Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is the end of 2021. The following partial spreadsheet has financial information needed for a capital budgeting project. Cash flows have been carefully forecasted

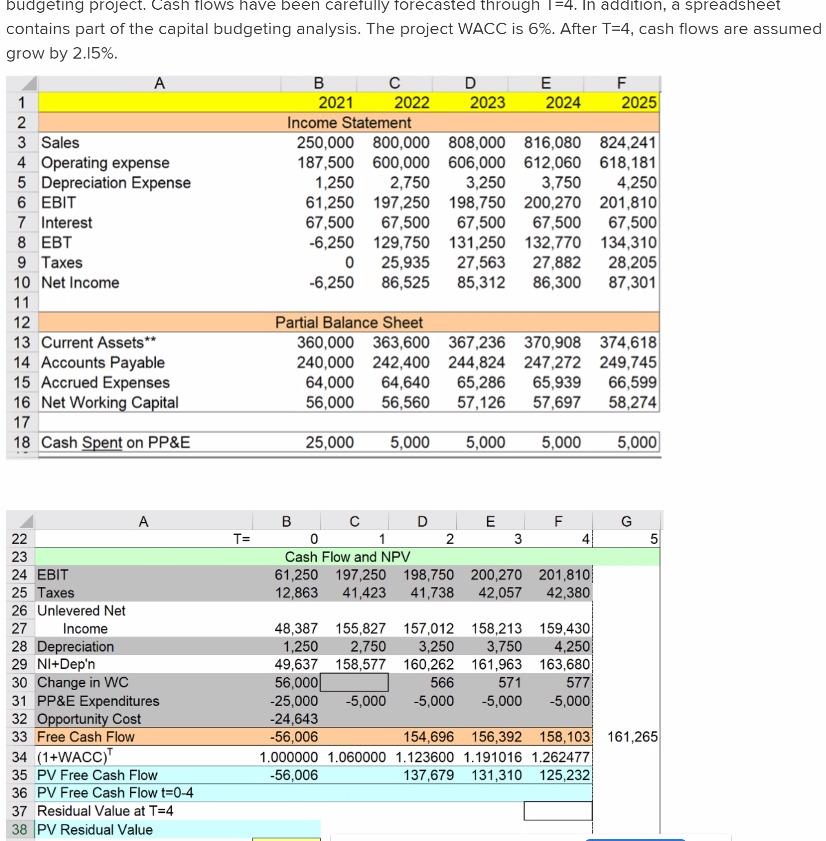

It is the end of 2021. The following partial spreadsheet has financial information needed for a capital budgeting project. Cash flows have been carefully forecasted through T=4. In addition, a spreadsheet contains part of the capital budgeting analysis. The project WACC is 6%. After T=4, cash flows are assumed to grow by 2.15%

What is the correct formula for cell C30?

What is the correct formula for cell F37?

budgeting project. Cash flows have been carefully forecasted through 1=4. In addition, a spreadsheet contains part of the capital budgeting analysis. The project WACC is 6%. After T=4, cash flows are assumed grow by 2.15%. A B D E F 1 2021 2022 2023 2024 2025 2 Income Statement 3 Sales 250,000 800,000 808,000 816,080 824,241 4 Operating expense 187,500 600,000 606,000 612,060 618,181 5 Depreciation Expense 1,250 2,750 3,250 3,750 4,250 6 EBIT 61,250 197,250 198,750 200,270 201,810 7 Interest 67,500 67,500 67,500 67,500 67,500 8 -6,250 129,750 131,250 132,770 134,310 9 Taxes 0 25,935 27,563 27,882 28,205 10 Net Income -6,250 86,525 85,312 86,300 87,301 11 12 Partial Balance Sheet 13 Current Assets ** 360,000 363,600 367,236 370,908 374,618 14 Accounts Payable 240,000 242,400 244,824 247,272 249,745 15 Accrued Expenses 64,000 64,640 65,286 65,939 66,599 16 Net Working Capital 56,000 56,560 57,126 57,697 58,274 17 18 Cash Spent on PP&E 25,000 5,000 5,000 5,000 5,000 G T= 5 5 B C D E F 0 1 2 3 4 Cash Flow and NPV 61,250 197,250 198,750 200,270 201,810 12,863 41,423 41,738 42,057 42,380 A 22 23 24 EBIT 25 Taxes 26 Unlevered Net 27 Income 28 Depreciation 29 NI+Dep'n 30 Change in WC 31 PP&E Expenditures 32 Opportunity Cost 33 Free Cash Flow 34 (1+WACC) 35 PV Free Cash Flow 36 PV Free Cash Flow t=0-4 37 Residual Value at T=4 38 PV Residual Value 48,387 155,827 157,012 158,213 159,430 1,250 2,750 3,250 3,750 4,250 49,637 158,577 160,262 161,963 163,680 56,000 566 571 577 -25,000 -5,000 -5,000 -5,000 -5,000 -24,643 -56,006 154,696 156,392 158,103 161,265 1.000000 1.060000 1.123600 1.191016 1.262477 -56,006 137,679 131,310 125,232Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started