Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is US tax law (Short Answer 3 points possible): Aspen Inc., a calendar year accrual method taxpayer, paid $1,339,000 for new machinery (seven-year recovery

it is US tax law

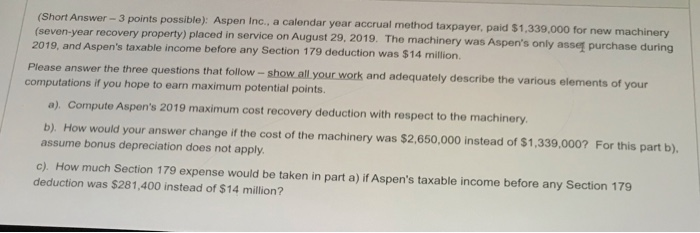

(Short Answer 3 points possible): Aspen Inc., a calendar year accrual method taxpayer, paid $1,339,000 for new machinery (seven-year recovery property) placed in service on August 29, 2019. The machinery was Aspen's only asser purchase during 2019, and Aspen's taxable income before any Section 179 deduction was $14 million. Please answer the three questions that follow - show all your work and adequately describe the various elements of your computations if you hope to earn maximum potential points. a). Compute Aspen's 2019 maximum cost recovery deduction with respect to the machinery, b). How would your answer change if the cost of the machinery was $2,650,000 instead of $1,339,000? For this part b). assume bonus depreciation does not apply. c). How much Section 179 expense would be taken in part a) if Aspen's taxable income before any Section 179 deduction was $281,400 instead of $14 million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started