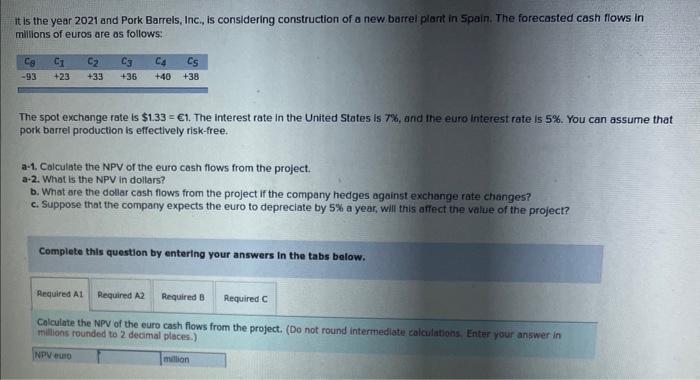

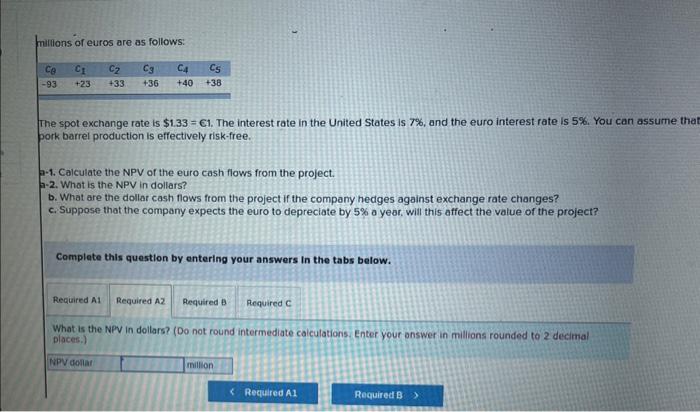

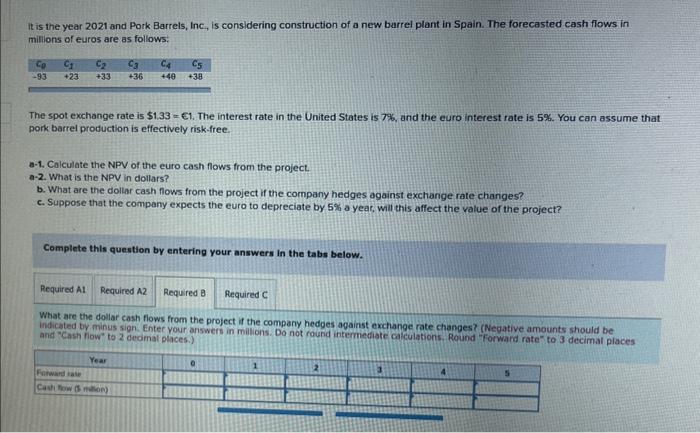

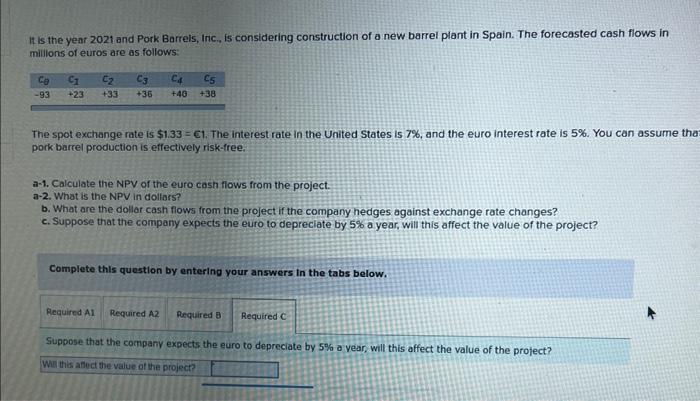

it is the year 2021 and Pork Barrels, Inc, is considering construction of a new barrel plant in Spain. The forecasted cash flows in mililions of euros are as follows: The spot exchange rate is $1.33=61. The interest rate in the United States is 7%, and the euro interest rate is 5%. You can assume that pork barrel production is effectlvely risk-free. a-1. Calculate the NPV of the euro cash flows from the project. a-2. What is the NPV in dollars? b. What are the dollar cash flows from the project if the company hedges against exchange rate changes? c. Suppose that the company expects the euro to depreciate by 5% a year, will this affect the value of the project? Complete this question by entering your answers in the tabs below. Colculate the NPV of the euro cash flows from the project. (Do not round intermedlate colculations. Enter your answer in millions rounded to 2 decimal places.) millions of euros are as follows: The spot exchange rate is $1.33=61. The interest rate in the United States is 7%, and the euro interest rate is 5%. You can assume th pork barrel production is effectively risk-free. 2-1. Calculate the NPV of the euro cash flows from the project. 2-2. What is the NPV in dollars? b. What are the dollar cash flows from the project if the company hedges against exchange rate changes? c. Suppose that the company expects the euro to depreciate by 5% a year, will this affect the value of the project? Complete this question by entering your answers in the tabs below. What is the NPV in dollars? (Do not round intermediate caiculations. Enter your answer in millions rounded to 2 decimal phaces.) places.) It is the year 2021 and Pork Barrels, Inc, is considering construction of a new barrel plant in Spain. The forecasted cash flows in milions of euros are as follows: The spot exchange rate is $1.33=61. The interest rate in the United States is 7%, and the euro interest rate is 5%. You can assume that pork barrel production is effectively risk-free. a-1. Calculate the NPV of the euro cash flows from the project. a-2. What is the NPV in dollars? b. What are the dollar cash flows from the project if the company hedges against exchange rate changes? c. Suppose that the company expects the euro to depreciate by 5% a year, will this affect the value of the project? Complete this question by entering your answers in the tabs below. What are the dollar cosh flows from the project if the company hedges against exchange rate changes? (Negative amounts should be indicated by minus sign. Enter your answers in millions. Do not found intermediate calculations. Round "Forward rate" to 3 decimal places and "Cash fow" to 2 dedimal places.) It is the year 2021 and Pork Barrels, Inc., is considering construction of a new barrel plant in Spain. The forecasted cash fiows in millions of euros are as follows: The spot exchange rate is $1.33=61. The interest rate in the United States is 7%, and the euro interest rate is 5%. You can assume pork barrel production is effectively risk-free. a-1. Calculate the NPV of the euro cash flows from the project. a-2. What is the NPV in dollars? b. What are the dollar cash flows from the project if the company hedges against exchange rate changes? c. Suppose that the company expects the euro to depreciate by 5% a year, will this affect the value of the project? Complete this question by entering your answers in the tabs below. Suppose that the company expects the euro to depreciate by 5% o vear, will this affect the value of the project