Question

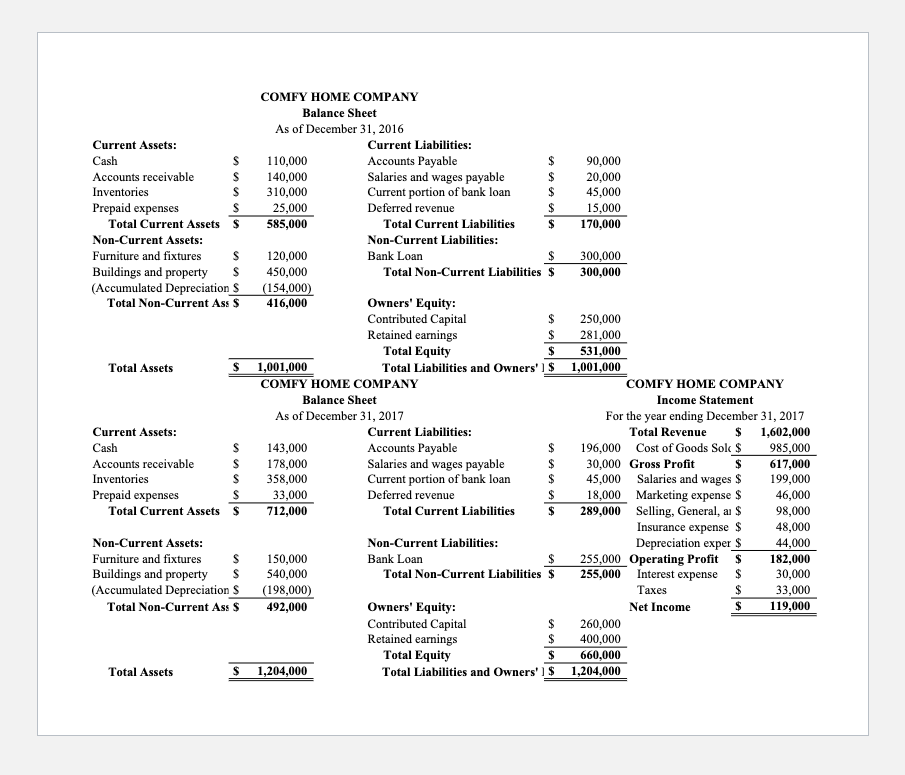

It is now January 2018. The year 2017 finished well. The finalized year-end financial statements for 2017 are provided in the excel file associated with

It is now January 2018. The year 2017 finished well. The finalized year-end financial statements for 2017 are provided in the excel file associated with this assignment.

Randolf and Tenisa at Comfy Home would like the accountant to prepare pro-forma financial statements for 2018 based on an optimistic sales forecast. Tenisa has won the business of a large corporate client and the couple believe that Comfy Home revenues will increase by 30% in 2018 as compared with the year 2017.

Using the actual financial statements for 2017 (in the excel file with this assignment), please prepare a pro-forma balance sheet and income statement for 2018 using the percent of sales method. For any financial statement line items where no additional information is provided to indicate otherwise, assume the line item changes proportionally to sales. Note: Please use excel formulas for all calculations and do not round any intermediate steps. If you round during intermediate steps, you may get rounding errors resulting in incorrect answers.

Randolf and Tenisa provide the following additional information to the accountant to prepare the pro-forma statements:

- No new investments in furniture and fixtures or buildings and property are expected for 2018.

- Of the $540,000 in building and properties at year-end 2017, $365,000 represents buildings and $175,000 represents property (land). The buildings are being depreciated straight-line over 10 years with no salvage value.

- The furniture and fixtures are being depreciated straight-line over 15 years with no salvage value.

- The $45,000 current portion of the bank loan will be paid on December 31, 2018. Of the $255,000 in long term debt, another $45,000 comes due on December 31, 2019.

- Comfy Home does not plan to obtain any additional loans in 2018.

- The interest rate for Comfy Homes borrowing has declined recently to 6%. It is expected to be the average rate of interest for Comfy Home short and long-term borrowings in 2018. Use total beginning borrowings to estimate the interest expense for 2018.

- Comfy Home's expected tax rate is 25%. Comfy Home has no outstanding deferred tax assets or deferred tax liabilities.

- Comfy Home is planning a $50,000 cash disbursement to its owners on 12/31/2018. No contributions to owners equity are foreseen.

- Comfy Homes insurance premium covers its buildings and property as well as liability and is not expected to increase in 2018.

- Use Cash as the plug in the pro-forma financial statements.

16. Comfy Home is considering investing in a new inventory management system. The system would cost $40,000 upfront. It will generate net cash flows of $3,300 per year for 15 years. Comfy Homes discount rate is 9%.

What is the net present value of this investment?

Use a spreadsheet to calculate your answer and round to the nearest whole dollar. If your answer is a negative number, please use the minus sign to represent negative numbers rather than parentheses. For instance, -1500 rather than (1500).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started