Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is with the same questions will rate the answer continuing questions will rate the answer 3% per year. If investors require a 8% return

it is with the same questions

will rate the answer

continuing questions

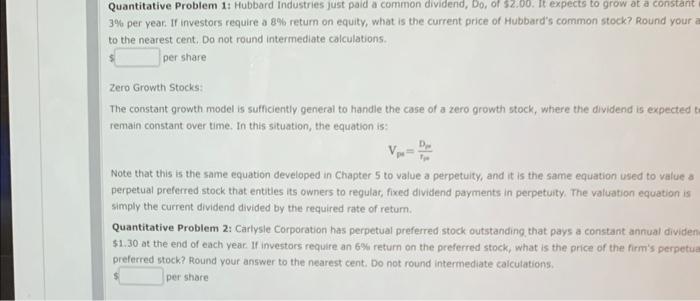

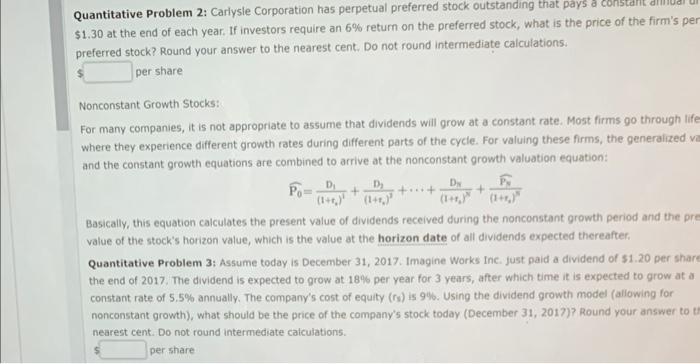

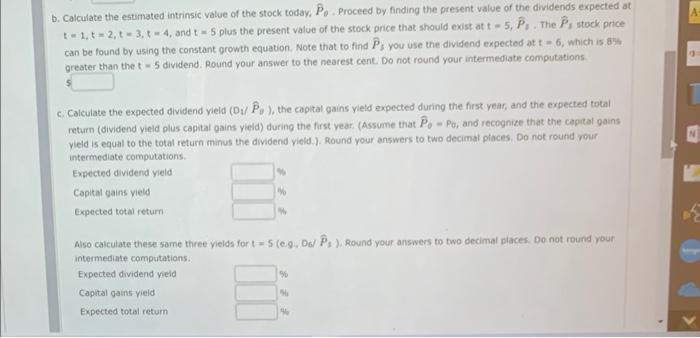

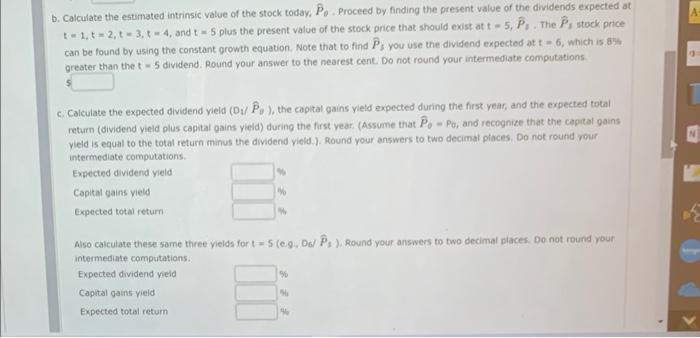

3% per year. If investors require a 8% return on equity, what is the current price of Hubbard's common stock? Round your to the nearest cent. Do not round intermediate calculations. per share Zero Growth Stocks: The constant growth model is sufficiently general to handle the case of a zero growth stock, where the dividend is expected remain constant over time. In this situation, the equation is: Vp=TpDe Note that this is the same equation developed in Chapter 5 to value a perpetuity, and it is the same equation used to value a perpetual preferred stock that entitles its owners to regular, fixed dividend payments in perpetuity, The valuation equation is simply the current dividend divided by the required rate of return. Quantitative Problem 2: Carlysle Corporation has perpetual preferred stock outstanding, that pays a constant annual dividen \$1. 30 at the end of each year. If investors require an 6% return on the preferred stock, what is the price of the firm's perpetua preferred stock? Round your answer to the nearest cent. Do not round intermediate caicutations. per share Quantitative Problem 2: Carlysle Corporation has perpetual preferred stock outstanding that pays a constalis dilioal w $1.30 at the end of each year. If investors require an 6% return on the preferred stock, what is the price of the firm's per preferred stock? Round your answer to the nearest cent. Do not round intermediate calculations. per share Nonconstant Growth Stocks: For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life where they experience different growth rates during different parts of the cycle. For valuing these firms, the generalized vi and the constant growth equations are combined to arrive at the nonconstant growth valuation equation: P0=(1+r2)1D1+(1+r2)3D3++(1+r3)NDr+(1+r3)5Pv Basically, this equation calculates the present value of dividends received during the nonconstant growth period and the pre value of the stock's horizon value, which is the value at the horizon date of all dividends expected thereafter. Quantitative Problem 3: Assume today is December 31, 2017. Imagine Works Inc. just paid a dividend of 51.20 per shark the end of 2017 . The dividend is expected to grow at 18% per year for 3 years, after which time it is expected to grow at a constant rate of 5.5% annually. The company's cost of equity (rs) is 9%. Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (December 31, 2017)? Round your answer to nearest cent. Do not round intermediate calculations. per share b. Calculate the estimated intrinsic value of the stock today, P0. Proceed by finding the present value of the dividends expected at t=1,t=2,t=3,t=4, and t=5 plus the present value of the stock price that should exist at t=5,P^s. The P^s stack price can be found by using the constant growth equation. Note that to find P^s you use the dividend expected at t=6, which is 835 greater than the t=5 dividend. Round your answer to the nearest cent. Do not round your intermediate computations. c. Calculate the expected dividend yield (D1/P^g), the capital gains yield expected during the first year, and the expected total return (dividend yield plus capital gains yield) during the first year. (Assume that P^0=P0, and recognize that the capital gains vield is equal to the total return minus the dividend yield.). Round your answers to two decimal places. Do not round rour intermediate computations. Also calculate these same three yielda for t=5(eg, Dof Ps), Round your answers to two decimal places. Do not round your intermediate computations will rate the answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started