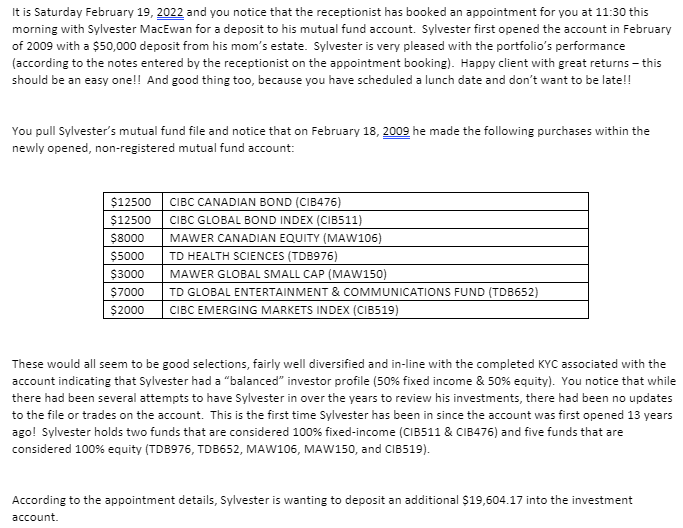

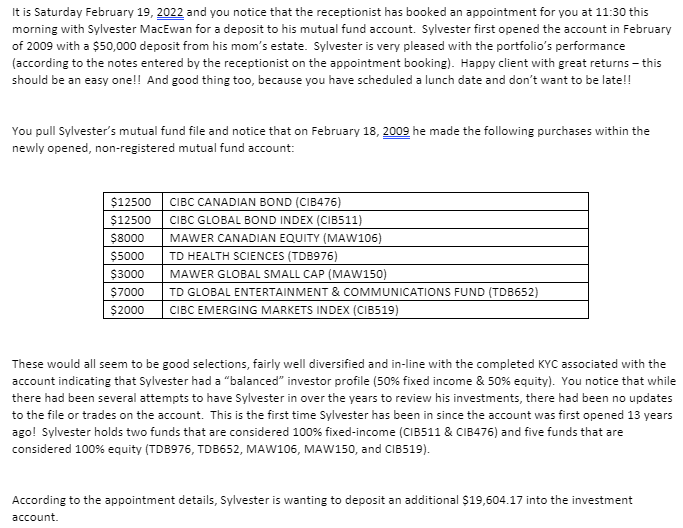

It is Saturday February 19, 2022 and you notice that the receptionist has booked an appointment for you at 11:30 this morning with Sylvester MacEwan for a deposit to his mutual fund account. Sylvester first opened the account in February of 2009 with a $50,000 deposit from his mom's estate. Sylvester is very pleased with the portfolio's performance (according to the notes entered by the receptionist on the appointment booking). Happy client with great returns - this should be an easy one!! And good thing too, because you have scheduled a lunch date and don't want to be late!! You pull Sylvester's mutual fund file and notice that on February 18, 2009 he made the following purchases within the newly opened, non-registered mutual fund account: $12500 $12500 $8000 $5000 $3000 $7000 $2000 CIBC CANADIAN BOND (CIB476) CIBC GLOBAL BOND INDEX (C1B511) MAWER CANADIAN EQUITY (MAW106) TD HEALTH SCIENCES (TDB976) MAWER GLOBAL SMALL CAP (MAW150) TD GLOBAL ENTERTAINMENT & COMMUNICATIONS FUND (TDB652) CIBC EMERGING MARKETS INDEX (C18519) These would all seem to be good selections, fairly well diversified and in-line with the completed KYC associated with the account indicating that Sylvester had a "balanced" investor profile (50% fixed income & 50% equity). You notice that while there had been several attempts to have Sylvester in over the years to review his investments, there had been no updates to the file or trades on the account. This is the first time Sylvester has been in since the account was first opened 13 years ago! Sylvester holds two funds that are considered 100% fixed-income (C1B511 & CIB476) and five funds that are considered 100% equity (TDB976, TD1652, MAW106, MAW150, and C1B519). According to the appointment details, Sylvester is wanting to deposit an additional $19,504.17 into the investment account 2. Under a separate calculation, compute the annually compounded return for the portfolio as a whole (2 marks) ** (USE CONVENTIONAL ROUNDING RULES TO 2 DECIMAL PLACES FOR % RATE OF RETURN) 5. Determine the overall portfolio's current Fixed Income / Equity asset mix (2 marks) ** (USE CONVENTIONAL ROUNDING RULES TO 2 DECIMAL PLACES FOR ASSET MIX) It is Saturday February 19, 2022 and you notice that the receptionist has booked an appointment for you at 11:30 this morning with Sylvester MacEwan for a deposit to his mutual fund account. Sylvester first opened the account in February of 2009 with a $50,000 deposit from his mom's estate. Sylvester is very pleased with the portfolio's performance (according to the notes entered by the receptionist on the appointment booking). Happy client with great returns - this should be an easy one!! And good thing too, because you have scheduled a lunch date and don't want to be late!! You pull Sylvester's mutual fund file and notice that on February 18, 2009 he made the following purchases within the newly opened, non-registered mutual fund account: $12500 $12500 $8000 $5000 $3000 $7000 $2000 CIBC CANADIAN BOND (CIB476) CIBC GLOBAL BOND INDEX (C1B511) MAWER CANADIAN EQUITY (MAW106) TD HEALTH SCIENCES (TDB976) MAWER GLOBAL SMALL CAP (MAW150) TD GLOBAL ENTERTAINMENT & COMMUNICATIONS FUND (TDB652) CIBC EMERGING MARKETS INDEX (C18519) These would all seem to be good selections, fairly well diversified and in-line with the completed KYC associated with the account indicating that Sylvester had a "balanced" investor profile (50% fixed income & 50% equity). You notice that while there had been several attempts to have Sylvester in over the years to review his investments, there had been no updates to the file or trades on the account. This is the first time Sylvester has been in since the account was first opened 13 years ago! Sylvester holds two funds that are considered 100% fixed-income (C1B511 & CIB476) and five funds that are considered 100% equity (TDB976, TD1652, MAW106, MAW150, and C1B519). According to the appointment details, Sylvester is wanting to deposit an additional $19,504.17 into the investment account 2. Under a separate calculation, compute the annually compounded return for the portfolio as a whole (2 marks) ** (USE CONVENTIONAL ROUNDING RULES TO 2 DECIMAL PLACES FOR % RATE OF RETURN) 5. Determine the overall portfolio's current Fixed Income / Equity asset mix (2 marks) ** (USE CONVENTIONAL ROUNDING RULES TO 2 DECIMAL PLACES FOR ASSET MIX)