Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#it is related to the tax Upon successfully obtaining the job, she commenced work on 1 May of the current FBT year and was provided

#it is related to the tax

#it is related to the tax

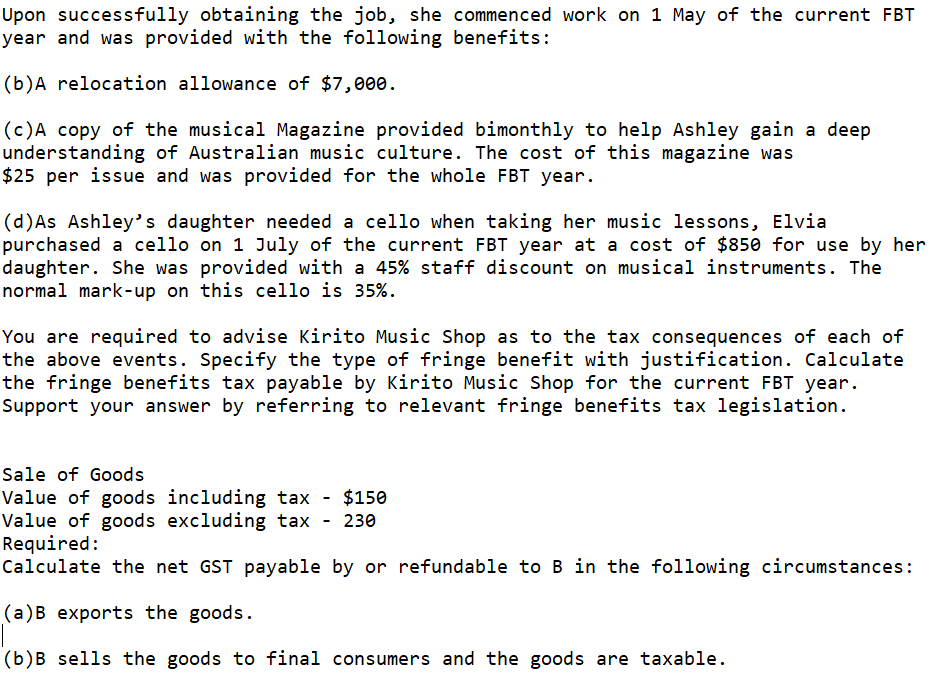

Upon successfully obtaining the job, she commenced work on 1 May of the current FBT year and was provided with the following benefits: (b) A relocation allowance of $7,000. (c)A copy of the musical Magazine provided bimonthly to help Ashley gain a deep understanding of Australian music culture. The cost of this magazine was $25 per issue and was provided for the whole FBT year. (d)As Ashley's daughter needed a cello when taking her music lessons, Elvia purchased a cello on 1 July of the current FBT year at a cost of $850 for use by her daughter. She was provided with a 45% staff discount on musical instruments. The normal mark-up on this cello is 35%. You are required to advise Kirito Music Shop as to the tax consequences of each of the above events. Specify the type of fringe benefit with justification. Calculate the fringe benefits tax payable by Kirito Music Shop for the current FBT year. Support your answer by referring to relevant fringe benefits tax legislation. Sale of Goods Value of goods including tax - $150 Value of goods excluding tax - 230 Required: Calculate the net GST payable by or refundable to B in the following circumstances: (a) exports the goods. (6)B sells the goods to final consumers and the goods are taxable. Upon successfully obtaining the job, she commenced work on 1 May of the current FBT year and was provided with the following benefits: (b) A relocation allowance of $7,000. (c)A copy of the musical Magazine provided bimonthly to help Ashley gain a deep understanding of Australian music culture. The cost of this magazine was $25 per issue and was provided for the whole FBT year. (d)As Ashley's daughter needed a cello when taking her music lessons, Elvia purchased a cello on 1 July of the current FBT year at a cost of $850 for use by her daughter. She was provided with a 45% staff discount on musical instruments. The normal mark-up on this cello is 35%. You are required to advise Kirito Music Shop as to the tax consequences of each of the above events. Specify the type of fringe benefit with justification. Calculate the fringe benefits tax payable by Kirito Music Shop for the current FBT year. Support your answer by referring to relevant fringe benefits tax legislation. Sale of Goods Value of goods including tax - $150 Value of goods excluding tax - 230 Required: Calculate the net GST payable by or refundable to B in the following circumstances: (a) exports the goods. (6)B sells the goods to final consumers and the goods are taxable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started