Question

It is relatively easy to find up-to-date information on banks because of their extensive reporting requirements. Go to the FDIC Quarterly Banking Profile site. This

It is relatively easy to find up-to-date information on banks because of their extensive reporting requirements.

Go to the FDIC Quarterly Banking Profile site.

This site is sponsored by the Federal Deposit Insurance Corporation (FDIC).

You will find summary data on financial institutions. Go to the most recent Quarterly Banking Profile (Access QBP).

Locate All FDIC- Insured Institutions Section. Click on Chart 1

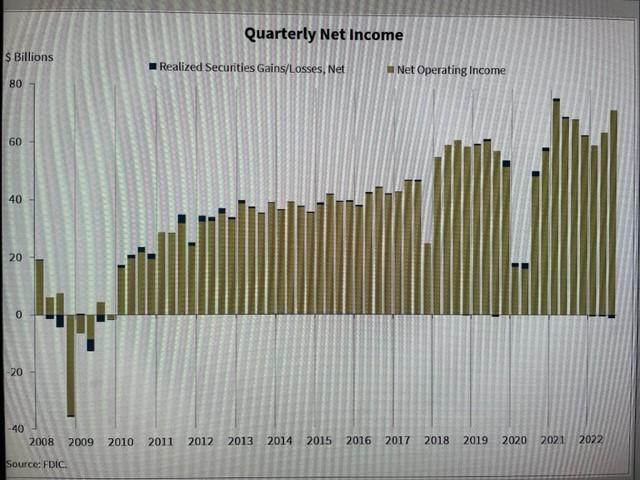

Have banks' quarterly net income increasing or decreasing over the last 3 years? Why do you think this is happening?

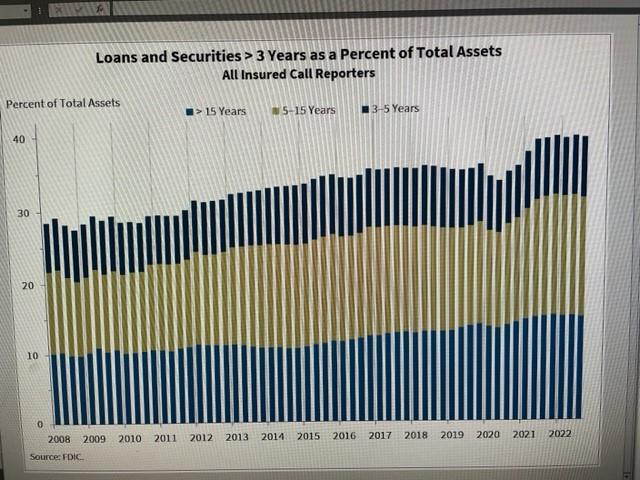

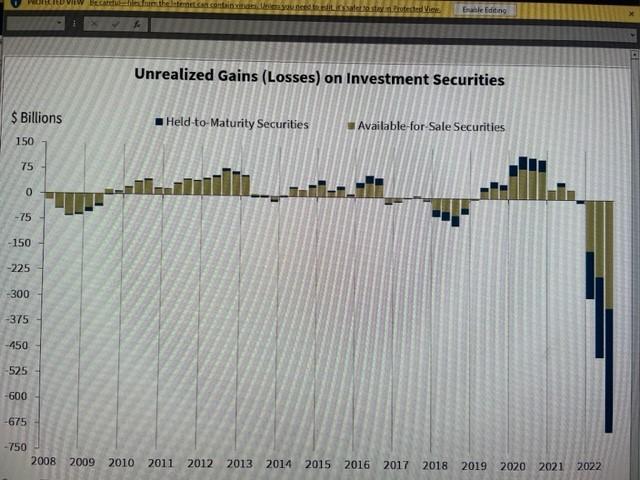

Click on Loans and Securities and discuss the trends you observe on these as a percentage of total assets. Has the core capital been increasing? Why do you think?

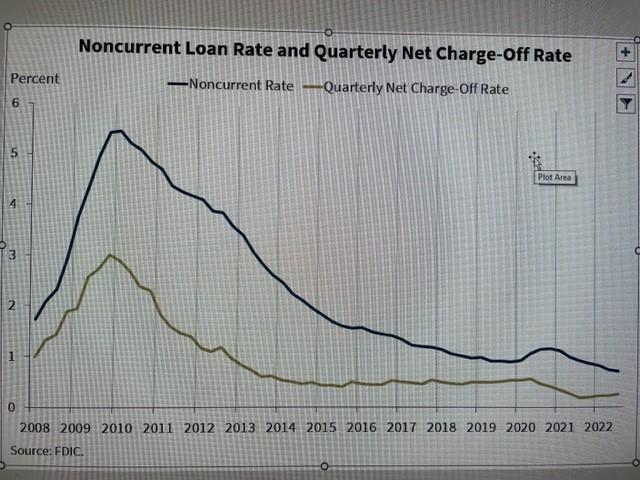

Click on Chart 6 and report what trends you are seeing about the change in loan balances. Financial institutions make money in three primary ways: fees, investments, and loans. With the recent trend in loans, what impact will this have on the finances of the financial institutions, and do you think this is a short-term trend or not?

Click on Chart 7 and report what trends you are seeing about the change in deposits. Explain the recent upward trends.

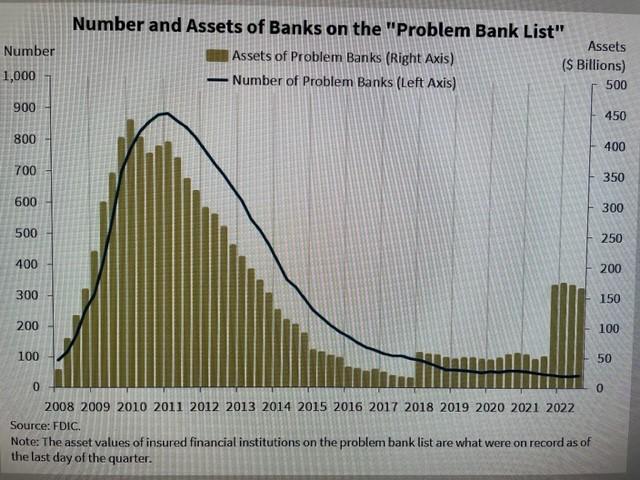

Click on Chart 8 and report what trends you are seeing about the number and assets of Problem Banks. Do you have any ideas on what may be causing the uptick?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started