Answered step by step

Verified Expert Solution

Question

1 Approved Answer

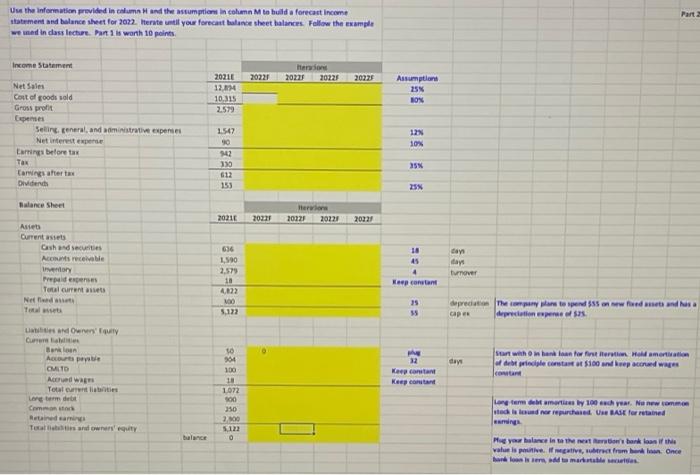

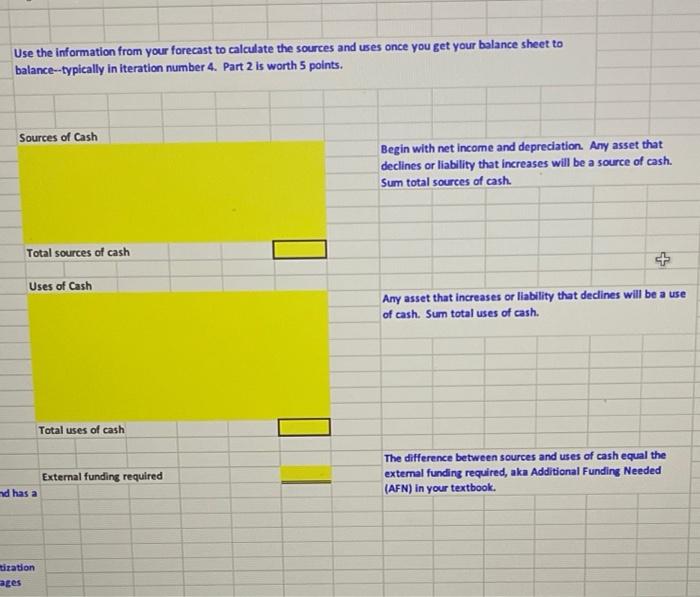

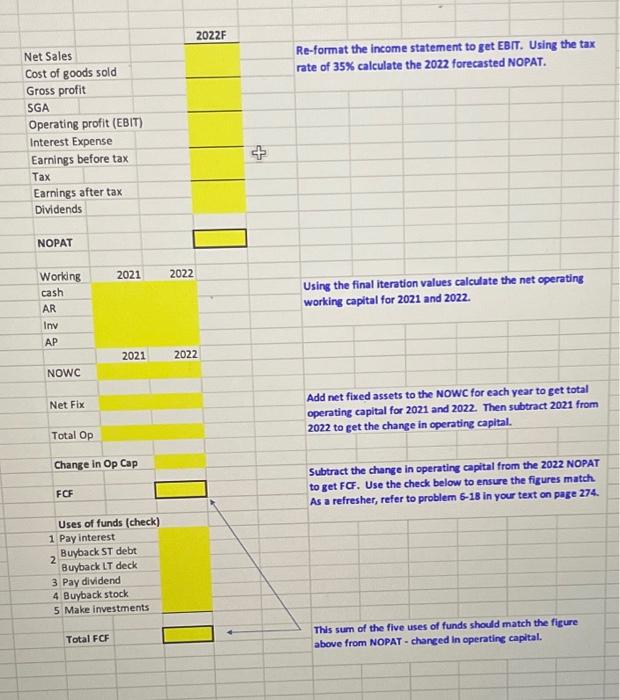

it is visible its a 3 part question what you get for part 1 will help you solve for part 2 and 3 Part Use

it is visible its a 3 part question what you get for part 1 will help you solve for part 2 and 3

Part Use the information provided in alumn and the stumption in column M to build a forecast income statement and balance sheet for 2072. Herste until your forecast balance sheet balance. Follow the example wewed in class lecture Part 1 is worth 10 points Income Statement 20210 20221 20228 Hero 20228 209.25 Assumption 25 12.04 10.315 2.579 SON 1547 Net Sales Cost of goods sold Gross profit pes Seling. Eeneral, and admitive expenses Net interest experte Carries before tax Tax Carwings after Dividends 12 10 $42 19 35 153 25N Balance Sheet Hero 20221 20221 20210 20221 20221 10 tay Asie Current assets Gash and securities Acounts receivable tony Prepaid expenses Total current Net turnover 636 1,590 2.579 18 4022 100 5.122 Komponent 35 5 depreciate the company was to end 555 on we met and usa depreciation of day dows quity Cura Banken Accounts pay MED Acord Totalt Large Camon Rendamine Tuscan writy sort with on han loan for first terata. Ho amortation of debt predilecta $100 and repared was contre 12 Keep con Keep contant 964 100 18 1072 900 350 20 123 0 Longterm or by 100 ch year. No new common Hadeland or repurchase. U BABE for retained balance Mee you hlace in to the tow'hank loans if the valmis vete, frumna. Once loisen marxa Use the information from your forecast to calculate the sources and uses once you get your balance sheet to balance--typically in iteration number 4. Part 2 is worth 5 points. Sources of Cash Begin with net income and depreciation. Any asset that declines or liability that increases will be a source of cash. Sum total sources of cash. Total sources of cash + Uses of Cash Any asset that increases or liability that declines will be a use of cash. Surn total uses of cash. Total uses of cash External funding required nd has a The difference between sources and uses of cash equal the external funding required, aka Additional Funding Needed (AFN) in your textbook. tiration aces 2022F Re-format the income statement to get EBIT. Using the tax rate of 35% calculate the 2022 forecasted NOPAT. Net Sales Cost of goods sold Gross profit SGA Operating profit (EBIT) Interest Expense Earnings before tax Tax Earnings after tax Dividends + NOPAT 2021 2022 Working cash AR Inv Using the final iteration values calculate the net operating working capital for 2021 and 2022. AP 2021 2022 NOWC Net Fix Add net fixed assets to the NOWC for each year to get total operating capital for 2021 and 2022. Then subtract 2021 from 2022 to get the change in operating capital. Total Op Change in Op Cap Subtract the change in operating capital from the 2022 NOPAT to get FCF. Use the check below to ensure the figures match As a refresher, refer to problem 6-18 in your text on page 274. FOF Uses of funds (check) 1 Pay interest 2 Buyback ST debt Buyback LT deck 3 Pay dividend 4 Buyback stock 5 Make investments Total FCF This sum of the five uses of funds should match the figure above from NOPAT - changed in operating capital. Part Use the information provided in alumn and the stumption in column M to build a forecast income statement and balance sheet for 2072. Herste until your forecast balance sheet balance. Follow the example wewed in class lecture Part 1 is worth 10 points Income Statement 20210 20221 20228 Hero 20228 209.25 Assumption 25 12.04 10.315 2.579 SON 1547 Net Sales Cost of goods sold Gross profit pes Seling. Eeneral, and admitive expenses Net interest experte Carries before tax Tax Carwings after Dividends 12 10 $42 19 35 153 25N Balance Sheet Hero 20221 20221 20210 20221 20221 10 tay Asie Current assets Gash and securities Acounts receivable tony Prepaid expenses Total current Net turnover 636 1,590 2.579 18 4022 100 5.122 Komponent 35 5 depreciate the company was to end 555 on we met and usa depreciation of day dows quity Cura Banken Accounts pay MED Acord Totalt Large Camon Rendamine Tuscan writy sort with on han loan for first terata. Ho amortation of debt predilecta $100 and repared was contre 12 Keep con Keep contant 964 100 18 1072 900 350 20 123 0 Longterm or by 100 ch year. No new common Hadeland or repurchase. U BABE for retained balance Mee you hlace in to the tow'hank loans if the valmis vete, frumna. Once loisen marxa Use the information from your forecast to calculate the sources and uses once you get your balance sheet to balance--typically in iteration number 4. Part 2 is worth 5 points. Sources of Cash Begin with net income and depreciation. Any asset that declines or liability that increases will be a source of cash. Sum total sources of cash. Total sources of cash + Uses of Cash Any asset that increases or liability that declines will be a use of cash. Surn total uses of cash. Total uses of cash External funding required nd has a The difference between sources and uses of cash equal the external funding required, aka Additional Funding Needed (AFN) in your textbook. tiration aces 2022F Re-format the income statement to get EBIT. Using the tax rate of 35% calculate the 2022 forecasted NOPAT. Net Sales Cost of goods sold Gross profit SGA Operating profit (EBIT) Interest Expense Earnings before tax Tax Earnings after tax Dividends + NOPAT 2021 2022 Working cash AR Inv Using the final iteration values calculate the net operating working capital for 2021 and 2022. AP 2021 2022 NOWC Net Fix Add net fixed assets to the NOWC for each year to get total operating capital for 2021 and 2022. Then subtract 2021 from 2022 to get the change in operating capital. Total Op Change in Op Cap Subtract the change in operating capital from the 2022 NOPAT to get FCF. Use the check below to ensure the figures match As a refresher, refer to problem 6-18 in your text on page 274. FOF Uses of funds (check) 1 Pay interest 2 Buyback ST debt Buyback LT deck 3 Pay dividend 4 Buyback stock 5 Make investments Total FCF This sum of the five uses of funds should match the figure above from NOPAT - changed in operating capital Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started