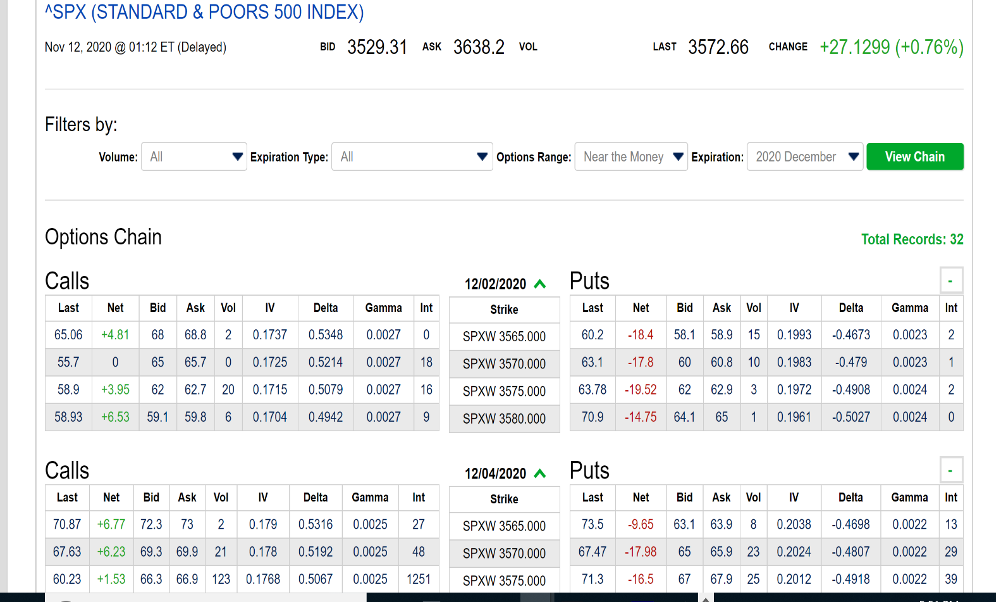

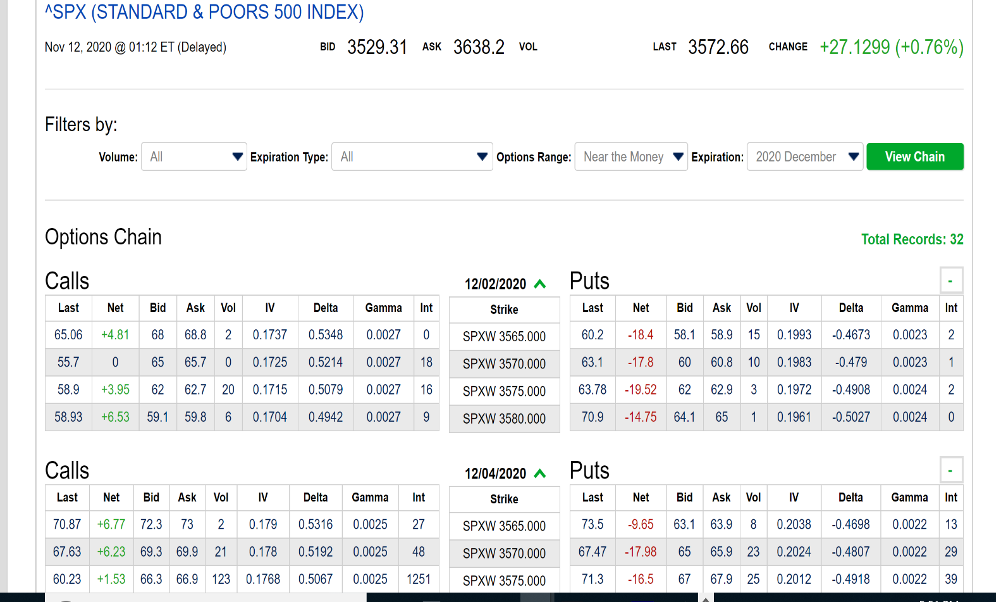

It is November 12th, 2020 and you are looking at the screen reported below. On a different screen (not shown) you see that the S&P500 dividend yield is 1.80% (per annum, continuously compounded) and that the USD Libor is at 0.1403% (also per annum and continuously compounded) Consider the 3575 December 4th. Call and Put. from the screenshot below. Your friend Howard Wolowitz, a well-known guru in the options market, tells you that over the life of the two options, the S&P500 will pay a cumulative dividend with a present value (as of today, November 12th.) of $9.0454

ASPX (STANDARD & POORS 500 INDEX) Nov 12, 2020 @ 01:12 ET (Delayed) BID 3529.31 ASK 3638.2 VOL LAST 3572.66 CHANGE +27.1299 (+0.76%) Filters by: Volume: All Expiration Type: All Options Range: Near the Money Expiration: 2020 December View Chain Options Chain Total Records: 32 Calls 12/02/2020 A Puts Last Net Bid Ask Vol IV Delta Strike Last Net Bid Ask Vol IV Delta Gamma Int Gamma Int 0.0027 0 65.06 +4.81 68 68.8 2 0.1737 0.5348 60.2 -18.4 58.1 58.9 15 0.1993 -0.4673 0.0023 2 SPXW 3565.000 SPXW 3570.000 55.7 0 65 65.7 0 0.1725 0.5214 63.1 -17.8 60 -0.479 0.0023 1 60.8 10 0.1983 62.9 3 0.1972 58.9 +3.95 62 62.7 20 0.1715 0.0027 18 0.0027 16 0.0027 9 0.5079 SPXW 3575.000 -0.4908 0.0024 2 63.78 -19.52 62 70.9 -14.75 64.1 58.93 +6.53 59.1 59.8 6 0.1704 0.4942 SPXW 3580.000 65 1 0.1961 -0.5027 0.0024 0 12/04/2020 Calls Last Puts Last Net Bid Ask Vol IV Delta Gamma Int Strike Net Bid Ask Vol IV Delta Gamma Int 27 SPXW 3565.000 73.5 -9.65 63.1 63.98 0.2038 -0.4698 0.0022 13 70.87 +6.77 72.3 73 2 0.179 0.5316 0.0025 67.63 +6.23 69.3 69.9 21 0.178 0.5192 0.0025 60.23 +1.53 66.3 66.9 123 0.1768 0.5067 0.0025 48 SPXW 3570.000 67.47 -17.98 65 65.923 0.2024 -0.4807 0.0022 29 1251 SPXW 3575.000 71.3 -16.5 67 67.9 25 0.2012 -0.4918 0.0022 39 ASPX (STANDARD & POORS 500 INDEX) Nov 12, 2020 @ 01:12 ET (Delayed) BID 3529.31 ASK 3638.2 VOL LAST 3572.66 CHANGE +27.1299 (+0.76%) Filters by: Volume: All Expiration Type: All Options Range: Near the Money Expiration: 2020 December View Chain Options Chain Total Records: 32 Calls 12/02/2020 A Puts Last Net Bid Ask Vol IV Delta Strike Last Net Bid Ask Vol IV Delta Gamma Int Gamma Int 0.0027 0 65.06 +4.81 68 68.8 2 0.1737 0.5348 60.2 -18.4 58.1 58.9 15 0.1993 -0.4673 0.0023 2 SPXW 3565.000 SPXW 3570.000 55.7 0 65 65.7 0 0.1725 0.5214 63.1 -17.8 60 -0.479 0.0023 1 60.8 10 0.1983 62.9 3 0.1972 58.9 +3.95 62 62.7 20 0.1715 0.0027 18 0.0027 16 0.0027 9 0.5079 SPXW 3575.000 -0.4908 0.0024 2 63.78 -19.52 62 70.9 -14.75 64.1 58.93 +6.53 59.1 59.8 6 0.1704 0.4942 SPXW 3580.000 65 1 0.1961 -0.5027 0.0024 0 12/04/2020 Calls Last Puts Last Net Bid Ask Vol IV Delta Gamma Int Strike Net Bid Ask Vol IV Delta Gamma Int 27 SPXW 3565.000 73.5 -9.65 63.1 63.98 0.2038 -0.4698 0.0022 13 70.87 +6.77 72.3 73 2 0.179 0.5316 0.0025 67.63 +6.23 69.3 69.9 21 0.178 0.5192 0.0025 60.23 +1.53 66.3 66.9 123 0.1768 0.5067 0.0025 48 SPXW 3570.000 67.47 -17.98 65 65.923 0.2024 -0.4807 0.0022 29 1251 SPXW 3575.000 71.3 -16.5 67 67.9 25 0.2012 -0.4918 0.0022 39