Question

It is September 2020. You currently own 20,000 shares of Exxon (XOM) at a price of $40 per share. In three months, you expect to

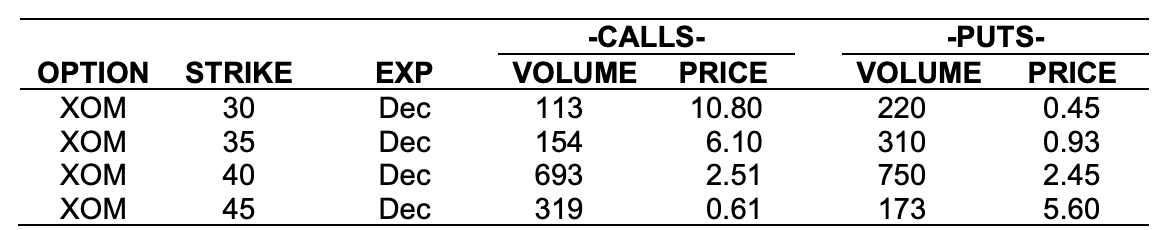

It is September 2020. You currently own 20,000 shares of Exxon (XOM) at a price of $40 per share. In three months, you expect to buy a house and plan to sell your XOM shares to make the down payment of $700,000. You believe XOM is a good investment and want to hold the shares until December. At the same time, you recognize that XOM is risky and want to make sure that your shares will be worth at least $700,000. The following table provides quotations on XOM options. Assume that you can transact at these prices. Furthermore, for simplicitys sake, suppose you have enough cash from other sources to cover the cost of any options (i.e., you dont sell shares to pay for the options). These options expire in December right before you need to sell your shares. Prices are quoted per share, but 1 option contract is for 100 shares.

a) Suppose the stock price in 3 months is $25, $35, or $45. For each price scenario, how much is your portfolio worth in 3 months if you do not hedge (hold only the stock and do not trade options)?

b) What rate of return do you realize in each scenario?

c) Suppose you buy 200 contracts of the X=35 put covering 20,000 shares. For each of the three price scenarios in part

i) How much is your portfolio worth in 3 months (what is the value of your shares plus the payoff from the options)?

ii) What rate of return do you realize in each price scenario if you hedge

iii) How does it compare with the rates of return in (a)?

iv) Does this strategy accomplish your goal? [To calculate the return, use the current value of your portfolio in the denominator, which equals $800,000 ($4020,000) plus the cost of options you buy. Think of the denominator as your total expenditures assuming you use outside cash to purchase the options.]

OPTION XOM XOM XOM XOM STRIKE 30 35 40 45 EXP Dec Dec Dec Dec -CALLS- VOLUME PRICE 113 10.80 154 6.10 693 2.51 319 0.61 -PUTS- VOLUME PRICE 220 0.45 310 0.93 750 2.45 173 5.60 OPTION XOM XOM XOM XOM STRIKE 30 35 40 45 EXP Dec Dec Dec Dec -CALLS- VOLUME PRICE 113 10.80 154 6.10 693 2.51 319 0.61 -PUTS- VOLUME PRICE 220 0.45 310 0.93 750 2.45 173 5.60Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started