Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is October 2020 and Anne has the good fortune of retiring at age 59 from Bell Canada with a full pension. Since her

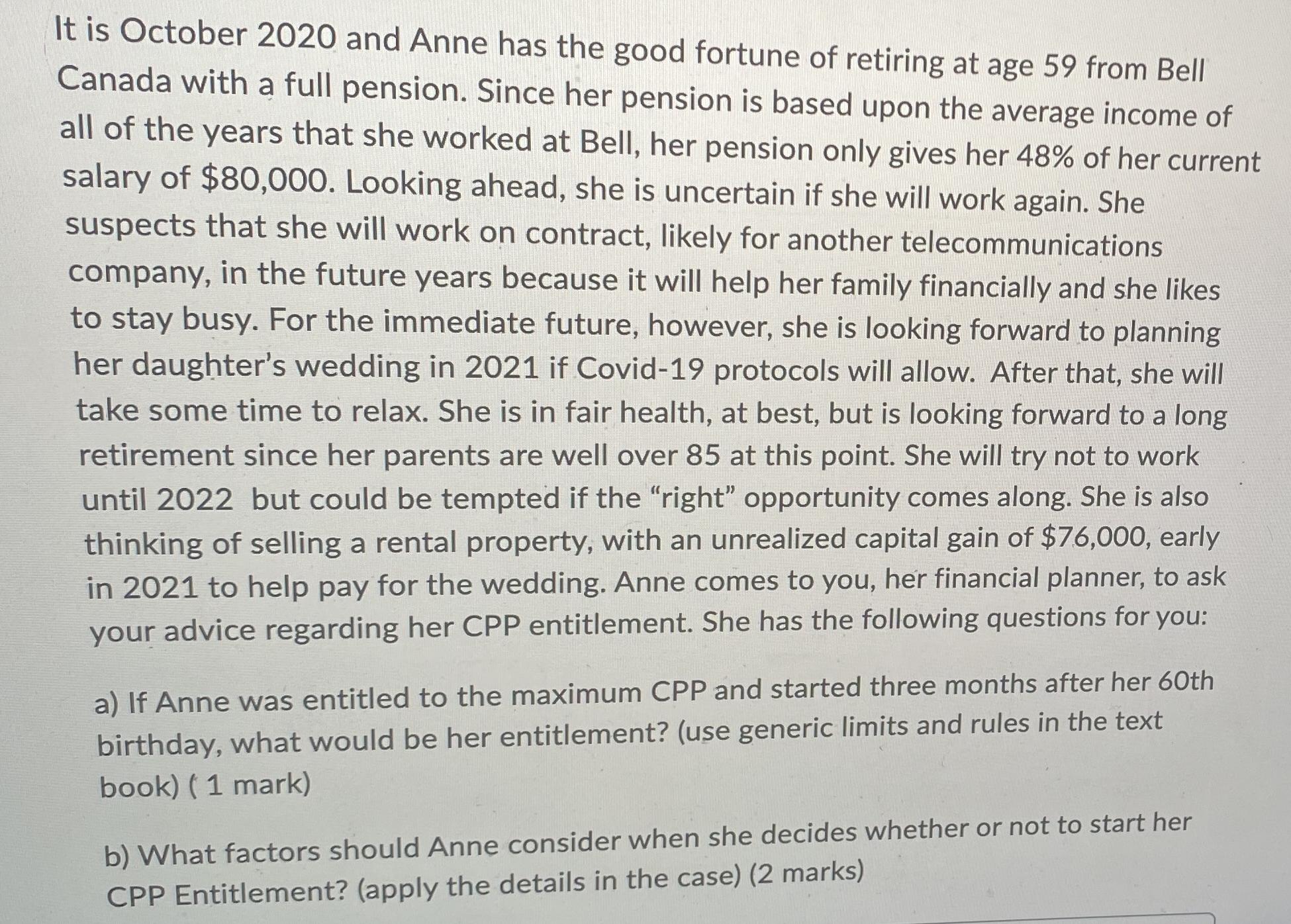

It is October 2020 and Anne has the good fortune of retiring at age 59 from Bell Canada with a full pension. Since her pension is based upon the average income of all of the years that she worked at Bell, her pension only gives her 48% of her current salary of $80,000. Looking ahead, she is uncertain if she will work again. She suspects that she will work on contract, likely for another telecommunications company, in the future years because it will help her family financially and she likes to stay busy. For the immediate future, however, she is looking forward to planning her daughter's wedding in 2021 if Covid-19 protocols will allow. After that, she will take some time to relax. She is in fair health, at best, but is looking forward to a long retirement since her parents are well over 85 at this point. She will try not to work until 2022 but could be tempted if the "right" opportunity comes along. She is also thinking of selling a rental property, with an unrealized capital gain of $76,000, early in 2021 to help pay for the wedding. Anne comes to you, her financial planner, to ask your advice regarding her CPP entitlement. She has the following questions for you: a) If Anne was entitled to the maximum CPP and started three months after her 60th birthday, what would be her entitlement? (use generic limits and rules in the text book) (1 mark) b) What factors should Anne consider when she decides whether or not to start her CPP Entitlement? (apply the details in the case) (2 marks)

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a If Anne was entitled to the maximum CPP and started three months after her 60th birthday her entit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started