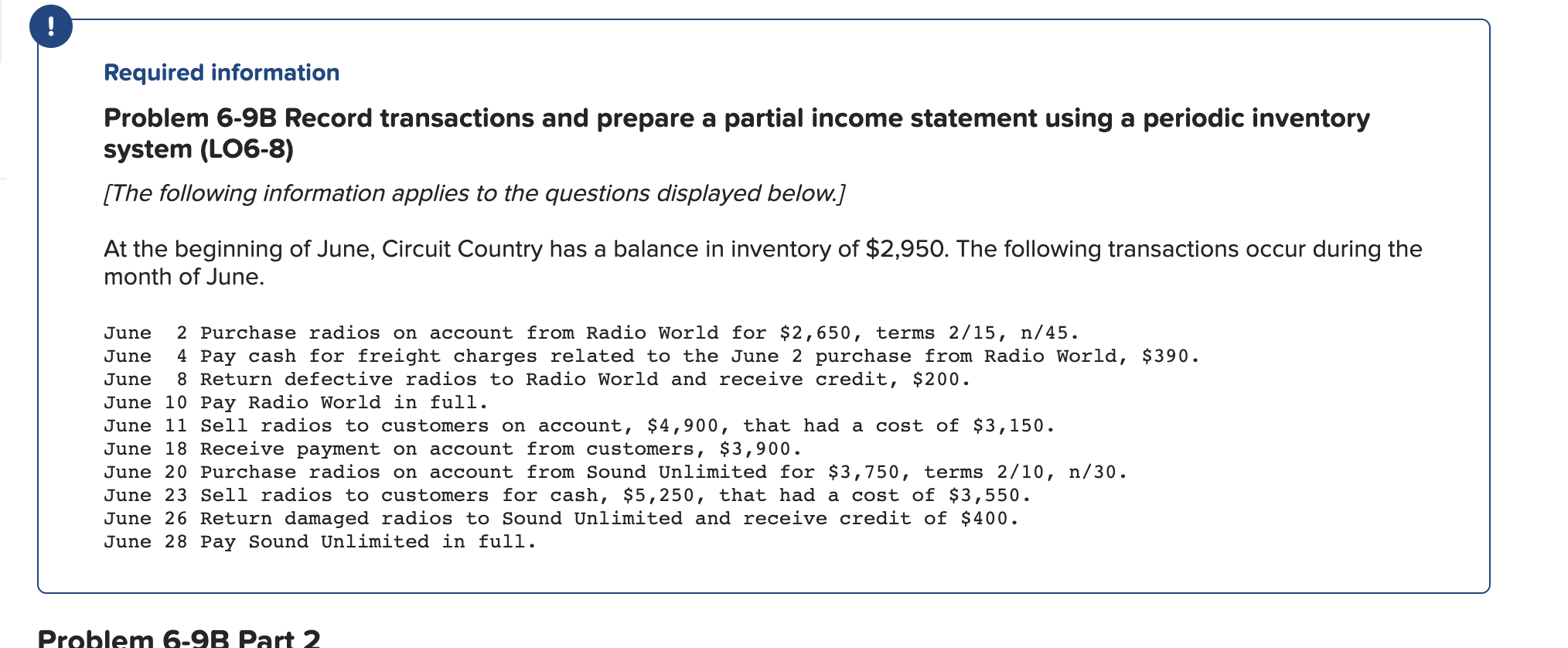

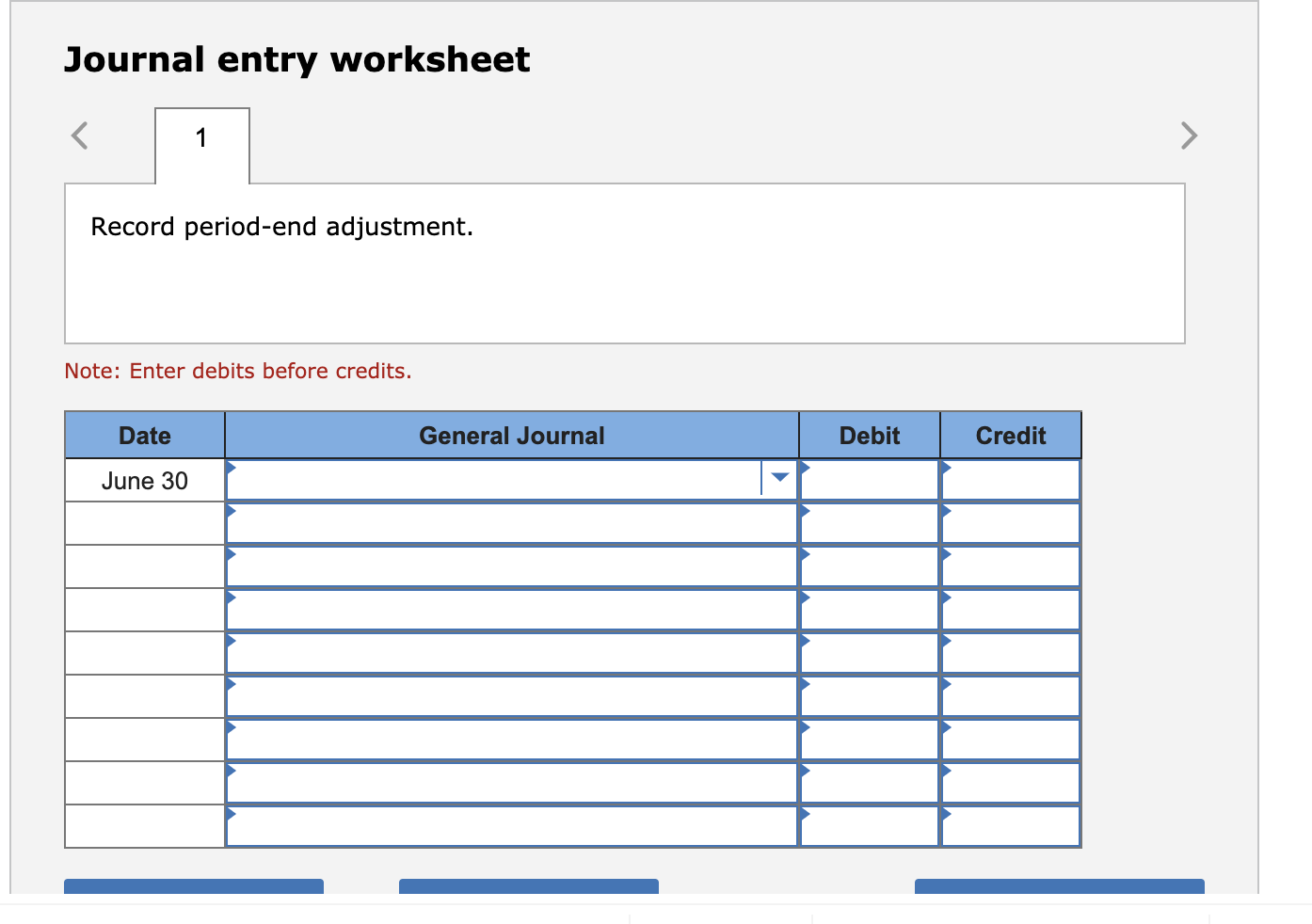

! Required information Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory system (LO6-8) [The following information applies to the questions displayed below.] At the beginning of June, Circuit Country has a balance in inventory of $2,950. The following transactions occur during the month of June. June 2 Purchase radios on account from Radio World for $2,650, terms 2/15, n/45. June 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $390. June 8 Return defective radios to Radio World and receive credit, $200. June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $4,900, that had a cost of $3,150. June 18 Receive payment on account from customers, $3,900. June 20 Purchase radios on account from Sound Unlimited for $3,750, terms 2/10, n/30. June 23 Sell radios to customers for cash, $5,250, that had a cost of $3,550. June 26 Return damaged radios to Sound Unlimited and receive credit of $400. June 28 Pay Sound Unlimited in full. Problem 6-9B Part 2 2. Record the month-end adjustment to inventory, assuming that a final count reveals ending inventory with a cost of $2,324. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 1 Record period-end adjustment. Note: Enter debits before credits. Date Gener Journal Debit Credit June 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started