Answered step by step

Verified Expert Solution

Question

1 Approved Answer

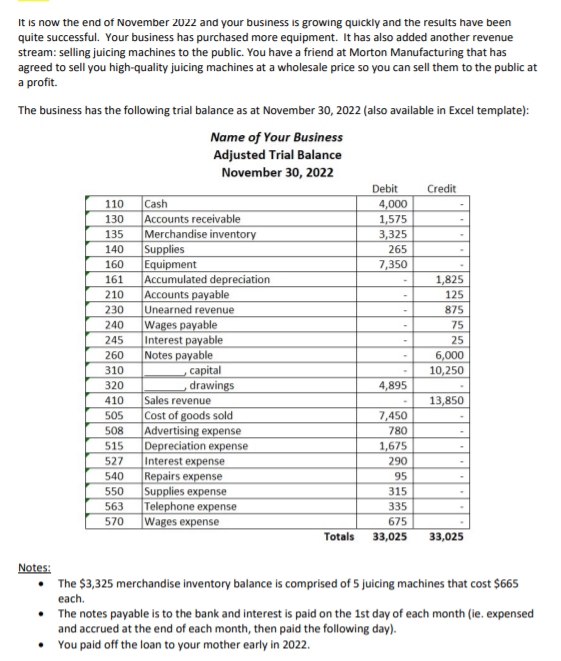

It is now the end of November 2022 and your business is growing quickly and the results have been quite successful. Your business has purchased

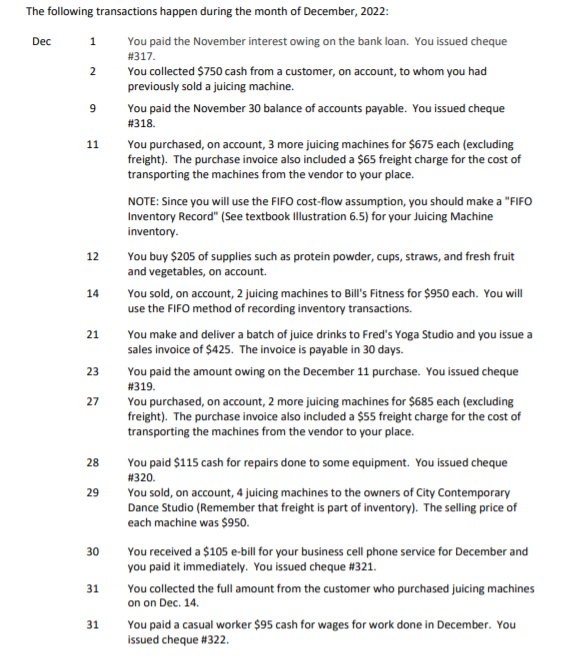

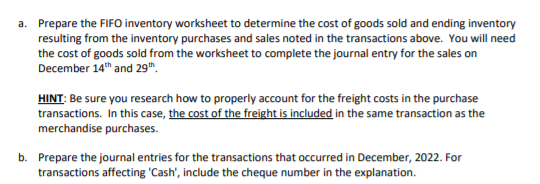

It is now the end of November 2022 and your business is growing quickly and the results have been quite successful. Your business has purchased more equipment. It has also added another revenue stream: selling juicing machines to the public. You have a friend at Morton Manufacturing that has agreed to sell you high-quality juicing machines at a wholesale price so you can sell them to the public at a profit. el - The business has the following trial balance as at November 30, 2022 (also available in Excel template): Name of Your Business Adjusted Trial Balance November 30, 2022 Debit Credit 110 Cash 4,000 130 Accounts receivable 1,575 135 Merchandise inventory 3,325 140 Supplies 265 160 Equipment 7,350 161 Accumulated depreciation 1,825 210 Accounts payable 125 230 Unearned revenue 875 240 Wages payable 75 245 Interest payable 25 Notes payable 6,000 310 capital 10,250 320 drawings 4,895 410 Sales revenue 13,850 505 Cost of goods sold 7,450 508 Advertising expense 780 515 Depreciation expense 1,675 527 Interest expense 290 540 Repairs expense 550 Supplies expense 315 563 Telephone expense 335 570 Wages expense 675 Totals 33,025 33,025 260 95 Notes: The $3,325 merchandise inventory balance is comprised of 5 juicing machines that cost $665 each. The notes payable is to the bank and interest is paid on the 1st day of each month (ie. expensed and accrued at the end of each month, then paid the following day). You paid off the loan to your mother early in 2022. 1 2 9 11 12 14 The following transactions happen during the month of December, 2022: Dec You paid the November interest owing on the bank loan. You issued cheque #317. You collected $750 cash from a customer, on account, to whom you had previously sold a juicing machine. You paid the November 30 balance of accounts payable. You issued cheque #318. You purchased, on account, 3 more juicing machines for $675 each (excluding freight). The purchase invoice also included a $65 freight charge for the cost of transporting the machines from the vendor to your place. NOTE: Since you will use the FIFO cost-flow assumption, you should make a "FIFO Inventory Record" (See textbook Illustration 6.5) for your Juicing Machine inventory. You buy $205 of supplies such as protein powder, cups, straws, and fresh fruit and vegetables, on account. You sold, on account, 2 juicing machines to Bill's Fitness for $950 each. You will use the FIFO method of recording inventory transactions. 21 You make and deliver a batch of juice drinks to Fred's Yoga Studio and you issue a sales invoice of $425. The invoice is payable in 30 days. You paid the amount owing on the December 11 purchase. You issued cheque #319. You purchased, on account, 2 more juicing machines for $685 each (excluding freight). The purchase invoice also included a $55 freight charge for the cost of transporting the machines from the vendor to your place. You paid $115 cash for repairs done to some equipment. You issued cheque #320. 29 You sold, on account, 4 juicing machines to the owners of City Contemporary Dance Studio (Remember that freight is part of inventory). The selling price of each machine was $950. 30 You received a $105 e-bill for your business cell phone service for December and you paid it immediately. You issued cheque #321. 31 You collected the full amount from the customer who purchased juicing machines on on Dec. 14. You paid a casual worker $95 cash for wages for work done in December. You issued cheque #322. 23 27 28 31 It is now the end of November 2022 and your business is growing quickly and the results have been quite successful. Your business has purchased more equipment. It has also added another revenue stream: selling juicing machines to the public. You have a friend at Morton Manufacturing that has agreed to sell you high-quality juicing machines at a wholesale price so you can sell them to the public at a profit. el - The business has the following trial balance as at November 30, 2022 (also available in Excel template): Name of Your Business Adjusted Trial Balance November 30, 2022 Debit Credit 110 Cash 4,000 130 Accounts receivable 1,575 135 Merchandise inventory 3,325 140 Supplies 265 160 Equipment 7,350 161 Accumulated depreciation 1,825 210 Accounts payable 125 230 Unearned revenue 875 240 Wages payable 75 245 Interest payable 25 Notes payable 6,000 310 capital 10,250 320 drawings 4,895 410 Sales revenue 13,850 505 Cost of goods sold 7,450 508 Advertising expense 780 515 Depreciation expense 1,675 527 Interest expense 290 540 Repairs expense 550 Supplies expense 315 563 Telephone expense 335 570 Wages expense 675 Totals 33,025 33,025 260 95 Notes: The $3,325 merchandise inventory balance is comprised of 5 juicing machines that cost $665 each. The notes payable is to the bank and interest is paid on the 1st day of each month (ie. expensed and accrued at the end of each month, then paid the following day). You paid off the loan to your mother early in 2022. 1 2 9 11 12 14 The following transactions happen during the month of December, 2022: Dec You paid the November interest owing on the bank loan. You issued cheque #317. You collected $750 cash from a customer, on account, to whom you had previously sold a juicing machine. You paid the November 30 balance of accounts payable. You issued cheque #318. You purchased, on account, 3 more juicing machines for $675 each (excluding freight). The purchase invoice also included a $65 freight charge for the cost of transporting the machines from the vendor to your place. NOTE: Since you will use the FIFO cost-flow assumption, you should make a "FIFO Inventory Record" (See textbook Illustration 6.5) for your Juicing Machine inventory. You buy $205 of supplies such as protein powder, cups, straws, and fresh fruit and vegetables, on account. You sold, on account, 2 juicing machines to Bill's Fitness for $950 each. You will use the FIFO method of recording inventory transactions. 21 You make and deliver a batch of juice drinks to Fred's Yoga Studio and you issue a sales invoice of $425. The invoice is payable in 30 days. You paid the amount owing on the December 11 purchase. You issued cheque #319. You purchased, on account, 2 more juicing machines for $685 each (excluding freight). The purchase invoice also included a $55 freight charge for the cost of transporting the machines from the vendor to your place. You paid $115 cash for repairs done to some equipment. You issued cheque #320. 29 You sold, on account, 4 juicing machines to the owners of City Contemporary Dance Studio (Remember that freight is part of inventory). The selling price of each machine was $950. 30 You received a $105 e-bill for your business cell phone service for December and you paid it immediately. You issued cheque #321. 31 You collected the full amount from the customer who purchased juicing machines on on Dec. 14. You paid a casual worker $95 cash for wages for work done in December. You issued cheque #322. 23 27 28 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started