Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is the end of 2 0 2 4 and the Frozen Donair Company has expanded and grown in the past year now producing several

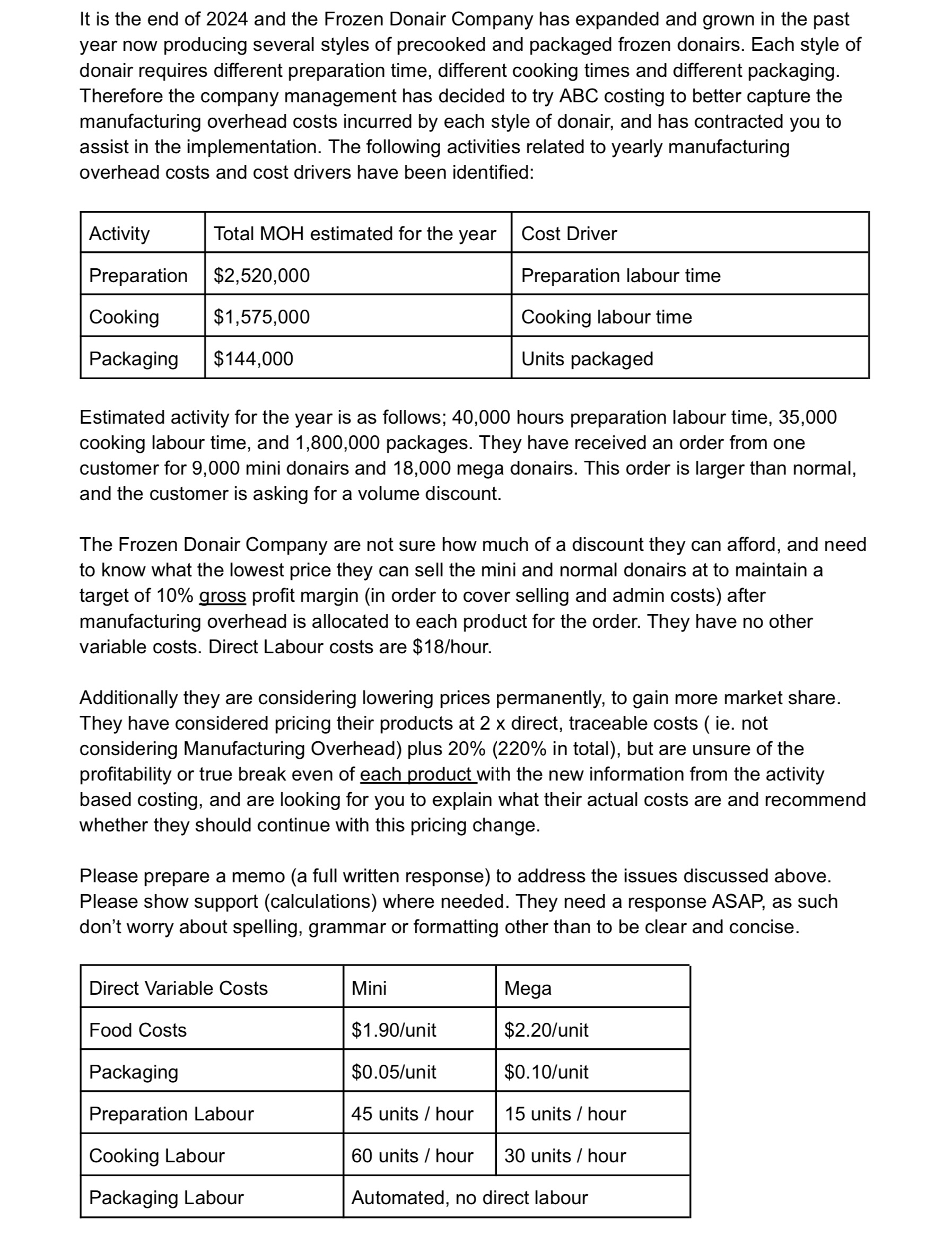

It is the end of and the Frozen Donair Company has expanded and grown in the past

year now producing several styles of precooked and packaged frozen donairs. Each style of

donair requires different preparation time, different cooking times and different packaging.

Therefore the company management has decided to try ABC costing to better capture the

manufacturing overhead costs incurred by each style of donair, and has contracted you to

assist in the implementation. The following activities related to yearly manufacturing

overhead costs and cost drivers have been identified:

Estimated activity for the year is as follows; hours preparation labour time,

cooking labour time, and packages. They have received an order from one

customer for mini donairs and mega donairs. This order is larger than normal,

and the customer is asking for a volume discount.

The Frozen Donair Company are not sure how much of a discount they can afford, and need

to know what the lowest price they can sell the mini and normal donairs at to maintain a

target of gross profit margin in order to cover selling and admin costs after

manufacturing overhead is allocated to each product for the order. They have no other

variable costs. Direct Labour costs are $ hour.

Additionally they are considering lowering prices permanently, to gain more market share.

They have considered pricing their products at direct, traceable costs ie not

considering Manufacturing Overhead plus in total but are unsure of the

profitability or true break even of each product with the new information from the activity

based costing, and are looking for you to explain what their actual costs are and recommend

whether they should continue with this pricing change.

Please prepare a memo a full written response to address the issues discussed above.

Please show support calculations where needed. They need a response ASAP, as such

don't worry about spelling, grammar or formatting other than to be clear and concise.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started