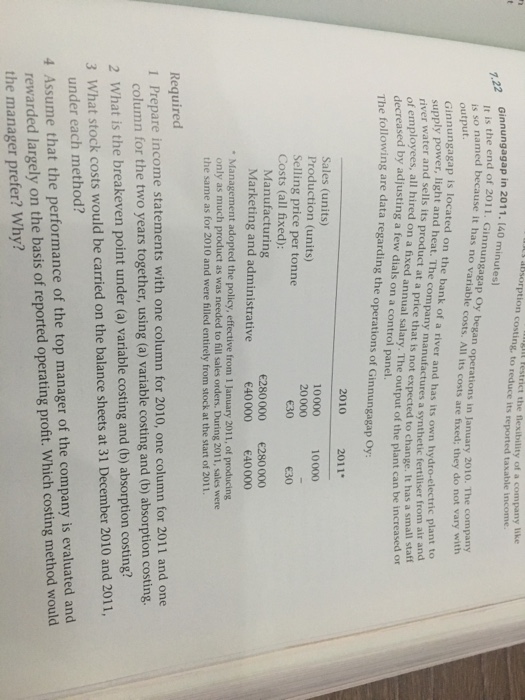

It is the end of 2011. Ginnungagap Oy began operations in January 2010. The company is so named becausy it has no variable costs. All its costs are fixed; they do not vary with output. Ginnungagap is located on the bank of a river and has its own hydro-electric plant to supply power, light and heat. The company manufactures a synthetic fertiliser from air and river water and sells its product at a price that is not expected to change. It has a small staff of employees, all hired on a fixed annual salary. The output of the plant can be increased or decreased by adusting a few dials on a control panel. The following are data regarding the operations of Ginnungagap Oy: Required 1 prepare income statements with one column for 2010, one column for 2011, and one column for the two years together, using (a) variable costing and (b) absorption costing. 2 What is the breakeven point under (a) variable costing and (b) absorption costing? 3 What stock costs would be carried on the balance sheets at 31 December 2010 and 2011, under each method? 4 Assume that the performance of the top manager of the company is evaluated and rewarded largely on the basis of reported operating profit. Which costing method would the manager prefer? Why? It is the end of 2011. Ginnungagap Oy began operations in January 2010. The company is so named becausy it has no variable costs. All its costs are fixed; they do not vary with output. Ginnungagap is located on the bank of a river and has its own hydro-electric plant to supply power, light and heat. The company manufactures a synthetic fertiliser from air and river water and sells its product at a price that is not expected to change. It has a small staff of employees, all hired on a fixed annual salary. The output of the plant can be increased or decreased by adusting a few dials on a control panel. The following are data regarding the operations of Ginnungagap Oy: Required 1 prepare income statements with one column for 2010, one column for 2011, and one column for the two years together, using (a) variable costing and (b) absorption costing. 2 What is the breakeven point under (a) variable costing and (b) absorption costing? 3 What stock costs would be carried on the balance sheets at 31 December 2010 and 2011, under each method? 4 Assume that the performance of the top manager of the company is evaluated and rewarded largely on the basis of reported operating profit. Which costing method would the manager prefer? Why