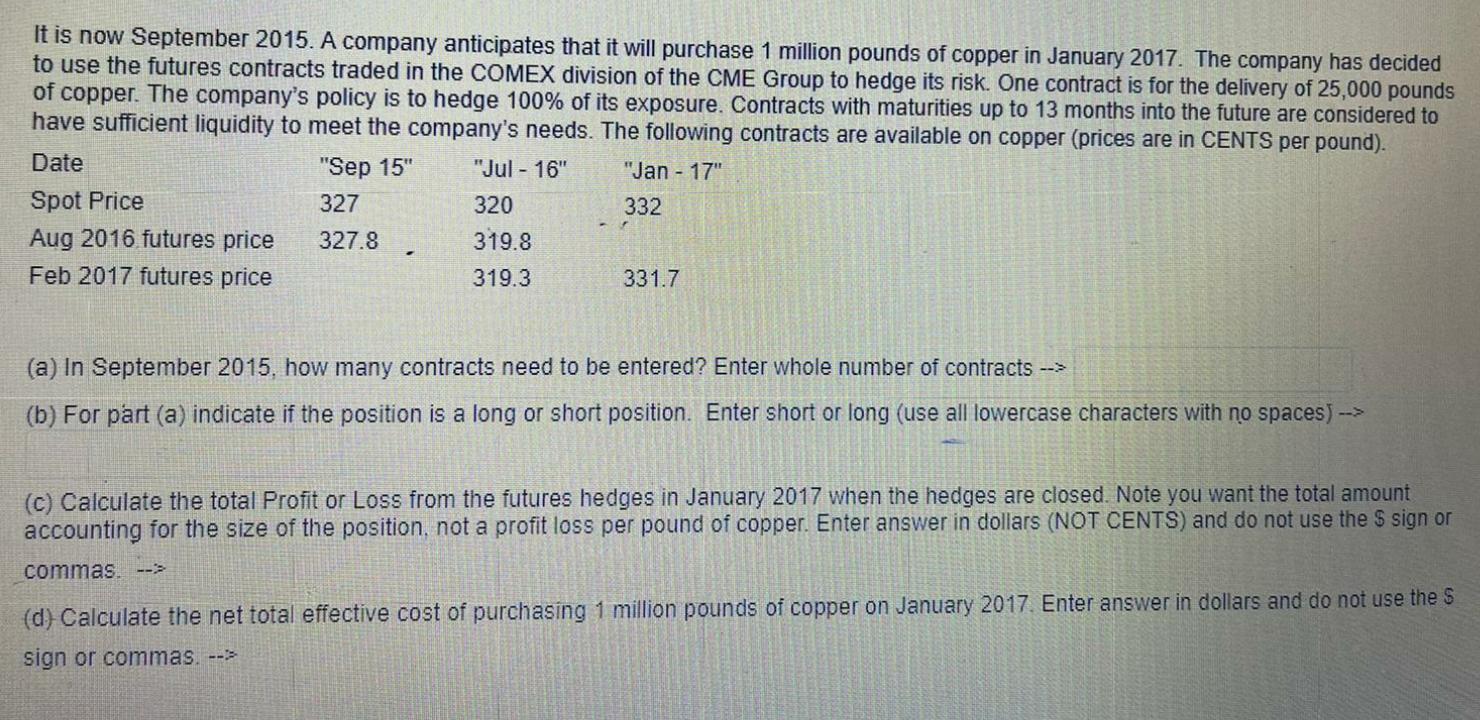

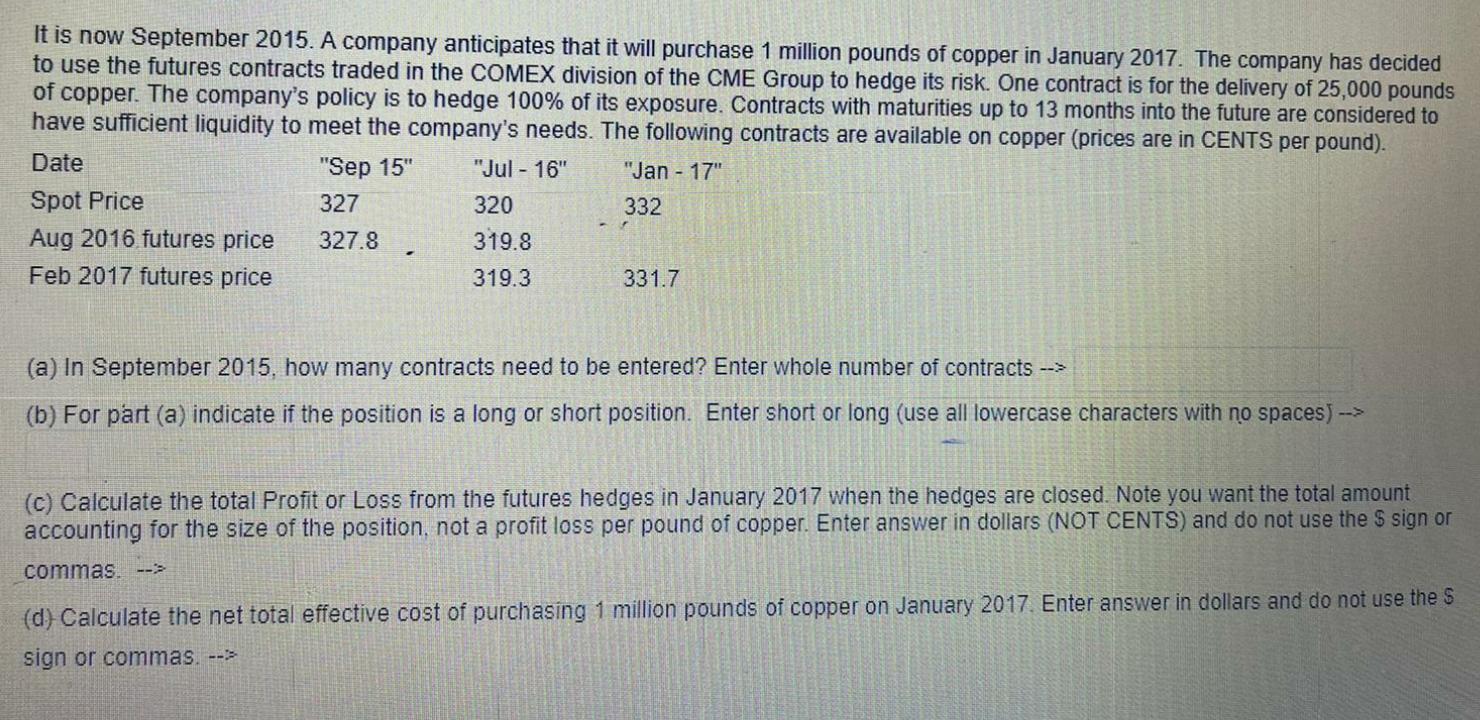

It is now September 2015. A company anticipates that it will purchase 1 million pounds of copper in January 2017. The company has decided to use the futures contracts traded in the COMEX division of the CME Group to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The company's policy is to hedge 100% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the company's needs. The following contracts are available on copper (prices are in CENTS per pound). Date "Sep 15" "Jul - 16" "Jan - 17" Spot Price 327 320 332 Aug 2016 futures price 327.8 319.8 Feb 2017 futures price 319.3 331.7 (a) In September 2015, how many contracts need to be entered? Enter whole number of contracts --> (b) For part (a) indicate if the position is a long or short position. Enter short or long (use all lowercase characters with no spaces) --> (c) Calculate the total Profit or Loss from the futures hedges in January 2017 when the hedges are closed. Note you want the total amount accounting for the size of the position, not a profit loss per pound of copper. Enter answer in dollars (NOT CENTS) and do not use the $ sign or commas. >>> (d) Calculate the net total effective cost of purchasing 1 million pounds of copper on January 2017. Enter answer in dollars and do not use the S sign or commas. -->> It is now September 2015. A company anticipates that it will purchase 1 million pounds of copper in January 2017. The company has decided to use the futures contracts traded in the COMEX division of the CME Group to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The company's policy is to hedge 100% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the company's needs. The following contracts are available on copper (prices are in CENTS per pound). Date "Sep 15" "Jul - 16" "Jan - 17" Spot Price 327 320 332 Aug 2016 futures price 327.8 319.8 Feb 2017 futures price 319.3 331.7 (a) In September 2015, how many contracts need to be entered? Enter whole number of contracts --> (b) For part (a) indicate if the position is a long or short position. Enter short or long (use all lowercase characters with no spaces) --> (c) Calculate the total Profit or Loss from the futures hedges in January 2017 when the hedges are closed. Note you want the total amount accounting for the size of the position, not a profit loss per pound of copper. Enter answer in dollars (NOT CENTS) and do not use the $ sign or commas. >>> (d) Calculate the net total effective cost of purchasing 1 million pounds of copper on January 2017. Enter answer in dollars and do not use the S sign or commas. -->>